PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801867

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801867

Europe Motorcycles and Scooters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

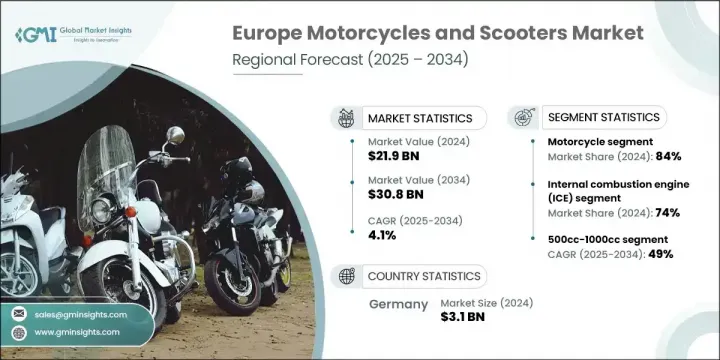

Europe Motorcycles and Scooters Market was valued at USD 21.9 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 30.8 billion by 2034. Increasing urbanization, surging demand for cost-effective personal mobility, and supportive government incentives for electric two-wheelers are accelerating adoption across the region. Urban dwellers continue to favor two-wheelers for their agility, affordability, and low operating costs, while leisure riders also contribute to market expansion through rising interest in touring and adventure models. The ongoing push for carbon-neutral transportation is reshaping product development, with industry players investing in battery-powered drivetrains, rider connectivity systems, and next-gen mobility infrastructure.

Despite early supply chain disruptions caused by the pandemic, the sector is now experiencing a rebound as various European countries roll out green incentives and invest in micro-mobility infrastructure. The broader shift toward electrification, coupled with a growing eco-conscious consumer base, is fostering long-term growth across both mature and emerging segments. Additionally, digitization, battery-swapping stations, and smart features are becoming central to how manufacturers approach mobility innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.9 Billion |

| Forecast Value | $30.8 Billion |

| CAGR | 4.1% |

The motorcycles segment held 84% share in 2024 and is projected to grow at a CAGR of 4% through 2034. The dominance of motorcycles is linked to their widespread appeal for both urban and recreational use. Brands are elevating the riding experience with technology such as intelligent rider assistance, advanced navigation, and over-the-air software updates. The adventure and touring categories are particularly gaining popularity due to their versatility and reliability, attracting both new and experienced users seeking performance across varied terrains.

In terms of powertrain, the internal combustion engine (ICE) segment held a 74% share in 2024 and is forecasted to grow at a CAGR of 4% during 2025-2034. ICE-powered two-wheelers remain widely preferred due to their proven performance, long range, and easy refueling. A well-developed fueling infrastructure and consumer familiarity with petrol engines continue to support the segment's lead across Europe, even as electric models steadily gain traction.

Germany Motorcycles and Scooters Market held 33% share and generated USD 3.1 billion in 2024. The country's strong automotive culture, favorable infrastructure, and high purchasing power have cultivated a robust two-wheeler market. German consumers have a clear preference for large-displacement engines, especially in the touring and adventure segments, supporting a premium demand structure. Home to iconic manufacturers like BMW Motorrad, Germany maintains a solid foothold with well-established road networks and performance-oriented rider preferences.

Leading companies active in the Europe Motorcycles and Scooters Market include Triumph Motorcycles, KTM AG, Piaggio Group, Royal Enfield, Honda Motor, Yamaha Motor, Ducati, Harley-Davidson, Suzuki Motor, Niu Technologies, and BMW Motorrad. To strengthen their position in the European motorcycles and scooters market, key companies are investing heavily in R&D focused on electric powertrains, rider-assist technologies, and sustainable manufacturing. Brands are also enhancing user experience by introducing features such as smart dashboards, remote diagnostics, and GPS-based safety alerts. Strategic partnerships with mobility platforms and infrastructure providers are being formed to build charging and battery-swapping ecosystems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Engine Displacement

- 2.2.5 Distribution Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban congestion and rising fuel prices

- 3.2.1.2 Government incentives for electric two-wheelers

- 3.2.1.3 Shift toward sustainable and green mobility

- 3.2.1.4 Growing demand for smart, connected mobility

- 3.2.1.5 Rising popularity of leisure and adventure motorcycling

- 3.2.1.6 Expansion of two-wheeler sharing platforms and delivery services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rider safety concerns in high-traffic zones

