PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801841

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801841

Cementitious Grouts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

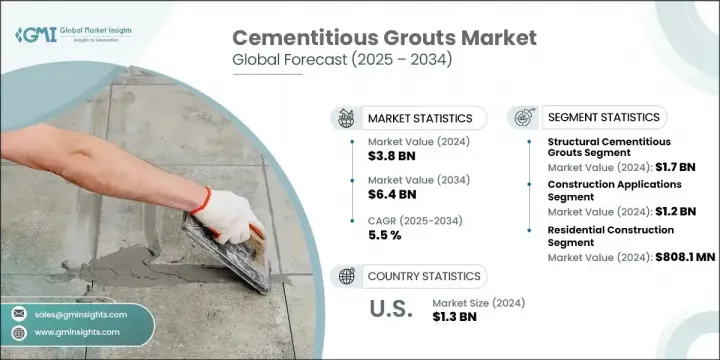

The Global Cementitious Grouts Market was valued at USD 3.8 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 6.4 billion by 2034. The market is experiencing solid growth due to increased use in infrastructure reinforcement, tunneling operations, geotechnical stabilization, and advanced construction applications. Investments across developing regions such as Eastern Europe, Asia-Pacific, and the Middle East are intensifying the demand for engineered cementitious materials.

Structural-grade grouts remain the most used due to their compressive strength and dimensional stability, particularly in large-scale infrastructure. However, the market is witnessing growing traction for chemical-resistant variants and rapid-set or shrinkage-compensated cementitious grouts, particularly in seismic retrofitting and tunnel applications, as performance-based construction becomes a priority globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.5% |

Geological complexities are also contributing to the shift from conventional cement grouts to microfine cement grouts, which hold a 10% share. These high-performance products are gaining demand in soil consolidation and fine crack remediation, especially in geotechnical applications that require precise penetration and substrate bonding. Polymer-modified and blended grouts are further capturing market interest where long-term durability, flowability, and resistance in extreme environmental conditions are essential, supporting the trend toward advanced and adaptable construction materials.

The structural cementitious grouts segment was worth USD 1.7 billion in 2024, maintaining dominance due to its strong uptake in civil and infrastructure construction. These materials are particularly used in load-critical applications like bridge bearings, base plates, and precast assemblies. Their high compressive strength, resistance to heavy dynamic loads, and dimensional stability make them the preferred choice in public infrastructure and transport projects. The fast-paced infrastructure development across Asia-Pacific, with countries like China and India contributing significantly, is driving up the demand, particularly for metro systems and expressway projects.

The cementitious grouts segment held 38% share in 2024. Their widespread use in reinforcement anchoring, high-rise structures, and precast systems is due to the demand for materials that can endure high loads and perform in varied climatic conditions, reflecting the critical role of structural grouts in modern construction techniques and high-performance concrete design.

US Cementitious Grouts Market held 82% share and generated USD 1.3 billion in 2024. This dominant position is supported by continual infrastructure renewal initiatives, expanded public funding through federal programs, and a growing shift toward sustainable construction materials. The market in the US is particularly driven by demand for high-performance grouts used in bridges, tunneling, precast bonding, and soil stabilization. These applications require solutions offering high strength, minimal permeability, and strong chemical resistance, particularly in demanding civil engineering environments.

The leading players in the Global Cementitious Grouts Market include Holcim Group (LafargeHolcim), MAPEI S.p.A, Sika AG, Fosroc International Limited, and BASF SE. To expand their presence in the cementitious grouts sector, key players are leveraging strategies such as investing in R&D to develop advanced grouting formulations that deliver improved mechanical performance and durability. Companies are focusing on low-shrinkage, rapid-setting, and eco-friendly grouts to align with evolving construction standards. Expanding manufacturing capacity in high-growth regions and forming strategic partnerships with regional distributors are also helping players tap into localized demand. Additionally, businesses are prioritizing certifications and compliance with green building codes to cater to infrastructure projects funded through sustainability-driven programs, ensuring broader adoption across public and private construction sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and modernization

