PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801853

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801853

Accelerometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

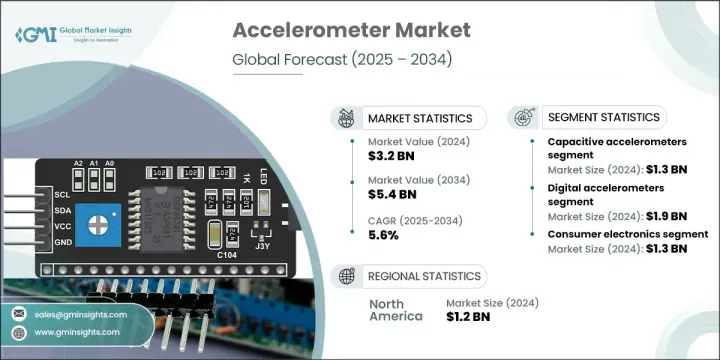

The Global Accelerometer Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 5.4 billion by 2034. The rising integration of accelerometers across consumer electronics, smart gadgets, and industrial systems is fueling growth. Their widespread application in smart wearables, medical devices, and next-gen automotive systems-including those used in advanced driver assistance technologies-is transforming how motion, direction, and force are sensed. Accelerometers are increasingly relied on for real-time data collection, offering precision across multiple fields such as aerospace, healthcare, and robotics.

Accelerometers are also becoming essential in predictive maintenance systems, ensuring performance and efficiency in automated industrial settings. As IoT adoption scales up, these sensors are playing a key role in enabling responsive, connected environments across homes, vehicles, and manufacturing plants. With technological advancements enhancing their compactness and performance, accelerometers continue to attract widespread interest across both high-volume consumer applications and critical enterprise-grade systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.6% |

The capacitive accelerometers segment generated USD 1.3 billion in 2024. These sensors are gaining traction for their compact form factor, cost-effectiveness, and low energy usage. Their growing use in mass-market devices such as airbags and mobile hardware is driving demand. Additionally, capacitive MEMS models are well-suited for intelligent platforms requiring accurate, repeatable motion detection. Manufacturers are channeling R&D into producing advanced capacitive accelerometers that integrate built-in signal processing, especially for fast-growing sectors like automotive, IoT, and wearables.

The digital accelerometers segment generated USD 1.9 billion in 2024. These components are in high demand due to their ease of integration with processors, strong signal clarity, and compatibility with digital communication protocols. From compact electronics to industrial systems, their versatility supports seamless connectivity. Digital accelerometers are being refined to meet next-gen requirements in devices that prioritize extended battery life and smart functionality. Companies are focusing on developing more efficient models with embedded intelligence to align with demand across IoT, fitness tech, and compact consumer gadgets.

North America Accelerometer Market was valued at USD 1.2 billion in 2024 and is projected to grow at a CAGR of 5.2% through 2034. The region continues to benefit from strong defense funding, advanced infrastructure, and increasing penetration of consumer tech. Growth is further reinforced by heightened automation in manufacturing and the growing adoption of smart technologies. To strengthen their position, manufacturers are encouraged to partner with local OEMs and participate in public sector R&D initiatives. Expanding innovation efforts in sectors like mining, aerospace, and industrial automation remains a key growth avenue.

Companies in the Global Accelerometer Market are strengthening their market position by focusing on miniaturization, energy efficiency, and enhanced signal accuracy. Strategic investments are directed toward R&D to produce intelligent MEMS accelerometers integrated with digital interfaces and built-in analytics. Expansion into emerging sectors like healthcare wearables and autonomous vehicles is enabling long-term revenue streams. Several key players are forming collaborations with OEMs to ensure seamless integration into smart devices and machinery. Companies are also increasing their global footprint through acquisitions and local partnerships to optimize supply chains and improve market access. Emphasis on compliance with international safety standards and development of industry-specific models helps accelerate adoption across verticals such as aerospace, automotive, and industrial automation. STMicroelectronics N.V., Bosch Sensortec GmbH, ROHM Semiconductor, TE Connectivity, Analog Devices, Inc., Texas Instruments Incorporated, Microchip Technology Inc., Kearfott Corporation, ASC GmbH, Safran, Hottinger Bruel & Kjaer GmbH, Infineon Technologies AG, Honeywell International Inc., Rockwell Automation Inc., Murata Manufacturing Co., Ltd., OMEGA Engineering Inc., TDK InvenSense, LITEF GmbH, Thales Group, NXP Semiconductors, and Kistler Group.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trend

