PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801868

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801868

Solar-Integrated Construction Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

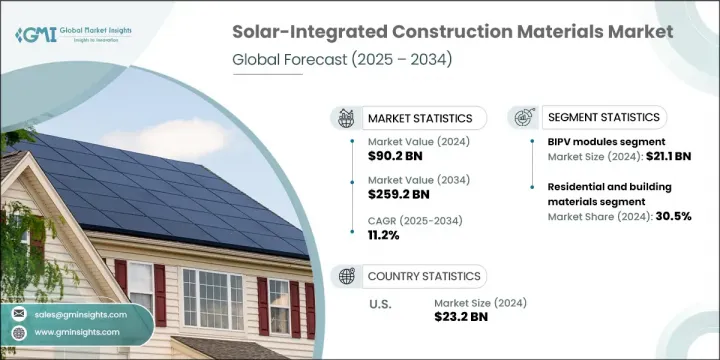

The Global Solar-Integrated Construction Materials Market was valued at USD 90.2 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 259.2 billion by 2034. Solar-integrated construction materials refer to building products that are embedded with solar technologies, such as photovoltaic (PV) panels. These materials serve as functional components of buildings, including facades, roofing, and windows, enabling the on-site generation of renewable energy. By using such materials, buildings can significantly reduce their reliance on conventional energy sources, improving energy efficiency.

The growing demand for solar-integrated materials is driven by government policies, financial incentives, and a global shift towards sustainable development and climate change mitigation. Additionally, the rise of smart city development, with an emphasis on energy-efficient, sustainable infrastructure, is further supporting the market. Cities worldwide are increasingly investing in such technologies to meet their sustainability targets, contributing to the overall growth of the sector. North America, with its focus on technological advancements and supportive policies, is the fastest-growing market. The combined forces of policy, innovation, and urban expansion are reshaping the global market for solar-integrated construction materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.2 Billion |

| Forecast Value | $259.2 Billion |

| CAGR | 11.2% |

In 2024, building-integrated photovoltaic (BIPV) modules generated USD 21.1 billion, representing a key segment of the market. BIPV modules are versatile, serving not only as energy-generating systems but also as structural elements for building envelopes, such as facades, roofs, and windows. This multi-functionality makes them highly popular with architects and developers seeking to meet sustainability standards while enhancing building aesthetics.

Residential and building materials made up 30.5% of the market in 2024. Increased consumer demand for energy-efficient homes, along with government incentives and building codes aimed at reducing carbon footprints, are key drivers behind the adoption of solar-integrated materials in residential buildings.

In 2024, the U.S. market for solar-integrated construction materials was valued at USD 23.2 billion, fueled by advancements in manufacturing, research and development (R&D), and a growing push towards green building practices. In Canada, the market is driven by a commitment to sustainable development and the country's climate goals, alongside rising consumer demand for eco-friendly building solutions.

Leading players in the Global Solar-Integrated Construction Materials Market include Trina Solar, JA Solar, Panasonic Corporation, AGC Inc., Tesla, JinkoSolar, First Solar, Mitrex Solar, SunPower Corporation, Saule Technologies, Onyx Solar, Sisecam Group, Guardian Glass, and LONGi. To strengthen their position in the solar-integrated construction materials market, companies are adopting various strategic approaches. These include investing in advanced research and development to enhance product performance and integrate innovative solar technologies into construction materials. Companies are also forming strategic partnerships with construction firms and developers to expand their reach and integrate solar solutions into new building projects. Additionally, firms are focusing on sustainable practices, ensuring their materials meet growing demand for energy-efficient and environmentally friendly building solutions. Increasing collaborations with government bodies and aligning product offerings with emerging green building standards have also been essential strategies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 BIPV modules

- 5.2.1 Crystalline silicon BIPV modules

- 5.2.2 Thin-film BIPV modules

- 5.2.3 Perovskite BIPV modules

- 5.3 Solar glass

- 5.3.1 Transparent solar glass

- 5.3.2 Semi-transparent solar glass

- 5.3.3 Colored solar glass

- 5.4 Solar tiles and shingles

- 5.4.1 Ceramic solar tiles

- 5.4.2 Polymer solar tiles

- 5.4.3 Integrated solar shingles

- 5.5 Solar facades

- 5.5.1 Curtain wall solar systems

- 5.5.2 Ventilated solar facades

- 5.5.3 Double-skin solar facades

- 5.6 Solar skylights and canopies

- 5.6.1 Transparent solar skylights

- 5.6.2 Semi-transparent solar canopies

- 5.7 Solar cladding systems

- 5.8 Others

- 5.8.1 Solar insulation materials

- 5.8.2 Solar membrane systems

- 5.8.3 Flexible solar films

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Residential applications

- 6.2.1 Single-family homes

- 6.2.2 Multi-family residential buildings

- 6.2.3 Residential retrofits

- 6.3 Commercial applications

- 6.3.1 Office buildings

- 6.3.2 Retail and shopping centers

- 6.3.3 Hotels and hospitality

- 6.3.4 Educational institutions

- 6.4 Healthcare facilities

- 6.5 Industrial applications

- 6.5.1 Manufacturing facilities

- 6.5.2 Warehouses and distribution centers

- 6.5.3 Industrial retrofits

- 6.6 Institutional applications

- 6.6.1 Government buildings

- 6.6.2 Religious buildings

- 6.6.3 Cultural and recreational facilities

- 6.7 Infrastructure applications

- 6.7.1 Transportation hubs

- 6.7.2 Parking structures

- 6.7.3 Bridge and tunnel integration

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Crystalline silicon technology

- 7.2.1 Monocrystalline silicon

- 7.2.2 Polycrystalline silicon

- 7.3 Thin-film technology

- 7.3.1 Amorphous silicon (a-Si)

- 7.3.2 Cadmium telluride (CdTe)

- 7.3.3 Copper indium gallium selenide (CIGS)

- 7.4 Perovskite technology

- 7.4.1 Lead-based perovskites

- 7.4.2 Lead-free perovskites

- 7.4.3 Perovskite-silicon tandems

- 7.5 Organic photovoltaics (OPV)

- 7.5.1 Small molecule OPV

- 7.5.2 Polymer OPV

- 7.6 Hybrid technologies

- 7.6.1 Perovskite-organic hybrids

- 7.6.2 Silicon-perovskite tandems

- 7.7 Emerging technologies

- 7.7.1 Quantum dot solar cells

- 7.7.2 Dye-sensitized solar cells

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AGC Inc

- 9.2 Canadian Solar

- 9.3 First Solar

- 9.4 Guardian Glass

- 9.5 JA Solar

- 9.6 JinkoSolar

- 9.7 LONGi

- 9.8 Mitrex Solar

- 9.9 Onyx Solar

- 9.10 Panasonic Corporation

- 9.11 Saule Technologies

- 9.12 Sisecam Group

- 9.13 SunPower Corporation

- 9.14 Tesla

- 9.15 Trina Solar