- 3.2.1.2 Growing construction industry demand

- 3.2.1.3 Tunneling and mining expansion

- 3.2.1.4 Sustainability and environmental regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical expertise requirements

- 3.2.2.3 Raw material price volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market penetration

- 3.2.3.2 Green building and sustainable construction

- 3.2.3.3 Advanced material innovations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Structural Cementitious Grouts

- 5.2.1 High-Performance Structural Grouts

- 5.2.2 Standard Structural Grouts

- 5.2.3 Rapid-Setting Structural Grouts

- 5.3 Non-Structural Cementitious Grouts

- 5.3.1 General Purpose Grouts

- 5.3.2 Void Filling Grouts

- 5.3.3 Sealing and Waterproofing Grouts

- 5.4 Specialty Cementitious Grouts

- 5.4.1 Ultra-High Performance Grouts

- 5.4.2 Marine and Offshore Grouts

- 5.4.3 High-Temperature Resistant Grouts

- 5.4.4 Chemical Resistant Grouts

- 5.5 Microfine Cement Grouts

- 5.6 Blended and Modified Grouts

- 5.6.1 Polymer-Modified Grouts

- 5.6.2 Fiber-Reinforced Grouts

- 5.6.3 Mineral Admixture Enhanced Grouts

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Construction applications

- 6.2.1 Foundation and base plate grouting

- 6.2.2 Anchor bolt installation

- 6.2.3 Precast element connections

- 6.2.4 Structural repairs and rehabilitation

- 6.3 Mining and tunneling

- 6.3.1 Ground consolidation and stabilization

- 6.3.2 Water ingress control

- 6.3.3 Rock mass reinforcement

- 6.3.4 Shaft and tunnel lining

- 6.4 Infrastructure projects

- 6.4.1 Bridge construction and repair

- 6.4.2 Dam and reservoir applications

- 6.4.3 Highway and transportation infrastructure

- 6.4.4 Utility and pipeline projects

- 6.5 Marine and offshore applications

- 6.5.1 Port and harbor construction

- 6.5.2 Offshore wind turbine installations

- 6.5.3 Underwater structural repairs

- 6.6 Industrial applications

- 6.6.1 Equipment foundation grouting

- 6.6.2 Floor and pavement applications

- 6.6.3 Chemical plant and facility construction

- 6.7 Geotechnical applications

- 6.7.1 Soil stabilization

- 6.7.2 Ground improvement

- 6.7.3 Slope stabilization

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Single-family housing

- 7.2.2 Multi-family housing

- 7.2.3 Renovation and remodeling

- 7.3 Commercial construction

- 7.3.1 Office buildings

- 7.3.2 Retail and shopping centers

- 7.3.3 Hospitality and entertainment

- 7.4 Industrial construction

- 7.4.1 Manufacturing facilities

- 7.4.2 Warehouses and distribution centers

- 7.4.3 Power generation facilities

- 7.5 Infrastructure and civil engineering

- 7.5.1 Transportation infrastructure

- 7.5.2 Water and wastewater treatment

- 7.5.3 Energy infrastructure

- 7.6 Mining and extractive industries

- 7.6.1 Coal mining

- 7.6.2 Metal and mineral extraction

- 7.6.3 Oil and gas operations

- 7.7 Marine and offshore industries

- 7.7.1 Shipbuilding and repair

- 7.7.2 Offshore energy projects

- 7.7.3 Port and terminal development

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Sika AG

- 9.2 MAPEI S.p.A

- 9.3 BASF SE (Master Builders Solutions)

- 9.4 Fosroc International Limited

- 9.5 Euclid Chemical Company

- 9.6 LafargeHolcim (Holcim Group)

- 9.7 CEMEX S.A.B. de C.V.

- 9.8 CRH plc

- 9.9 HeidelbergCement AG

- 9.10 Arkema Group

- 9.11 UltraTech Cement Limited

- 9.12 Perma Construction Aids Pvt. Ltd.

- 9.13 Saint-Gobain Weber

- 9.14 Ambuja Cements Limited