PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801817

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801817

North America Off-Shore Crane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

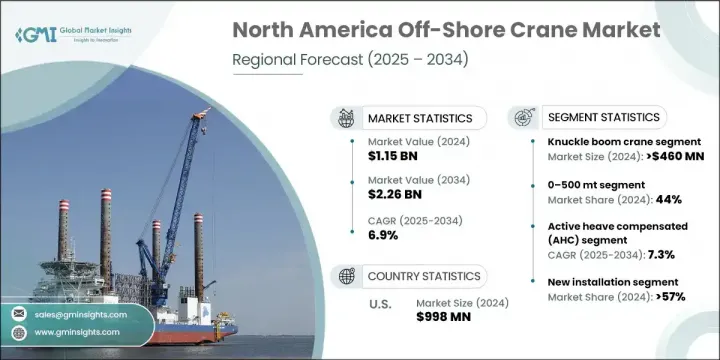

North America Off-Shore Crane Market was valued at USD 1.15 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 2.26 billion by 2034. Growth in this market is driven by expanding energy exploration and offshore infrastructure development. Off-shore cranes play a central role across various sectors such as oil extraction units, floating platforms, subsea operations, marine energy installations, and support vessels. In the United States, demand for durable and high-performance cranes remains high, particularly along the Gulf Coast. As operations shift toward renewable energy, the East Coast is seeing increased demand for lifting equipment engineered for wind turbine assembly and cable laying. Across Canada, particularly near Newfoundland & Labrador, offshore fields continue to call for cranes adapted to extreme marine environments.

The introduction of government-backed initiatives through infrastructure legislation is further advancing domestic manufacturing and port equipment modernization, especially for heavy-duty and container-handling cranes. These investments are improving industrial capabilities across the region and encouraging new entrants and innovation within the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.15 Billion |

| Forecast Value | $2.26 Billion |

| CAGR | 6.9% |

The knuckle boom cranes segment held 40% share and generated USD 460 million in 2024. Their flexible jointed design and compact form factor make them highly suitable for space-constrained offshore settings. Frequently deployed aboard support ships, FPSOs, and small offshore installations, they're ideal for precision-based activities such as material handling, personnel movement, and onboard maintenance. These cranes offer adaptability and ease of operation, even in challenging marine conditions, and can be stored compactly, making them a preferred option in modular and retrofitted environments.

In terms of lifting capacity, cranes in the 0-500 mt segment held a 44% share in 2024 and is projected to grow at a CAGR of 6.1% through 2034. These light-duty systems are commonly utilized for routine offshore applications, including transferring supplies and conducting maintenance tasks. Typically installed on smaller oil platforms, FPSOs, and service vessels, these cranes offer excellent functionality for day-to-day operations, particularly in near-shore and shallow-water regions. Their affordability and operational versatility make them a dependable solution for logistical offshore duties, supporting ongoing activity across North American waters.

U.S. Off-Shore Crane Market held 86% share in 2024 generating USD 998 million. This dominance is bolstered by an expanding offshore wind sector, prompting demand for specialized lifting equipment and infrastructure. Major coastal ports are transforming into logistics hubs, supported by large-scale investments in wind energy. Infrastructure improvements are being accelerated in states aiming to become leaders in the clean energy transition, helping reinforce the country's lead in offshore crane adoption.

Leading companies operating within the North America Off-Shore Crane Market include NOV, Huisman, Heila Cranes, Konecranes, Cargotec, Liebherr, and KenzFigee. To establish and sustain a competitive edge in the North America Off-Shore Crane Market, major players are focusing on strategic moves such as forming long-term contracts with energy companies and upgrading their product portfolios to offer cranes tailored for renewable projects. They are investing in R&D for safer, compact, and more energy-efficient crane designs suited for restricted offshore environments. Companies are also expanding regional service networks to ensure rapid maintenance and minimize downtime.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crane

- 2.2.3 Lifting capacity

- 2.2.4 Design

- 2.2.5 Installation

- 2.2.6 Application

- 2.3 TAM Analysis, 2025 2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of Off-Shore wind energy projects

- 3.2.1.2 Revitalization of US Off-Shore oil operations

- 3.2.1.3 Increasing demand for automated and remotely operated cranes

- 3.2.1.4 Focus on vessel safety and lifting regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited Standardization Across Crane Platforms

- 3.2.2.2 Regulatory hurdles and environmental constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Digital twin and condition monitoring adoption

