PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844265

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844265

Asia Pacific Offshore Crane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

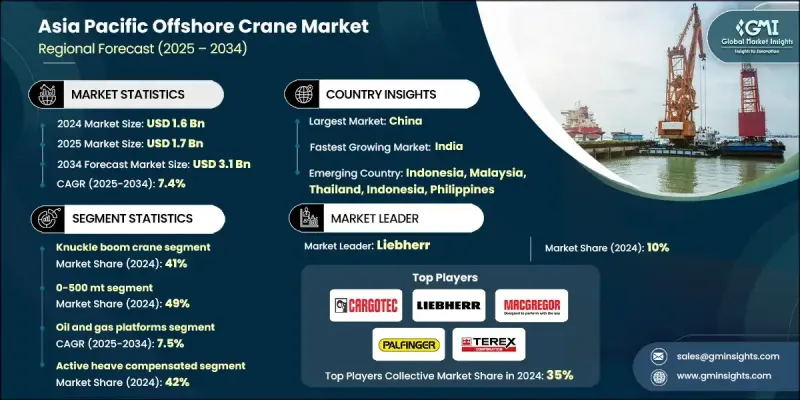

Asia Pacific Offshore Crane Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 3.1 billion by 2034.

Industry is undergoing significant evolution, with offshore operations in the energy and marine sectors demanding more efficient and technologically advanced equipment. As exploration in deep-sea oil and gas projects continues and offshore wind farms expands rapidly, the need for robust, high-capacity cranes becomes increasingly urgent. Companies are shifting focus toward automation, safety, and precision by incorporating advanced technologies that streamline heavy-load handling in tough offshore environments. These modern cranes are designed to withstand extreme marine conditions while offering optimal performance. Demand is also rising due to infrastructure upgrades at ports and the evolution of offshore engineering practices. China remains the dominant force in the market, while countries across the region are seeing a surge in offshore investments. The industry is defined by innovations that allow cranes to seamlessly operate in confined spaces and support high-efficiency load transfers, a necessity in increasingly complex maritime construction and energy projects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.4% |

The knuckle boom crane segment held a 41% share in 2024 and is projected to grow at a CAGR of 8.1% through 2034. Their dominance is attributed to a compact design, ease of movement, and the capability to handle tasks in restricted or submerged environments. These cranes are particularly valued in offshore lifting scenarios where precision, minimal space usage, and operational efficiency are critical. Their adoption is rising steadily across offshore applications due to advanced load control systems and their compatibility with digitally enabled vessels, helping improve lift safety and performance in unpredictable conditions.

In terms of lifting capacity, the cranes in the 0-500 metric ton segment held a 49% share in 2024 and are estimated to grow at a CAGR of 7% from 2025 to 2034. Their widespread usage is driven by their compact nature and suitability for smaller platforms and limited deck spaces. These cranes are highly preferred for regular tasks such as supply transfers, general deck handling, and maintenance. Technological improvements such as active heave compensation and smart automation features enhance their effectiveness for routine offshore activities, ensuring precise handling even under unstable sea states.

China Offshore Crane Market held a 60% share and generated USD 992.8 million in 2024. Its market leadership stems from a stronghold in shipbuilding and the production of heavy industrial machinery. The rapid expansion of its offshore energy projects, including oil and gas exploration zones and marine construction, continues to drive the demand for modern high-capacity cranes. The local manufacturing ecosystem is well-equipped to produce cranes tailored for demanding offshore conditions, further reinforcing China's position in the regional crane landscape.

Key companies participating in the Asia Pacific Offshore Crane Market include Huisman Equipment, Liebherr, Heila Cranes, Sparrows Offshore, Palfinger Marine, MacGregor, Kenz Figee, Terex, National Oilwell Varco (NOV), and Cargotec. To strengthen their position in the Asia Pacific Offshore Crane Market, companies are focusing on innovation-driven strategies. Most firms are investing heavily in R&D to enhance crane automation, efficiency, and operational safety. Collaborations with offshore engineering contractors and shipyards are being emphasized to develop cranes that seamlessly integrate into specific vessel and platform designs. Additionally, manufacturers are leveraging digital monitoring systems and eco-efficient designs to align with environmental standards. Local production and regional expansion remain a priority to ensure faster delivery and reduce lead times.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crane

- 2.2.3 Lifting capacity

- 2.2.4 Application

- 2.2.5 Design

- 2.2.6 Installation

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising offshore oil & gas and renewable energy projects

- 3.2.1.2 Expansion of shipbuilding and marine construction hubs

- 3.2.1.3 Adoption of automation and remote-controlled crane technologies

- 3.2.1.4 Government-supported infrastructure and port modernization

- 3.2.1.5 Increasing focus on safety and regulatory compliance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure

- 3.2.2.2 Harsh marine and weather conditions

- 3.2.3 Market opportunities

- 3.2.3.1 Rapid expansion of offshore oil & gas exploration in China, India, and Australia

- 3.2.3.2 Growth of offshore wind farms in China, Japan, South Korea, and Taiwan

- 3.2.3.3 Rising demand for automation and remote operation

- 3.2.3.4 Increasing collaboration between global OEMs and regional shipyards

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 IMO maritime safety standards implementation

- 3.4.2 China Maritime Safety Administration

- 3.4.3 Japan Coast Guard regulations

- 3.4.4 Korea Maritime & Fisheries Ministry

- 3.4.5 Australian Maritime Safety Authority

- 3.4.6 Indian Directorate General of Shipping

- 3.4.7 ASEAN Maritime Safety Framework

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Crane automation & control systems