- 2.2.2 Axis configuration trends

- 2.2.3 Output type trends

- 2.2.4 End use application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Proliferation of Consumer Electronics

- 3.3.1.2 Rise in Industrial Automation and Predictive Maintenance

- 3.3.1.3 Growth in Aerospace and Defense Applications

- 3.3.1.4 Increased Usage in IoT and Smart Devices

- 3.3.1.5 Surge in Healthcare and Medical Device Integration

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 High Competition and Price Pressure

- 3.3.2.2 Integration Complexity with Multi-Sensor Systems

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Sustainability measures

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market estimates and forecast, by Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Capacitive accelerometers

- 5.3 Piezoelectric accelerometers

- 5.4 Piezoresistive accelerometers

- 5.5 Servo accelerometers

- 5.6 Thermal accelerometers

- 5.7 Others

Chapter 6 Market estimates and forecast, by Axis Configuration, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 1-axis accelerometers

- 6.3 2-axis accelerometers

- 6.4 3-axis accelerometers

- 6.5 6-axis and above

Chapter 7 Market estimates and forecast, by Output Type, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Analog Accelerometers

- 7.3 Digital Accelerometers

Chapter 8 Market estimates and forecast, by End Use Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.2.1 Smartphones and tablets

- 8.2.2 Wearables

- 8.2.3 Gaming devices

- 8.2.4 Others

- 8.3 Automotive

- 8.3.1 Airbag systems

- 8.3.2 Vehicle stability control

- 8.3.3 Navigation and telematics

- 8.3.4 Others

- 8.4 Industrial & manufacturing

- 8.4.1 Robotics and automation

- 8.4.2 Condition monitoring

- 8.4.3 Structural health monitoring

- 8.4.4 Others

- 8.5 Healthcare

- 8.5.1 Patient monitoring devices

- 8.5.2 Activity trackers

- 8.5.3 Others

- 8.6 Aerospace and defense

- 8.6.1 Aircraft navigation systems

- 8.6.2 Missile guidance

- 8.6.3 UAVs and drones

- 8.6.4 Others

- 8.7 Others

Chapter 9 Market estimates and forecast, by Region, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company profiles

- 10.1 Global Key Players

- 10.1.1 Bosch Sensortec GmbH

- 10.1.2 Infineon Technologies AG

- 10.1.3 Kearfott Corporation

- 10.1.4 NXP Semiconductors

- 10.1.5 OMEGA Engineering Inc.

- 10.1.6 Rockwell Automation Inc.

- 10.1.7 Safran

- 10.1.8 STMicroelectronics N.V.

- 10.1.9 TE Connectivity

- 10.1.10 Texas Instruments Incorporated

- 10.1.11 Thales Group

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Analog Devices, Inc.

- 10.2.1.2 Honeywell International Inc.

- 10.2.1.3 Microchip Technology Inc.

- 10.2.2 Europe

- 10.2.2.1 ASC GmbH

- 10.2.2.2 Hottinger Bruel & Kjaer GmbH

- 10.2.2.3 Kistler Group

- 10.2.3 Asia-Pacific

- 10.2.3.1 Murata Manufacturing Co., Ltd.

- 10.2.3.2 ROHM Semiconductor

- 10.2.3.3 TDK InvenSense

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 LITEF GmbH