PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801845

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801845

North America Class 6 Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

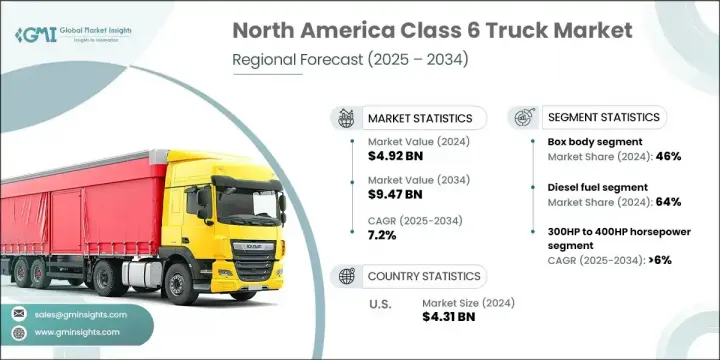

North America Class 6 truck Market was valued at USD 4.92 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 9.47 billion by 2034. The region's medium-duty truck segment is undergoing a significant transformation as demand for regional logistics, vocational applications, and last-mile delivery continues to surge. Fleet operators are increasingly favoring Class 6 trucks for their ability to strike the right balance between payload, power, and fuel efficiency. These vehicles are gaining prominence in municipal services, urban freight routes, and infrastructure-related operations. With a growing push for cleaner, more intelligent transport, operators are transitioning toward connected and more sustainable fleets.

This shift is being supported by changing emissions standards, the rise of electric models, and improved telematics integration. Recent developments in e-commerce and logistics, particularly after the pandemic, have driven companies to modernize their fleets by embracing predictive analytics and real-time monitoring. State-level grants and electrification incentives are further accelerating this trend, particularly among utility fleets and city governments incorporating sustainability mandates into vehicle procurement. Innovation in chassis and drivetrain platforms is becoming essential for maintaining brand competitiveness in this increasingly dynamic market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.92 Billion |

| Forecast Value | $9.47 Billion |

| CAGR | 7.2% |

The diesel segment held a 64% share in 2024 and is projected to grow at a CAGR of 6% through 2034. The diesel-powered Class 6 truck segment continues to lead due to its extensive fueling infrastructure, robust technology base, and strong track record in long-haul and demanding operations. Most medium-duty fleets remain diesel-centric, benefiting from the reliability and range that diesel engines offer. Major OEMs offering diesel platforms have managed to retain their edge by meeting evolving emissions standards while preserving engine efficiency and power delivery for heavy-duty tasks.

The box body configuration segment held a 46% share in 2024 and is forecasted to grow at a CAGR of 7% through 2034. Its enclosed, built, and secure structure makes it a preferred choice across a wide array of industries-from retail logistics and wholesale distribution to consumer shipping. Box body trucks are integral to regional logistics and remain vital for businesses needing secure, versatile, and weather-resistant freight solutions.

U.S. Class 6 truck market held an 87% share and generated USD 4.31 billion in 2024. The country's leadership is driven by its expansive highway systems, advanced logistics capabilities, and consistent demand across last-mile, urban, and regional transport sectors. The strength of local assembly, innovation pipelines, and well-supported aftermarket services continues to elevate the market's maturity.

Key players involved in the North America Class 6 Truck Market include OEMs such as Navistar, Mack Trucks, Ford, Peterbilt Motors, Volvo Trucks, PACCAR, Daimler Truck, Isuzu Commercial Truck, Lion Electric, and Hino Motors either headquartered or operating extensively within the US, the region enjoys a robust supply chain and high frequency of product updates. Key players are focusing on platform-level upgrades to boost fuel efficiency, reduce emissions, and extend vehicle life cycles. Investments in electric drivetrains and alternative fuels are accelerating to meet sustainability regulations and customer demands. Companies are also integrating advanced telematics for real-time diagnostics, remote monitoring, and enhanced fleet visibility. Collaborations with state programs and energy agencies are helping OEMs secure funding and streamline deployment of zero-emission models. Modular vehicle designs are being introduced to offer greater flexibility across industries. Moreover, partnerships with technology providers are enabling seamless connectivity for predictive maintenance and route optimization.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fuel

- 2.2.3 Body type

- 2.2.4 Horsepower

- 2.2.5 Axle

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in urbanization and last-mile delivery

- 3.2.1.2 Surge in fleet electrification initiatives

- 3.2.1.3 Increasing demand from utility and municipal sectors

- 3.2.1.4 Growth of temperature-controlled logistics

- 3.2.1.5 Standardization of telematics and fleet analytics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Charging infrastructure gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Commercialization of hydrogen fuel-cell Class 6 trucks

- 3.2.3.2 Deployment of autonomous delivery pilots in urban zones

- 3.2.3.3 Retrofitting diesel fleets with low-emission technologies

- 3.2.3.4 OEM investment in dedicated EV production facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Emissions standards across North America

