PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836612

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836612

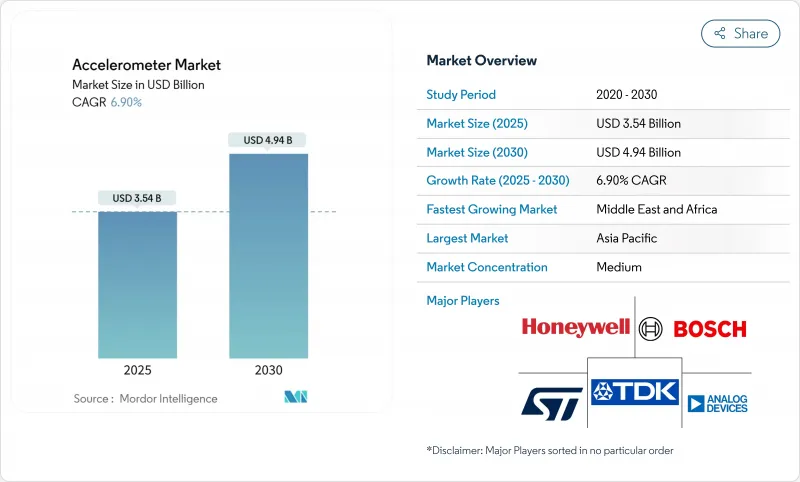

Accelerometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The accelerometer market is valued at USD 3.54 billion in 2025 and is forecast to reach USD 4.94 billion in 2030, representing a 6.9% CAGR over the period.

Demand scales with the sensor's increasingly critical role in consumer devices, automotive safety systems and industrial monitoring. Continuous MEMS miniaturization lowers system cost while enabling integration into space-constrained products, and AI-enhanced on-chip processing now lets accelerometers deliver real-time insights at the edge. Tier-1 automotive suppliers are embedding high-g variants in ADAS sensor-fusion suites, while precision-grade piezoelectric devices sustain differentiated value in aerospace and defense niches. Supply-side risks include lingering 8-inch MEMS wafer constraints and price compression in commoditized consumer segments, but design wins in healthcare wearables and renewable-energy infrastructure keep the overall growth outlook intact.

Global Accelerometer Market Trends and Insights

MEMS Miniaturization and Cost Reduction

Third-generation MEMS processes now fabricate sub-millimeter proof-mass structures that cut die size and power draw without degrading noise density. Bosch's miniature 2024 accelerometer series exemplifies how wafer-level chip-scale packaging lowers material cost while sustaining +-2 g to +-16 g dynamic range. Larger 300 mm MEMS fabs promise further scale economies, allowing OEMs to allocate tighter bill-of-materials budgets to additional sensing functions. STMicroelectronics' LIS2DUXS12 integrates a machine-learning core enabling event classification at microwatt levels, removing the need for a companion MCU and shrinking board footprint. As foundries migrate to larger wafers, average selling prices decline and unlock latent demand in cost-sensitive IoT nodes, reinforcing the growth loop for the accelerometer market.

Consumer Electronics and Wearables Boom

Smartphones, earbuds and fitness trackers remain volume engines, but 2025 design roadmaps reveal an accelerating pivot toward medical-grade wearables that require sub-30 μg/√Hz noise floors and continuous operation for multi-day battery life. Analog Devices' ADXL380 targets true-wireless earbuds with dual signal paths so a single sensor supports both active-noise-cancellation feedback and head-gesture recognition. In medical devices, AI-inference embedded in the sensor offloads cloud processing, enabling fall-detection wearables certified under IEC 60601-1 for hospital use. Higher-value clinical applications ease margin pressure and expand the accelerometer market into regulated healthcare channels that favor quality over lowest price.

Price Pressure and Commoditization

In smartphones the bill-of-materials allotment for inertial sensing shrank by nearly 30% between 2022 and 2024, pushing suppliers to differentiate with embedded ML cores and lower power-suspend modes. Kionix's KX224 series sells below USD 0.30 at million-piece volumes, underscoring deteriorating average selling prices for legacy parts. Vendors invest in automated calibration to recoup margin; however, factory-trim routines raise capex and erode benefit. The imbalance confines many competitors to break-even PandL positions, tempering near-term revenue expansion for the accelerometer market.

Other drivers and restraints analyzed in the detailed report include:

- Automotive ADAS / Safety Integration

- Industry-4.0 Condition Monitoring Uptake

- Accuracy Limits vs. Piezoelectric High-G

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MEMS devices captured 72% accelerometer market share in 2024 owing to unmatched cost-performance balance. Volume manufacturing on 200 mm wafers combined with wafer-level packaging positions MEMS at the heart of smartphones, wearables and automotive ECUs. Piezoelectric units, while representing a smaller base, advance at 7.8% annually as defense and aerospace operators demand sub-1 µg bias stability and radiation tolerance. Piezoresistive and capacitive variants serve niche industrial uses where shock survivability or ultra-low power trumps absolute precision.

MEMS leadership rests on integration advantages. STMicroelectronics' sensor-hub architecture merges a digital machine-learning core and FIFO buffers directly on the die, trimming external component count. Still, when g-range, temperature extremes or bias stability exceed MEMS limits, designers revert to piezoelectric stacks.

The trend toward full-six-degree-of-freedom measurement places 3-axis accelerometers at 64.5% revenue share in 2024. OEMs prefer unified X-Y-Z readings to support gesture recognition and vibration diagnostics with minimal sensor fusion overhead. Meanwhile, combo IMUs embedding 6-axis or 9-axis capability demonstrate an 8.4% growth trajectory, driven by drones, AR/VR headsets and robotics, where synchronized gyro-accelerometer data simplifies algorithm tuning. Single-axis devices persist in tilt switches and automotive airbag triggers, but share steadily erodes.

