PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801814

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801814

US Motorcycles and Scooters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

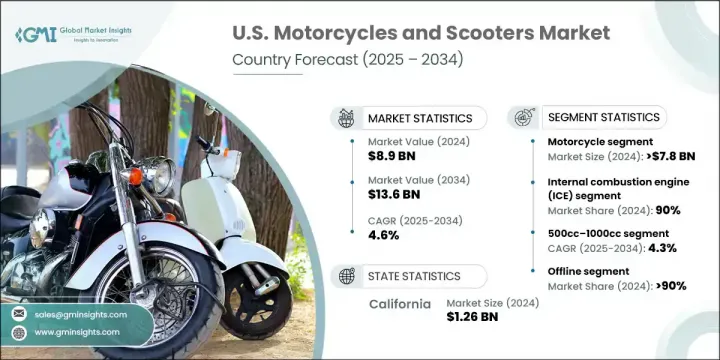

US Motorcycles and Scooters Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13.6 billion by 2034. Two-wheelers continue to serve as a key component of the US mobility landscape, supporting everything from daily city commutes to recreational travel and urban commercial deliveries. This market includes a wide array of vehicle types, such as cruisers, touring bikes, standard motorcycles, sport models, and increasingly, electric motorcycles and scooters designed for efficient navigation in urban environments. The rising influence of micromobility is reshaping city transport systems, with local governments integrating motorcycles and scooters into urban planning.

Shared fleets, designated parking, and first- and last-mile connections are making these vehicles more accessible in crowded metro regions. Electric variants are gaining traction as federal and state incentives, including rebates and tax benefits, encourage both individuals and commercial users to switch to eco-friendly transportation. With environmental priorities becoming more prominent, adoption of electric two-wheelers continues to rise, further supported by city-led initiatives aimed at reducing emissions and congestion while expanding affordable mobility solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 4.6% |

The motorcycles segment held 87% share, generating USD 7.8 billion in 2024. This category includes a range of styles from cruisers and touring bikes to sport and standard models, offering versatility for long-distance rides, lifestyle-oriented use, and highway capability. Their powerful engines and road performance distinguish them from scooters, making them suitable for various personal and commercial applications.

The internal combustion engine (ICE) vehicles held a 90% share in 2024 and is projected to grow at a CAGR of 1.8% through 2034. ICE two-wheelers continue to appeal to riders across the country due to the established fueling infrastructure and rider familiarity. While regulations targeting emissions from ICE vehicles are gradually evolving, these models remain the most widely adopted in the US market.

California Motorcycles and Scooters Market generated USD 1.26 billion in 2024, capturing 50% share. The state benefits from favorable terrain, an active lifestyle culture, and progressive transportation policies focused on sustainability. With the highest number of registered motorcycles in the nation, California continues to shape trends in both traditional and electric two-wheeler adoption.

Key manufacturers influencing the US Motorcycles and Scooters Market include Yamaha, Honda, Harley-Davidson, Triumph, BMW, KTM, Suzuki, Indian Motorcycle, Ducati, and Kawasaki. Manufacturers in the US motorcycles and scooters market are leveraging several strategies to strengthen their competitive edge. A major focus lies in expanding electric vehicle offerings to cater to eco-conscious consumers and capitalize on incentive-driven demand. Companies are enhancing vehicle performance and integrating smart features such as app-based connectivity, diagnostics, and GPS to appeal to tech-savvy riders. Collaborations with ride-sharing platforms and retail financing services are being used to increase accessibility and user reach. Regional expansion through dealership networks, localized marketing campaigns, and after-sales services ensures deeper market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Engine displacement

- 2.2.5 Distribution channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025 - 2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for fuel-efficient urban mobility

- 3.2.1.2 Rise in electric two-wheeler adoption

- 3.2.1.3 Recreational motorcycle culture and touring demand

- 3.2.1.4 Expanding e-commerce and last-mile delivery

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of nationwide EV charging infrastructure

- 3.2.2.2 Regulatory inconsistencies across states

- 3.2.3 Market opportunities

- 3.2.3.1 Growing youth preference for personal mobility

- 3.2.3.2 Technological innovation in two-wheeler design

- 3.2.3.3 Fleet electrification initiatives

- 3.2.3.4 Retrofitting aging Off-Shore platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1.1 Federal Vehicle and emission standards

- 3.4.1.2 State-Level motorcycle licensing & helmet laws

- 3.4.1.3 Local noise and zoning regulations

- 3.4.1.4 Safety, performance & inspection standards

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology innovation and advanced features