- 3.4.1.1.1 EPA Phase 2 & Phase 3 GHG standards enforcement

- 3.4.1.1.2 California ACT and ACF regulations

- 3.4.1.1.3 State-specific implementation timelines

- 3.4.1.1.4 CO2 emissions targets and penalties

- 3.4.1.2 Safety and vehicle standards

- 3.4.1.2.1 FMVSS vehicle type approval procedures

- 3.4.1.2.2 Enhanced safety requirements under FMCSA

- 3.4.1.2.3 Crash testing and advanced driver assistance systems (ADAS) mandates

- 3.4.1.3 Government incentives and policies

- 3.4.1.3.1 Electrification incentives and grants

- 3.4.1.3.2 Subsidies for fleet modernization and scrappage programs

- 3.4.1.3.3 Cross-border emissions and trade regulations

- 3.4.1.1 Emissions standards across North America

- 3.4.1 North America

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.9.3.1 North America statistics by country

- 3.9.3.2 Import dependency analysis

- 3.9.3.3 Trade balance assessment

- 3.9.3.4 Key export destinations outside North America

- 3.9.3.5 Intra-regional trade flow

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing cost components

- 3.10.1.1 Raw materials and components

- 3.10.1.2 Labor costs

- 3.10.1.3 Research and development

- 3.10.1.4 Marketing and distribution

- 3.10.1.5 Overhead and administrative

- 3.10.2 Total cost of ownership (TCO) analysis

- 3.10.3 Operating cost comparison by fuel

- 3.10.4 Maintenance and service cost analysis

- 3.10.1 Manufacturing cost components

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Market penetration and adoption rates

- 3.13.1 Market penetration by country

- 3.13.2 Electric vehicle adoption rates

- 3.13.3 Technology adoption curves

- 3.13.4 Fleet modernization trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 US

- 4.2.2 Canada

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Natural gas

- 5.4 Hybrid electric

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Body, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Box

- 6.3 Dump

- 6.4 Beverage

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Horsepower, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 200HP to 300HP

- 7.3 300HP to 400HP

Chapter 8 Market Estimates & Forecast, By Axle, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 4X2

- 8.3 6X4

- 8.4 6X6

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Freight delivery

- 9.3 Utility services

- 9.4 Construction and Mining

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Northeast US

- 10.3.1 Connecticut

- 10.3.2 Maine

- 10.3.3 Massachusetts

- 10.3.4 New Hampshire

- 10.3.5 New Jersey

- 10.3.6 New York

- 10.3.7 Pennsylvania

- 10.3.8 Rhode Island

- 10.3.9 Vermont

- 10.4 Midwest US

- 10.4.1 Illinois

- 10.4.2 Indiana

- 10.4.3 Iowa

- 10.4.4 Kansas

- 10.4.5 Michigan

- 10.4.6 Minnesota

- 10.4.7 Missouri

- 10.4.8 Nebraska

- 10.4.9 North Dakota

- 10.4.10 Ohio

- 10.4.11 South Dakota

- 10.4.12 Wisconsin

- 10.5 South US

- 10.5.1 Alabama

- 10.5.2 Arkansas

- 10.5.3 Delaware

- 10.5.4 Florida

- 10.5.5 Georgia

- 10.5.6 Kentucky

- 10.5.7 Louisiana

- 10.5.8 Maryland

- 10.5.9 Mississippi

- 10.5.10 North Carolina

- 10.5.11 Oklahoma

- 10.5.12 South Carolina

- 10.5.13 Tennessee

- 10.5.14 Texas

- 10.5.15 Virginia

- 10.5.16 West Virginia

- 10.5.17 Washington D.C.

- 10.6 West US

- 10.6.1 Alaska

- 10.6.2 Arizona

- 10.6.3 California

- 10.6.4 Colorado

- 10.6.5 Hawaii

- 10.6.6 Idaho

- 10.6.7 Montana

- 10.6.8 Nevada

- 10.6.9 New Mexico

- 10.6.10 Oregon

- 10.6.11 Utah

- 10.6.12 Washington

- 10.6.13 Wyoming

- 10.7 Canada

- 10.7.1 Alberta

- 10.7.2 British Columbia

- 10.7.3 Manitoba

- 10.7.4 New Brunswick

- 10.7.5 Newfoundland and Labrador

- 10.7.6 Nova Scotia

- 10.7.7 Ontario

- 10.7.8 Prince Edward Island

- 10.7.9 Quebec

- 10.7.10 Saskatchewan

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Daimler Truck

- 11.1.2 Ford

- 11.1.3 Volvo Trucks

- 11.1.4 PACCAR

- 11.1.5 Navistar

- 11.1.6 Hino Motors

- 11.1.7 Isuzu Commercial Truck

- 11.1.8 Peterbilt Motors

- 11.1.9 Mack Trucks

- 11.1.10 Scania

- 11.2 Regional Players

- 11.2.1 Autocar Trucks

- 11.2.2 Spartan Motors

- 11.2.3 Western Star Trucks

- 11.2.4 Kenworth

- 11.2.5 Blue Bird Corporation

- 11.2.6 International Trucks

- 11.2.7 Freightliner Trucks

- 11.2.8 Oshkosh Corporation

- 11.2.9 Nikola Corporation

- 11.2.10 IC Bus

- 11.3 Emerging Players

- 11.3.1 Lion Electric

- 11.3.2 Workhorse Group

- 11.3.3 GreenPower Motor Company

- 11.3.4 Xos Trucks

- 11.3.5 VIA Motors

- 11.3.6 REE Automotive

- 11.3.7 Canoo

- 11.3.8 Phoenix Motorcars

- 11.3.9 SEA Electric

- 11.3.10 Battle Motors