Collins Aerospace's SiIMU02 illustrates the premium end of multi-axis integration, achieving near-fiber-optic gyro accuracy in a palm-sized MEMS assembly. For mid-tier consumer products, suppliers consolidate accelerometer, gyroscope and sometimes magnetometer on a single ASIC with programmable digital filters. This convergence compresses PCB area and bill-of-materials cost, ensuring the accelerometer market maintains momentum as application complexity rises.

Accelerometer Market is Segmented by Type (MEMS Accelerometers, Piezoelectric Accelerometers, and More), Dimension (1-Axis, 2-Axis, and More), End User (Consumer Electronics, Automotive, and More), Performance Grade (Consumer Grade, Industrial Grade, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 46.8% of global revenue in 2024, anchored by China's consumer-electronics export base and a dense 8-inch MEMS foundry footprint. Shenzhen-headquartered MEMSIC recorded triple-digit growth after focusing capacitor-type accelerometers on domestic smartphone OEMs. Japan and South Korea contribute high-reliability variants for automotive and industrial sectors, while Taiwan's pure-play foundries support contract manufacturing. The region's accelerometer market will expand at a steady 6.4% CAGR, although wafer-capacity constraints and rising labor costs temper upside.

The Middle East and Africa represents the fastest 8.7% CAGR through 2030 as Saudi Arabia's Vision 2030 stimulus funds local semiconductor initiatives and scales renewable-energy assets requiring turbine vibration monitoring. Wind farms across Egypt and Morocco adopt triaxial accelerometers to meet ISO 10816 predictive-maintenance benchmarks. Regional public-private partnerships with European sensor makers expedite technology transfer, accelerating indigenous production and lifting the local accelerometer market trajectory.

North America holds a strong second position driven by automotive ADAS mandates and an advanced industrial IoT install base. Adoption of Industry-4.0 maintenance strategies across oil and gas, chemicals and metals drives demand for rugged, hazardous-area-rated accelerometers. Europe trails marginally yet enjoys higher average selling prices as OEMs prioritize quality and functional safety. EU funding for Horizon Europe robotics projects further stimulates precision-grade sensor uptake, reinforcing regional participation in the accelerometer market.

- Analog Devices Inc.

- Robert Bosch GmbH

- STMicroelectronics

- TDK InvenSense

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd. (Kionix)

- NXP Semiconductors N.V.

- MEMSIC Inc.

- TE Connectivity (Measurement Specialties)

- Silicon Sensing Systems Ltd.

- Sensonor AS

- PCB Piezotronics (MTS Systems)

- Northrop Grumman LITEF GmbH

- Rockwell Automation Inc.

- Kearfott Corporation

- Meggitt PLC (Endevco)

- Dytran Instruments Inc.

- Al Cielo Inertial Solutions Ltd.

- Atlantic Inertial Systems Ltd.

- LORD MicroStrain (HBK)

- QST Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 MEMS miniaturization and cost reduction

- 4.2.2 Consumer-electronics and wearables boom

- 4.2.3 Automotive ADAS / safety integration

- 4.2.4 Industry-4.0 condition monitoring uptake

- 4.2.5 Precision-agriculture drone adoption

- 4.2.6 Renewable-energy tilt/vibration demand

- 4.3 Market Restraints

- 4.3.1 Price pressure and commoditization

- 4.3.2 Accuracy limits vs. piezoelectric high-g

- 4.3.3 8-inch MEMS foundry capacity bottlenecks

- 4.3.4 Firmware/security vulnerabilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Type

- 5.1.1 MEMS Accelerometers

- 5.1.2 Piezoelectric Accelerometers

- 5.1.3 Piezoresistive Accelerometers

- 5.1.4 Capacitive Accelerometers

- 5.1.5 Thermal and Other Types

- 5.2 By Dimension

- 5.2.1 1-Axis

- 5.2.2 2-Axis

- 5.2.3 3-Axis

- 5.2.4 6-Axis and Above (Combo IMUs)

- 5.3 By End User

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Aerospace and Defense

- 5.3.4 Industrial and Manufacturing

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other End Users

- 5.4 By Performance Grade

- 5.4.1 Consumer Grade

- 5.4.2 Industrial Grade

- 5.4.3 Tactical Grade

- 5.4.4 Navigation Grade

- 5.4.5 Space Grade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Taiwan

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Analog Devices Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 STMicroelectronics

- 6.4.4 TDK InvenSense

- 6.4.5 Honeywell International Inc.

- 6.4.6 Murata Manufacturing Co., Ltd. (Kionix)

- 6.4.7 NXP Semiconductors N.V.

- 6.4.8 MEMSIC Inc.

- 6.4.9 TE Connectivity (Measurement Specialties)

- 6.4.10 Silicon Sensing Systems Ltd.

- 6.4.11 Sensonor AS

- 6.4.12 PCB Piezotronics (MTS Systems)

- 6.4.13 Northrop Grumman LITEF GmbH

- 6.4.14 Rockwell Automation Inc.

- 6.4.15 Kearfott Corporation

- 6.4.16 Meggitt PLC (Endevco)

- 6.4.17 Dytran Instruments Inc.

- 6.4.18 Al Cielo Inertial Solutions Ltd.

- 6.4.19 Atlantic Inertial Systems Ltd.

- 6.4.20 LORD MicroStrain (HBK)

- 6.4.21 QST Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment