PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801864

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801864

Grouts and Anchors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

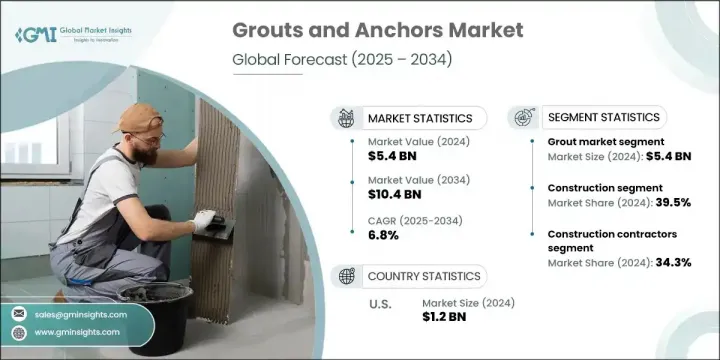

The Global Grouts and Anchors Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 10.4 billion by 2034. Market expansion is strongly tied to increased urbanization, a surge in construction activity, and the growing emphasis on infrastructure resilience. Grouts and anchors are essential materials that ensure structural integrity by stabilizing foundations, securing fixtures, and filling gaps across both modern construction and retrofitting projects. These components are foundational to the safety and longevity of civil infrastructure, including commercial buildings, bridges, tunnels, and more.

As global investments in residential, commercial, and public infrastructure accelerate, so does the demand for high-performance and durable construction materials. The growing preference for technologically advanced and easy-to-apply anchoring and grouting solutions is also shaping the industry. Additionally, the push for compliance with evolving building codes and safety regulations continues to drive market momentum across both developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.4 Billion |

| CAGR | 6.8% |

The grouts segment dominated with a 54.3% market share in 2024, as these materials are widely used to stabilize structures, fill cavities, and improve load distribution. Known for their strength and adaptability, grouts are essential for structural rehabilitation, foundation reinforcements, and demanding construction tasks requiring durability and precision. Their long-term reliability makes them the go-to solution in both small-scale repairs and large-scale infrastructure projects.

The construction segment held a 39.5% share in 2024, owing to constant global demand for residential, industrial, and commercial developments. As builders aim for longer-lasting, code-compliant buildings, they are turning to high-quality grouting and anchoring products to meet performance and safety expectations. The shift toward sustainable construction materials is also playing a role in reinforcing the use of advanced grouts and anchors in modern building practices.

U.S. Grouts and Anchors Market held an 88.7% share and generated USD 1.2 billion in 2024. This leadership position stems from large-scale investments in infrastructure upgrades and new construction across the country. Ongoing federal infrastructure initiatives are sustaining the demand for reliable grouting and anchoring materials that offer strength, longevity, and improved resilience. As infrastructure ages and climate resilience becomes critical, builders continue to seek high-performance products that align with evolving structural demands.

Key players shaping the Global Grouts and Anchors Market include Hilti AG, MAPEI S.p.A., Sika AG, BASF SE, and Fosroc International. To strengthen their market position, leading companies in the grouts and anchors space are focusing on several strategic initiatives. These include expanding R&D to develop innovative materials with faster curing times, higher durability, and sustainability features. Many are investing in product customization and advanced chemical formulations to meet the needs of specific construction applications. Strategic mergers, regional partnerships, and acquisitions are also common approaches to widen their geographical footprint. Furthermore, companies are emphasizing on training programs for contractors to boost product adoption and ensure proper application, while integrating digital tools for precise formulation recommendations and project planning.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward sustainable construction

- 3.2.1.2 Adoption of hybrid and smart technologies

- 3.2.1.3 Injectable adhesive anchors leading growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material supply instability

- 3.2.2.2 Regulatory compliance pressure

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in modular and prefabricated construction

- 3.2.3.2 Customization and specialty products

- 3.2.3.3 Collaboration with construction technology firms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Grouts market

- 5.2.1 Cementitious grouts

- 5.2.2 Epoxy grouts

- 5.2.3 Chemical grouts

- 5.2.4 Other grout types

- 5.2.4.1 Polyurethane grouts

- 5.2.4.2 Acrylic grouts

- 5.3 Anchors market

- 5.3.1 Mechanical anchors

- 5.3.2 Chemical anchors

- 5.3.3 Adhesive anchors

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Construction

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Infrastructure

- 6.3.1 Transportation

- 6.3.1.1 Bridges and highways

- 6.3.1.2 Tunnels and underground

- 6.3.1.3 Railway infrastructure

- 6.3.1.4 Airport construction

- 6.3.2 Utilities

- 6.3.2.1 Water and wastewater

- 6.3.2.2 Power generation

- 6.3.2.3 Telecommunications

- 6.3.2.4 Energy infrastructure

- 6.3.1 Transportation

- 6.4 Marine and offshore

- 6.4.1 Port and harbor construction

- 6.4.2 Offshore platforms

- 6.4.3 Coastal protection

- 6.4.4 Marine repair and maintenance

- 6.5 Mining and underground applications

- 6.5.1 Mine support systems

- 6.5.2 Underground excavation

- 6.5.3 Tunnel stabilization

- 6.5.4 Ground improvement

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Construction Contractors

- 7.2.1 General Contractors

- 7.2.2 Specialty Contractors

- 7.3 Infrastructure Developers

- 7.4 Industrial End Use

- 7.5 Distributors and Retailers

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Arkema Group (via Bostik)

- 9.2 BASF SE (Master Builders Solutions)

- 9.3 Fosroc International Limited

- 9.4 H.B. Fuller Company

- 9.5 Henkel AG & Co. KGaA (Loctite brand)

- 9.6 Hilti AG

- 9.7 Laticrete International

- 9.8 MAPEI S.p.A.

- 9.9 Saint-Gobain Weber

- 9.10 Sika AG

- 9.11 Stanley Black & Decker

- 9.12 Wurth Group