PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801847

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801847

Seaweed-Based Fertilizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

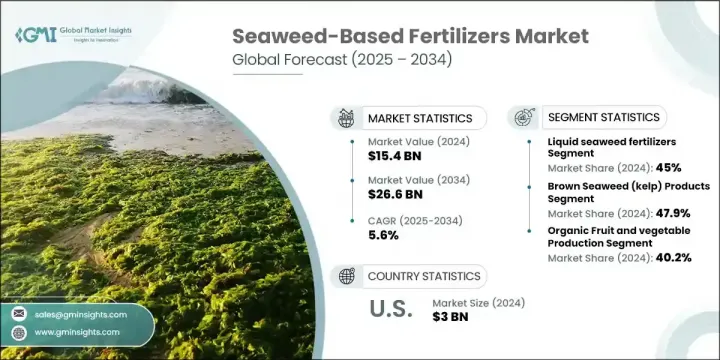

The Global Seaweed-Based Fertilizers Market was valued at USD 15.4 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 26.6 billion by 2034. Seaweed-based fertilizers are playing an increasingly vital role in sustainable agriculture by using natural extracts from various seaweed species to improve crop growth, enhance soil health, and boost environmental resilience. The growing shift toward organic and sustainable farming practices is the primary driver of market expansion, as more farmers seek chemical-free and nutrient-dense products. Additionally, the rising awareness of soil health and the importance of microbial diversity in agriculture further fuels demand.

Seaweed fertilizers, with their bioactive compounds, help create beneficial soil communities, enhance nutrient cycling, moisture retention, and resistance to diseases. Furthermore, these fertilizers contribute to climate change mitigation by improving soil carbon content and crop resilience to environmental stresses, which ultimately lowers carbon footprints. Ongoing advancements in extraction techniques have led to more efficient and high-quality seaweed-based fertilizers, offering a range of products for various farming needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Billion |

| Forecast Value | $26.6 Billion |

| CAGR | 5.6% |

The liquid seaweed fertilizers segment held a 45% share in 2024, with expectations to grow at a CAGR of 5.7% by 2034. Their popularity stems from their quick absorption, easy application, and versatility in both foliar and soil drenching methods, making them particularly favored for organic and precision agriculture.

The brown seaweed products segment held the largest share of 47.9% in 2024 and is expected to grow at a CAGR of 5.6%. Kelp products are rich in natural plant growth hormones, micronutrients, and alginates, making them crucial for improving crop yield, drought resistance, and soil health.

U.S. Seaweed-Based Fertilizers Market was valued at USD 3 billion in 2024, with an expected CAGR of 4.7% by 2034. The U.S. leads the market due to strong adoption of organic farming practices, cutting-edge crop management techniques, and significant investments in sustainable agriculture, particularly in liquid seaweed-based biostimulants. The country's advanced production infrastructure and collaboration between agri-tech innovators have further accelerated the growth of this market, particularly in precision agriculture.

Key players in the Global Seaweed-Based Fertilizers Market include Seasol International Pty Ltd., Haifa Group, AlgaEnergy S.A., Acadian Seaplants Limited, Brandt Consolidated, Inc., Kelpak (Kelp Products International), Bioiberica S.A.U., Biostadt India Limited, COMPO EXPERT GmbH, Grow More, Inc., Maxicrop USA, Inc., Leili Marine Bioindustry Inc., Chase Organics GB Ltd., and West Coast Marine Bio-Processing Corp. To strengthen their position in the market, companies in the seaweed-based fertilizers industry focus on several key strategies. These include continued investment in research and development to enhance the efficiency and quality of their products. Companies are also expanding their product portfolios to meet diverse agricultural needs, from large-scale commercial farming to smaller, organic operations. Strategic partnerships and collaborations with agricultural research institutions and farming communities help foster product innovation and increase market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Seaweed type

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for organic and sustainable agriculture

- 3.2.1.2 Environmental concerns and chemical fertilizer alternatives

- 3.2.1.3 Soil health and microbiome enhancement focus

- 3.2.1.4 Climate change mitigation and carbon sequestration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Higher cost vs traditional chemical fertilizers

- 3.2.2.2 Limited seaweed supply and harvesting capacity

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market organic agriculture growth

- 3.2.3.2 Precision agriculture and technology integration

- 3.2.3.3 Value-added processing and product development

- 3.2.3.4 Government incentives and sustainability programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid seaweed fertilizers

- 5.2.1 Concentrated liquid extracts

- 5.2.2 Ready-to-use spray solutions

- 5.3 Solid and granular products

- 5.3.1 Dried seaweed meal

- 5.3.2 Granulated and pelletized fertilizers

- 5.4 Specialty and functional products

- 5.4.1 Biostimulant formulations

- 5.4.2 Blended and enhanced product

Chapter 6 Market Estimates and Forecast, By Seaweed Type, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Brown seaweed (kelp) products

- 6.2.1 Ascophyllum nodosum

- 6.2.2 Laminaria and kelp species

- 6.3 Red seaweed products

- 6.3.1 Gracilaria and porphyra species

- 6.4 Green seaweed products

- 6.4.1 Ulva and chlorella applications

- 6.5 Mixed and blended seaweed products

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Organic fruit and vegetable production

- 7.2.1 Organic fruit orchards

- 7.2.1.1 Apple, citrus, and stone fruit

- 7.2.1.2 Berry and small fruit production

- 7.2.1.3 Tropical and exotic fruit cultivation

- 7.2.2 Organic vegetable farming

- 7.2.2.1 Leafy greens and salad crops

- 7.2.2.2 Root vegetables and tubers

- 7.2.2.3 Tomatoes and nightshade crops

- 7.2.1 Organic fruit orchards

- 7.3 Field crop and grain production

- 7.3.1 Organic grain and cereal crops

- 7.3.1.1 Wheat, corn, and rice production

- 7.3.1.2 Specialty and ancient grains

- 7.3.1.3 Legume and pulse crops

- 7.3.2 Pasture and forage crops

- 7.3.2.1 Grass and hay production

- 7.3.2.2 Livestock feed and grazing

- 7.3.1 Organic grain and cereal crops

- 7.4 Specialty and high-value crops

- 7.4.1 Organic herb and spice production

- 7.4.2 Ornamental and landscape applications

- 7.5 Aquaculture and marine applications

- 7.5.1 Fish and shellfish production

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants Limited

- 9.2 AlgaEnergy S.A.

- 9.3 Bioiberica S.A.U.

- 9.4 Biostadt India Limited

- 9.5 Brandt Consolidated, Inc.

- 9.6 Chase Organics GB Ltd.

- 9.7 COMPO EXPERT GmbH

- 9.8 Grow More, Inc.

- 9.9 Haifa Group

- 9.10 Kelpak (Kelp Products International)

- 9.11 Leili Marine Bioindustry Inc.

- 9.12 Maxicrop USA, Inc.

- 9.13 Seasol International Pty Ltd.

- 9.14 West Coast Marine Bio-Processing Corp.