- 3.7.1.2 Remote operation technology

- 3.7.1.3 Predictive maintenance systems

- 3.7.1.4 IoT & sensor integration

- 3.7.2 Emerging technologies

- 3.7.2.1 Digital twin & simulation

- 3.7.2.2 Advanced materials & design

- 3.7.1 Current technological trends

- 3.8 Price trend analysis

- 3.8.1 Historical pricing evolution by region

- 3.8.2 Country-specific price variations

- 3.8.3 Local vs international manufacturer pricing

- 3.8.4 Technology premium analysis

- 3.8.5 Currency impact on pricing

- 3.8.6 Total cost of ownership comparison

- 3.9 Cost breakdown analysis

- 3.9.1 Manufacturing & material costs

- 3.9.2 R&D development expenses

- 3.9.3 Certification & testing costs

- 3.9.4 Installation & commissioning

- 3.9.5 Ongoing maintenance & service

- 3.9.6 Regional cost structure variations

- 3.10 Production statistics

- 3.10.1 Major import countries

- 3.10.2 Major export countries

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment landscape analysis

- 3.13.1 Regional offshore energy investment

- 3.13.2 Government infrastructure funding

- 3.13.3 Private sector project investment

- 3.13.4 Foreign direct investment trends

- 3.13.5 Technology development investment

- 3.13.6 ROI analysis by investment type

- 3.14 Customer behavior analysis

- 3.14.1 Regional procurement preferences

- 3.14.2 Local vs international vendor selection

- 3.14.3 Technology adoption patterns

- 3.14.4 Service & support requirements

- 3.14.5 Total cost of ownership priorities

- 3.14.6 Cultural & business practice variations

- 3.14.7 Government influence on procurement

- 3.15 Business model evolution

- 3.15.1 Traditional equipment sales

- 3.15.2 Technology licensing models

- 3.15.3 Joint venture partnerships

- 3.15.4 Local manufacturing partnerships

- 3.15.5 Service & support localization

- 3.16 Quality & performance standards

- 3.16.1 Regional quality standards

- 3.16.2 International certification requirements

- 3.16.3 Performance specification variations

- 3.16.4 Environmental durability standards

- 3.17 Risk assessment framework

- 3.17.1 Geopolitical & territorial risks

- 3.17.2 Regulatory compliance risks

- 3.17.3 Technology transfer risks

- 3.17.4 Currency & economic risks

- 3.17.5 Environmental & weather risks

- 3.18 Technology standardization impact

- 3.18.1 Regional standard development

- 3.18.2 International standard adoption

- 3.18.3 Interoperability requirements

- 3.18.4 Certification harmonization

- 3.18.5 Quality assurance standards

- 3.19 Future market scenarios

- 3.19.1 Regional manufacturing dominance

- 3.19.2 Technology leadership transition

- 3.19.3 Offshore energy expansion

- 3.19.4 Autonomous offshore operations

- 3.19.5 Scenario planning framework

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 China

- 4.2.2 India

- 4.2.3 Japan

- 4.2.4 South Korea

- 4.2.5 Rest of APAC

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Crane, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Knuckle boom crane

- 5.3 Lattice boom crane

- 5.4 Telescopic boom crane

Chapter 6 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 0-500 mt

- 6.3 500-3,000 mt

- 6.4 Above 3,000 mt

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Oil & gas platforms

- 7.3 Offshore wind farms

- 7.4 Subsea operations

- 7.5 Marine vessels & FPSOs

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Design, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Active heave compensated (AHC)

- 8.3 Passive heave compensated (PHC)

- 8.4 Non-compensated

Chapter 9 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 New installation

- 9.3 Replacement/Retrofit

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 China

- 10.3 India

- 10.4 Japan

- 10.5 South Korea

- 10.6 Australia

- 10.7 Southeast Asia

- 10.7.1 Brunei

- 10.7.2 Cambodia

- 10.7.3 Indonesia

- 10.7.4 Laos

- 10.7.5 Malaysia

- 10.7.6 Myanmar

- 10.7.7 Philippines

- 10.7.8 Singapore

- 10.7.9 Thailand

- 10.7.10 Vietnam

- 10.8 Rest of APAC

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Cargotec

- 11.1.2 CSSC (China State Shipbuilding Corporation)

- 11.1.3 Heila Cranes

- 11.1.4 Huisman Equipment

- 11.1.5 Hyundai Heavy Industries

- 11.1.6 IHI

- 11.1.7 Kenz Figee

- 11.1.8 Konecranes

- 11.1.9 Liebherr

- 11.1.10 MacGregor

- 11.1.11 National Oilwell Varco (NOV)

- 11.1.12 Palfinger Marine

- 11.1.13 Sparrows Offshore

- 11.1.14 Tadano

- 11.1.15 Terex

- 11.1.16 ZPMC (Shanghai Zhenhua Heavy Industries)

- 11.2 Regional Players

- 11.2.1 CIMC Raffles

- 11.2.2 Cochin Shipyard

- 11.2.3 Daewoo Shipbuilding & Marine Engineering

- 11.2.4 Larsen & Toubro

- 11.2.5 Mitsubishi Heavy Industries

- 11.2.6 Sembcorp Marine

- 11.2.7 Wison Offshore & Marine

- 11.3 Emerging Players

- 11.3.1 Batamec Shipyard

- 11.3.2 China Merchants

- 11.3.3 COSCO SHIPPING

- 11.3.4 Dyna-Mac

- 11.3.5 Jiangsu Dajin

- 11.3.6 Keppel Offshore & Marine

- 11.3.7 PTSC Marine