- 3.2.2.2 High initial cost of electric two-wheelers

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric two-wheeler segment

- 3.2.3.2 Integration of IoT and smart connectivity

- 3.2.3.3 Growth of micromobility and shared mobility platforms

- 3.2.3.4 Tourism and recreational riding trends

- 3.2.4 European motorcycle and scooter market evolution

- 3.2.4.1 Historical market development and maturity analysis

- 3.2.4.2 Transition from traditional to modern mobility solutions

- 3.2.4.3 Technology adoption lifecycle in two-wheeler segment

- 3.2.4.4 Market consolidation and industry restructuring trends

- 3.2.1 Growth drivers

- 3.3 Technology innovation and advanced features

- 3.3.1 Motorcycle ADAS and safety technology integration

- 3.3.2 Connected motorcycle solutions and IoT integration

- 3.3.3 Advanced powertrain technologies

- 3.3.4 Autonomous and semi-autonomous features development

- 3.4 Electric motorcycle and scooter market transformation

- 3.4.1 Electric two-wheeler technology evolution

- 3.4.2 Battery technology and range optimization

- 3.4.3 Charging infrastructure development and accessibility

- 3.4.4 Government incentives and policy support analysis

- 3.5 Consumer behavior and market preferences

- 3.5.1 Demographic profile and target customer analysis

- 3.5.2 Purchase decision factors and buying journey

- 3.5.3 Usage patterns and mobility behavior

- 3.5.4 Brand loyalty and switching patterns

- 3.5.5 Price sensitivity and value perception analysis

- 3.6 Growth potential analysis

- 3.7 Regulatory landscape

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost breakdown analysis

- 3.13 Patent analysis

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Northern Europe

- 4.2.2 Western Europe

- 4.2.3 Southern Europe

- 4.2.4 Eastern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Motorcycles

- 5.2.1 Cruiser motorcycles

- 5.2.2 Sport motorcycles

- 5.2.3 Touring motorcycles

- 5.2.4 Standard/naked motorcycles

- 5.2.5 Adventure/dual-sport motorcycles

- 5.2.6 Off-road/dirt motorcycles

- 5.3 Scooters

- 5.3.1 Traditional gasoline scooters

- 5.3.2 Electric scooters

- 5.3.3 Maxi scooters

- 5.3.4 Moped-style scooters

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Engine Displacement, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Under 250cc

- 7.3 250cc-500cc

- 7.4 500cc-1000cc

- 7.5 Above 1000cc

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 France

- 10.2.3 Netherlands

- 10.2.4 Belgium

- 10.2.5 Switzerland

- 10.2.6 Austria

- 10.2.7 Luxembourg

- 10.2.8 Liechtenstein

- 10.2.9 Ireland

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Czech Republic

- 10.3.3 Portugal

- 10.3.4 Serbia

- 10.3.5 Albania

- 10.3.6 Slovakia

- 10.3.7 Romania

- 10.3.8 Slovenia

- 10.3.9 Bulgaria

- 10.3.10 Estonia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Norway

- 10.4.5 Iceland

- 10.4.6 Faroe Islands

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Vatican City

- 10.5.4 San Marino

- 10.5.5 Greece

- 10.5.6 Cyprus

Chapter 11 Company Profiles

- 11.1 ICE & EV players

- 11.1.1 BMW Motorrad

- 11.1.2 Ducati

- 11.1.3 Harley-Davidson

- 11.1.4 Honda Motor

- 11.1.5 Kawasaki Heavy Industries

- 11.1.6 KTM AG

- 11.1.7 Mahindra Group

- 11.1.8 Piaggio Group

- 11.1.9 Royal Enfield

- 11.1.10 Suzuki Motor

- 11.1.11 Triumph Motorcycles

- 11.1.12 Yamaha Motor

- 11.2 EV players

- 11.2.1 Silence

- 11.2.2 Askoll EVA

- 11.2.3 Niu Technologies

- 11.2.4 Electric Motion

- 11.2.5 Energica Motor Company.

- 11.2.6 Gogoro Inc.

- 11.2.7 Stark Future

- 11.2.8 Vmoto Soco

- 11.2.9 Zero Motorcycles

- 11.3 Regional & emerging players

- 11.3.1 Bajaj Auto Ltd.

- 11.3.2 Benelli Q.J.

- 11.3.3 Hero MotoCorp

- 11.3.4 Rieju

- 11.3.5 Sachs Motorcycles

- 11.3.6 Scomadi Ltd

- 11.3.7 TVS Motor Company