- 3.2.3.2 Hybrid powered cranes and green Off-Shore operations

- 3.2.3.3 Expansion in Canadian Off-Shore field developments

- 3.2.3.4 Retrofitting aging Off-Shore platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 US

- 3.4.2 Canada

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trend analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.10 Production statistics

- 3.10.1 Major import countries

- 3.10.2 Market export countries

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 US

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Crane, 2021-2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Knuckle boom crane

- 5.3 Lattice boom crane

- 5.4 Telescopic boom crane

Chapter 6 Market Estimates & Forecast, By Lifting Capacity, 2021-2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 0-500 mt

- 6.3 500-3,000 mt

- 6.4 Above 3,000 mt

Chapter 7 Market Estimates & Forecast, By Design, 2021-2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Active heave compensated (AHC)

- 7.3 Passive heave compensated (PHC)

- 7.4 Non-compensated

Chapter 8 Market Estimates & Forecast, By Installation, 2021-2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 New installation

- 8.3 Replacement/Retrofit

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Oil & Gas Platforms

- 9.3 Off-Shore Wind Farms

- 9.4 Subsea Operations

- 9.5 Marine Vessels & FPSOs

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 US

- 10.2.1 Alabama

- 10.2.2 Alaska

- 10.2.3 Arizona

- 10.2.4 Arkansas

- 10.2.5 California

- 10.2.6 Colorado

- 10.2.7 Connecticut

- 10.2.8 Delaware

- 10.2.9 Florida

- 10.2.10 Georgia

- 10.2.11 Hawaii

- 10.2.12 Idaho

- 10.2.13 Illinois

- 10.2.14 Indiana

- 10.2.15 Iowa

- 10.2.16 Kansas

- 10.2.17 Kentucky

- 10.2.18 Louisiana

- 10.2.19 Maine

- 10.2.20 Maryland

- 10.2.21 Massachusetts

- 10.2.22 Michigan

- 10.2.23 Minnesota

- 10.2.24 Mississippi

- 10.2.25 Missouri

- 10.2.26 Montana

- 10.2.27 Nebraska

- 10.2.28 Nevada

- 10.2.29 New Hampshire

- 10.2.30 New Jersey

- 10.2.31 New Mexico

- 10.2.32 New York

- 10.2.33 North Carolina

- 10.2.34 North Dakota

- 10.2.35 Ohio

- 10.2.36 Oklahoma

- 10.2.37 Oregon

- 10.2.38 Pennsylvania

- 10.2.39 Rhode Island

- 10.2.40 South Carolina

- 10.2.41 South Dakota

- 10.2.42 Tennessee

- 10.2.43 Texas

- 10.2.44 Utah

- 10.2.45 Vermont

- 10.2.46 Virginia

- 10.2.47 Washington

- 10.2.48 West Virginia

- 10.2.49 Wisconsin

- 10.2.50 Wyoming

- 10.3 Canada

- 10.3.1 Alberta

- 10.3.2 British Columbia

- 10.3.3 Manitoba

- 10.3.4 New Brunswick

- 10.3.5 Newfoundland and Labrador

- 10.3.6 Nova Scotia

- 10.3.7 Ontario

- 10.3.8 Prince Edward Island

- 10.3.9 Quebec

- 10.3.10 Saskatchewan

- 10.3.11 Northwest Territories

- 10.3.12 Nunavut

- 10.3.13 Yukon

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Cargotec

- 11.1.2 Huisman equipment

- 11.1.3 Konecranes

- 11.1.4 Liebherr group

- 11.1.5 Manitowoc company

- 11.1.6 National oilwell varco

- 11.1.7 Palfinger

- 11.1.8 Terex corporation

- 11.1.9 TTS group

- 11.1.10 Seatrax

- 11.2 Established & emerging players

- 11.2.1 Allied systems company

- 11.2.2 Appleton marine

- 11.2.3 EBI cranes

- 11.2.4 Forum energy technologies

- 11.2.5 Hawboldt industries

- 11.2.6 Heila cranes

- 11.2.7 Kenzfigee

- 11.2.8 Red rock marine

- 11.2.9 Sparrows group

- 11.2.10 Techcrane International

- 11.3 Niche & specialized manufacturers

- 11.3.1 Arctic crane services

- 11.3.2 Bardex

- 11.3.3 DMW marine group

- 11.3.4 Favelle favco berhad

- 11.3.5 Hydralift

- 11.3.6 Indal technologies

- 11.3.7 Melcal marine cranes

- 11.3.8 MacGregor

- 11.3.9 Rapp marine

- 11.3.10 TMI