PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801825

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801825

Religious and Spiritual Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

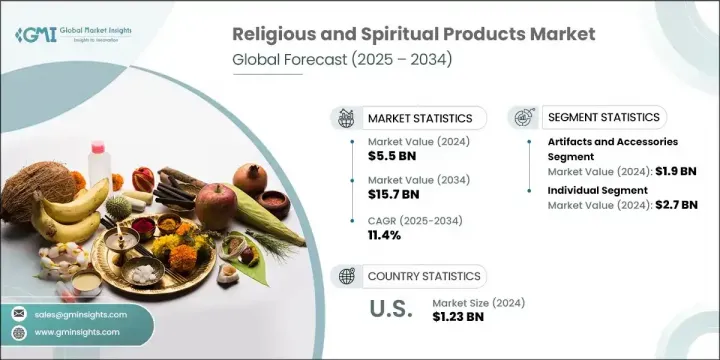

The Global Religious and Spiritual Products Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 15.7 billion by 2034. Market expansion is being fueled by a blend of evolving spiritual practices and the rise of ethical consumerism, where buyers are seeking products that resonate with their values. There's increasing demand for goods that are not only spiritually meaningful but also sustainable, such as cruelty-free ritual candles or environmentally conscious incense. This shift enables brands to appeal to both traditional users and conscious consumers, unlocking premium price potential. The alignment of spiritual products with health and wellness practices is also enhancing product relevance.

As spiritual tools like prayer and meditation gain traction for their mental health benefits, they're being positioned as wellness essentials rather than strictly religious items. This transition reflects how belief and commerce intersect, turning symbolic artifacts into lifestyle products. The market is moving beyond religious boundaries to serve a broader demographic interested in personal growth, mindfulness, and self-care. Digital accessibility and the personalization of spiritual products further increase their reach, attracting a new generation of consumers seeking both meaning and convenience in their purchases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 billion |

| Forecast Value | $15.7 billion |

| CAGR | 11.4% |

In 2024, the artifacts and accessories segment generated USD 1.9 billion and is expected to grow at a CAGR of 10.1% through 2034. Products such as sacred symbols, prayer beads, and idols carry strong cultural value and are integral to spiritual routines across diverse traditions. Their frequent use in both personal worship and ceremonial gifting keeps demand steady across urban and rural regions alike. These items also allow for customization, regional adaptation, and creative design, giving manufacturers the flexibility to cater to various spiritual preferences and aesthetic tastes.

The individual segment generated USD 2.7 billion and accounted for 49.1% share in 2024. Individuals consistently purchase spiritual products for their personal rituals, meditation practices, and mindfulness routines. The growth of spiritual self-care has broadened product relevance, especially among younger consumers seeking emotional well-being and daily balance. The convenience of online shopping platforms and mobile applications has enhanced accessibility, allowing users to explore and buy directly without relying on traditional retail or institutional intermediaries. Items like incense, accessories, and even digital spiritual content are being tailored for personal use, offering comfort, personalization, and emotional resonance.

United States Religious and Spiritual Products Market was valued at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 10.4% between 2025 and 2034. The U.S. remains one of the most influential markets due to its strong religious landscape and high level of individual engagement in spiritual activities. This environment supports demand for ceremonial goods, spiritual literature, and lifestyle-based accessories. Religious freedom and institutional support also contribute to a market that remains culturally and politically favorable for faith-based commerce. The integration of spirituality with wellness and mental health routines further fuels consumption. Digital commerce platforms have enhanced accessibility, enabling broader outreach and more personalized shopping experiences for consumers across age groups and belief systems.

Key players influencing the Global Religious and Spiritual Products Market include Divine Hindu, Pujahome, Brown Living, Powerfulhand.com, Rudra India, Indo Divine Spiritual Solutions Pvt. Ltd., Stuller, Inc., Mysore Deep Perfumery House, Rgyan Shop, Namoh Indiya, Bolsius International BV, Delsbo Candle AB, Shubhkart, Sounds True Inc., and Prajjwal International. Leading brands in the religious and spiritual products market are expanding their footprint through diversified product lines that cater to both traditional faith practices and modern wellness routines. Many companies are focusing on eco-conscious manufacturing, offering biodegradable, cruelty-free, and ethically sourced goods to attract value-driven consumers. Customization options and region-specific designs are enabling deeper consumer connection. Firms are also leveraging digital channels, creating immersive e-commerce experiences and mobile apps that streamline the customer journey. Strategic collaborations with spiritual influencers and wellness platforms are helping brands expand their visibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 End use

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 -2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Artifacts and accessories

- 5.3 Ceremonial items

- 5.4 Digital products

- 5.5 Textbooks

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use, 2021 -2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Individual

- 6.3 Religious institutions

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 -2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Online

- 7.2.1 Company website

- 7.2.2 E-commerce website

- 7.3 Offline

- 7.3.1 Religious bookstores

- 7.3.2 Gift shops

- 7.3.3 Specialty stores

- 7.3.4 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 -2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 U.K.

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Bolsius International BV

- 9.2 Brown Living

- 9.3 Delsbo Candle AB

- 9.4 Divine Hindu

- 9.5 Indo Divine Spiritual Solutions Pvt. Ltd.

- 9.6 Mysore Deep Perfumery House

- 9.7 Namoh Indiya

- 9.8 Powerfulhand.com

- 9.9 Prajjwal International

- 9.10 Pujahome

- 9.11 Rgyan Shop

- 9.12 Rudra India

- 9.13 Shubhkart

- 9.14 Sounds True Inc.

- 9.15 Stuller, Inc.