PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801811

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801811

Biostimulants Formulation Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

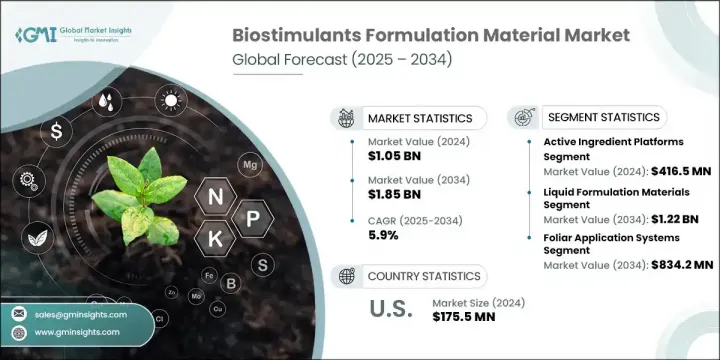

The Global Biostimulants Formulation Material Market was valued at USD 1.05 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 1.85 billion by 2034. The market is gaining significant traction due to the worldwide emphasis on sustainable agricultural practices and the increasing demand for productivity-boosting yet environmentally conscious inputs. The broader shift toward nature-based and biological crop enhancement solutions, combined with favorable policy environments, is propelling market expansion. Foliar application remains the dominant method of usage, accounting for nearly half of all applications. However, growing interest in seed treatments and soil-applied formulations is reshaping industry dynamics, especially as innovation in targeted delivery methods becomes more advanced and widely available.

The transition to natural formulation materials-such as microbial solutions, seaweed extracts, and natural polysaccharides-is intensifying. Regulatory pressure to reduce chemical inputs, coupled with consumer preference for residue-free food, is accelerating this move toward sustainable biostimulants. Producers are dedicating resources to research and development focused on biodegradable, effective, and sustainable solutions that support modern agriculture. There's a growing trend toward highly tailored formulations designed for specific crop types, soil conditions, and local climates. Companies are leveraging advanced data analytics and agronomic insights to offer customized biostimulants that boost yields, command premium pricing, and foster long-term relationships with growers seeking precise, high-value crop solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.05 Billion |

| Forecast Value | $1.85 Billion |

| CAGR | 5.9% |

The stabilizers and adjuvants segment will grow at a CAGR of 7.4% through 2034, supported by their ability to preserve active ingredients, improve shelf-life, and enhance the functional delivery of biostimulants across a wide range of applications. These ingredients, including emulsifiers and surfactants, play a key role in maintaining formulation uniformity, ensuring absorption, and supporting compatibility with other agricultural products. Their rising use highlights the growing complexity and precision required in today's crop input formulations.

The dry formulation materials segment will grow at a CAGR of 4.6% through 2034. While liquid formulations are becoming more prominent due to ease of use and innovation, dry forms remain critical in scenarios requiring long shelf-life and stability. As the market evolves, a slight decline in dry formulation share is anticipated, although demand will remain steady in certain use cases.

U.S. Biostimulants Formulation Material Market held 80.1% share, generating USD 175.5 million in 2024. The region benefits from a well-developed regulatory landscape, ongoing investment in agricultural R&D, and a strong push for environmentally responsible farming practices. Polysaccharides are widely favored in the U.S. due to their environmental compatibility and effectiveness. In this highly industrialized and tech-focused market, stabilizers and adjuvants are essential to maintaining product stability and ensuring alignment with other agrochemical systems. The dominant use of active ingredients such as microbial inoculants, amino acids, and seaweed-based materials underscores a growing preference for biologicals and precision inputs in modern agriculture.

Key players shaping the Global Biostimulants Formulation Material Market include Novozymes A/S, BASF SE, Valagro S.p.A., UPL Limited, and Syngenta AG. To establish a strong foothold in the Biostimulants Formulation Material Market, companies are investing heavily in research to develop sustainable, crop-specific products that enhance yield while aligning with environmental standards. A major focus lies in innovation-particularly in creating biodegradable, tailored formulations suited for varied climatic and soil conditions. Strategic collaborations with agricultural tech firms, research institutes, and growers are helping companies co-develop region-specific solutions. Firms are also expanding global distribution networks and entering emerging markets to tap into new growth areas. Emphasis on digital platforms and precision agriculture tools supports real-time customization of product offerings.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Material type

- 2.2.2 Form

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable and organic agricultural inputs

- 3.2.1.2 Regulatory support for eco-friendly crop protection products

- 3.2.1.3 Increasing focus on crop yield and quality enhancement

- 3.2.1.4 Technological advancements in formulation and delivery systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and technical knowledge

- 3.2.2.2 Variability in product efficacy due to environmental factors

- 3.2.3 Market opportunities

- 3.2.3.1 Development of crop-specific and customized formulations

- 3.2.3.2 Integration with digital agriculture and precision farming

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, by Material Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Natural polysaccharides

- 5.3 Stabilizers and adjuvants

- 5.4 Active ingredient platforms

- 5.4.1 Seaweed extract formulation materials

- 5.4.2 Humic and fulvic acid derivatives

- 5.4.3 Amino acid and protein hydrolysate bases

- 5.4.4 Microbial encapsulation materials

Chapter 6 Market Estimates & Forecast, by Form, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Liquid formulation materials

- 6.2.1 Emulsifiers and solubilizers

- 6.2.2 Suspension agents and thickeners

- 6.2.3 Preservatives and antimicrobial agents

- 6.2.4 Freeze-thaw stabilizers

- 6.3 Dry formulation materials

- 6.3.1 Granulation and pelletization aids

- 6.3.2 Anti-caking and flow enhancement agents

- 6.3.3 Dust control and handling improvers

- 6.3.4 Moisture barrier coatings

Chapter 7 Market Estimates & Forecast, by Application Method, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Seed treatment formulation materials

- 7.2.1 Coating materials and binders

- 7.2.2 Adhesion promoters and film formers

- 7.2.3 Colorants and identification systems

- 7.2.4 Protective encapsulation materials

- 7.3 Foliar application systems

- 7.3.1 Spray adjuvants and penetration enhancers

- 7.3.2 Anti-drift and deposition aids

- 7.3.3 UV protectants and stability enhancers

- 7.3.4 Compatibility agents for tank mixing

- 7.4 Soil application materials

- 7.4.1 Granulation aids and binding agents

- 7.4.2 Slow-release coating systems

- 7.4.3 Soil penetration enhancers

- 7.4.4 Moisture management materials

- 7.5 Others

Chapter 8 Market Estimates & Forecast, by Crop Type, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 Cereals and grains

- 8.3 Fruits and vegetables

- 8.4 Others

Chapter 9 Market Estimates & Forecast, by Region, 2021 - 2034 (USD Mn, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Italy

- 9.3.4 Spain

- 9.3.5 Germany

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Ashland Global Holdings Inc.

- 10.2 BASF SE

- 10.3 Biotechnica (UK)

- 10.4 Citymax Group (China)

- 10.5 Croda International Plc

- 10.6 Elemental Enzymes

- 10.7 Evonik Industries AG

- 10.8 Fertinagro Biotech

- 10.9 Genvor

- 10.10 Natural Growth Biostimulants LLC

- 10.11 Novozymes A/S

- 10.12 SIPCAM Inagra (Europe)

- 10.13 Syngenta AG

- 10.14 UPL Limited

- 10.15 Valagro S.p.A