PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822562

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822562

Antiques and Collectibles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

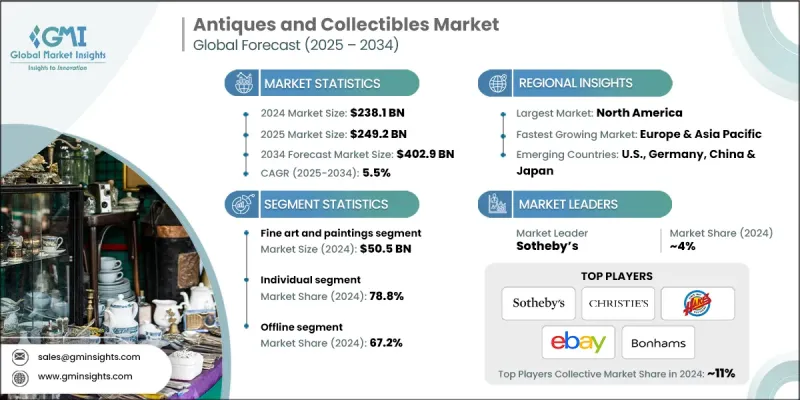

The antiques and collectibles market was valued at USD 238.1 billion in 2024 and is projected to grow from USD 249.2 billion in 2025 to USD 402.9 billion by 2034, at a CAGR of 5.5%, according to the latest report published by Global Market Insights, Inc.

The market growth is supported by a resurgence in nostalgic and vintage products, the expansion of digital auction sites, and increasing interest in non-traditional investments, such as fine art, rare toys, memorabilia, and ancient artifacts. Both mature collectors and the newer generations are fueling demand both online and offline.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $238.1 Billion |

| Forecast Value | $402.9 Billion |

| CAGR | 5.5% |

Key Drivers:

1. Increasing popularity of alternative investments: Collectibles, art, and vintage products are increasingly perceived as a store of value during market instability.

2. Auction digitalization: Mobile apps and internet platforms have expanded access to collectibles worldwide.

3. Growing Appeal of celebrity and pop culture: Collectibles with links to iconic figures, movies, and brands are still attracting big bids.

4. Rise in millennial and Gen Z engagement: Younger generations are adopting collectibles like Pokemon cards, vinyl records, and 90s memorabilia.

Key Players:

- The major players in the antiques and collectibles sector in 2024 are Christie's, Sotheby's, Heritage Auctions, eBay, Bonhams, and Hakes Auctions. In total, these six players have an estimated market share of ~11%.

Key Challenges:

- Authenticity and provenance concerns: Counterfeit risks remain a chief deterrent (especially for high-end and digital collectibles).

- Price uncertainty: Value can fluctuate based on trends or economic changes, which can discourage purchases for consumers (especially those who are risk-averse).

1. By Product Category - Fine Art & Paintings captures the Largest market share

Fine art and paintings took up the largest part of the market in 2024, with an increase in auction prices for both traditional and contemporary art (including original pieces) being made by known artists. Original pieces by recognised artists create demand by 'high net worth' collectors and institutional buyers alike.

2. By End Use - Individual Buyers Lead the Market

Individual buyers made up the largest group of end users in 2024 and bought based on personal interest, nostalgia, or investment value at estate sales, antique shows or on the internet.

3. By Distribution Channel - Offline Channels Remain Important

Offline channels, whether delivered through traditional auction houses, antique fairs, galleries, or estate sales, continued as the largest in 2024, by capturing the largest share of the market. The capacity to physically examine the item, or verify if the item is as described, and live bidding still brings serious collectors and investors to the table, even with the increasing use of e-commerce.

4. By Region - North America Leads Global Demand

North America was the leader in antiques and collectibles in 2022. Antiques are clearly recognized as a part of culture, and there is an abundant infrastructure for auctions and a nationwide established secondary market in place.

North America led the antiques and collectibles market in 2024, with an established auction industry and high-net-worth individual collectors, which was also driven by interest in sports memorabilia, comic books, and pop culture memorabilia. The U.S. specifically experiences strong activity in both in-person estate sales and online auctions, with increasing interest in certified and graded collectibles.

Major players in the collectibles and antiques industry are Sotheby's, Christie's International, Bonhams, Heritage Auctions, RR Auction, Skinner, Invaluable, Julien's Auctions, Lelands, PWCC Marketplace, BiddingForGood, ComicLink, Hake's Americana & Collectibles, The Upper Deck Company, Funko, Golden Auctions, Hasbro, Stanley Gibbons Group, and eBay.

Key players are now making significant investments in NFT adoption, digitalization, and global expansion to capitalize on evolving consumer preferences. Sotheby's and Christie's have boosted the number of online auctions. In addition, eBay and PWCC Marketplace are building AI-based authentication tools for graded collectibles. Hasbro and Funko are moving towards licensing collaborations to meet the market demand spun from pop culture. Likewise, other auction houses, such as RR Auction and Bonhams, are also developing streamlined physical-digital hybrid bidding solutions for participatory, accessible experiences for global collectors. These strategies are consistent with the observed increase in digitization and democratisation of the collectibles economy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product category

- 2.2.3 Price range

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing interest in art and history

- 3.2.1.2 Cultural and historical appeal

- 3.2.1.3 Investment of potential antiques and collectibles

- 3.2.1.4 Rising disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Authentication and provenance issues

- 3.2.2.2 Regulatory and legal challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product category

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Category, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Fine art and paintings

- 5.3 Antique furniture and decorative arts

- 5.4 Metalwork and sculpture

- 5.5 Jewelry and watches

- 5.6 Collectible toys and games

- 5.7 Books, manuscripts, and paper ephemeral

- 5.8 Coins, currency, and numismatics

- 5.9 Sports memorabilia and trading cards

- 5.10 Musical instruments and audio equipment

- 5.11 Others (automotive and transportation collectibles)

Chapter 6 Market Estimates & Forecast, By Price range, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Individual

- 7.3 Commercial

- 7.3.1 Museum

- 7.3.2 Institutions

- 7.3.3 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 Dedicated antique platforms

- 8.2.2 E-commerce platforms

- 8.3 Offline

- 8.3.1 Traditional auction houses

- 8.3.2 Brick-and-mortar dealers

- 8.3.3 Antique fairs and shows

- 8.3.4 Estate sales and liquidations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 BiddingForGood

- 10.2 Bonhams

- 10.3 Christie’s International

- 10.4 ComicLink

- 10.5 eBay

- 10.6 Funko

- 10.7 Golden Auctions

- 10.8 Hake’s Americana & Collectibles

- 10.9 Hasbro

- 10.10 Heritage Auctions

- 10.11 Invaluable

- 10.12 Julien's Auctions

- 10.13 Lelands

- 10.14 PWCC Marketplace

- 10.15 RR Auction

- 10.16 Skinner

- 10.17 Sotheby's

- 10.18 Stanley Gibbons Group

- 10.19 The Upper Deck Company