- 3.7.1 Motorcycle ADAS and safety technology integration

- 3.7.2 Connected motorcycle solutions and iot integration

- 3.7.3 Advanced powertrain technologies

- 3.7.4 Autonomous and semi-autonomous features development

- 3.8 Electric motorcycle and scooter market transformation

- 3.8.1 Electric two-wheeler technology evolution

- 3.8.2 Battery technology and range optimization

- 3.8.3 Charging infrastructure development and accessibility

- 3.8.4 Government incentives and policy support analysis

- 3.9 Consumer behavior and market preferences

- 3.9.1.1 Demographic profile and target customer analysis

- 3.9.1.2 Purchase decision factors and buying journey

- 3.9.1.3 Usage patterns and mobility behavior

- 3.9.1.4 Brand loyalty and switching patterns

- 3.9.1.5 Price sensitivity and value perception analysis

- 3.9.2 Purchase decision factors

- 3.9.2.1 Price sensitivity analysis

- 3.9.2.2 Brand preference and loyalty

- 3.9.2.3 Feature importance rankings

- 3.9.2.4 Performance, durability, and reliability expectations

- 3.10 Patent landscape

- 3.11 Price trend

- 3.11.1 By country

- 3.11.2 By product

- 3.12 Cost breakdown analysis

- 3.13 Production statistics

- 3.13.1 Import and export

- 3.13.2 Major import countries

- 3.13.3 Major export countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northeast

- 4.2.2 West

- 4.2.3 South

- 4.2.4 Midwest

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Motorcycles

- 5.2.1 Cruiser motorcycles

- 5.2.2 Sport motorcycles

- 5.2.3 Touring motorcycles

- 5.2.4 Standard/naked motorcycles

- 5.2.5 Adventure/dual-sport motorcycles

- 5.2.6 Off-road/dirt motorcycles

- 5.3 Scooters

- 5.3.1 Traditional gasoline scooters

- 5.3.2 Electric scooters

- 5.3.3 Maxi scooters

- 5.3.4 Moped-style scooters

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021-2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Engine Displacement, 2021-2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Under 250cc

- 7.3 250cc-500cc

- 7.4 500cc-1000cc

- 7.5 Above 1000cc

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Northeast US

- 10.2.1 Connecticut

- 10.2.2 Maine

- 10.2.3 Massachusetts

- 10.2.4 New Hampshire

- 10.2.5 Rhode Island

- 10.2.6 Vermont

- 10.2.7 New Jersey

- 10.2.8 New York

- 10.2.9 Pennsylvania

- 10.3 Midwest US

- 10.3.1 Illinois

- 10.3.2 Indiana

- 10.3.3 Michigan

- 10.3.4 Ohio

- 10.3.5 Wisconsin

- 10.3.6 Iowa

- 10.3.7 Kansas

- 10.3.8 Minnesota

- 10.3.9 Missouri

- 10.3.10 Nebraska

- 10.3.11 North Dakota

- 10.3.12 South Dakota

- 10.4 South US

- 10.4.1 Delaware

- 10.4.2 Florida

- 10.4.3 Georgia

- 10.4.4 Maryland

- 10.4.5 North Carolina

- 10.4.6 South Carolina

- 10.4.7 Virginia

- 10.4.8 West Virginia

- 10.4.9 Washington D.C.

- 10.4.10 Alabama

- 10.4.11 Kentucky

- 10.4.12 Mississippi

- 10.4.13 Tennessee

- 10.4.14 Arkansas

- 10.4.15 Louisiana

- 10.4.16 Oklahoma

- 10.4.17 Texas

- 10.5 West US

- 10.5.1 Arizona

- 10.5.2 Colorado

- 10.5.3 Idaho

- 10.5.4 Montana

- 10.5.5 Nevada

- 10.5.6 New Mexico

- 10.5.7 Utah

- 10.5.8 Wyoming

- 10.5.9 Alaska

- 10.5.10 California

- 10.5.11 Hawaii

- 10.5.12 Oregon

- 10.5.13 Washington

Chapter 11 Company Profiles

- 11.1 Major Motorcycle Manufacturers

- 11.1.1 Aprilia

- 11.1.2 Benelli

- 11.1.3 BMW Motorrad

- 11.1.4 CFMOTO

- 11.1.5 Ducati

- 11.1.6 Harley-Davidson

- 11.1.7 Honda

- 11.1.8 Husqvarna Motorcycles

- 11.1.9 Indian Motorcycle

- 11.1.10 Kawasaki

- 11.1.11 KTM

- 11.1.12 Moto Guzzi

- 11.1.13 Royal Enfield

- 11.1.14 Suzuki

- 11.1.15 Triumph Motorcycles

- 11.1.16 Yamaha

- 11.2 Electric Motorcycle & Scooter Manufacturers

- 11.2.1 Energica Motor Company

- 11.2.2 LiveWire

- 11.2.3 NIU Technologies

- 11.2.4 Revolt Motors

- 11.2.5 Super Soco

- 11.2.6 Volcon ePowersports

- 11.2.7 Zero Motorcycles

- 11.3 Custom, Niche, & Off-Road Brands

- 11.3.1 Buell Motorcycle

- 11.3.2 Can-Am (BRP)

- 11.3.3 Rokon

- 11.3.4 Segway Powersports

- 11.4 Scooter-Specific & Urban Mobility Brands

- 11.4.1 CSC Motorcycles

- 11.4.2 Genuine Scooter Company

- 11.4.3 Kymco