PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801880

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801880

North America Blood Collection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

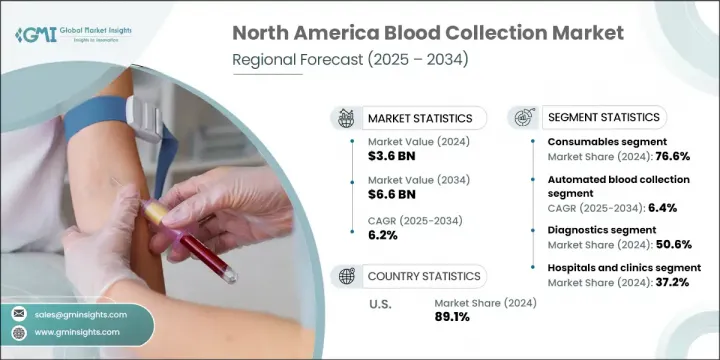

North America Blood Collection Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 6.6 billion by 2034. The market's expansion is largely driven by the rising burden of chronic and infectious illnesses-including diabetes, cancer, HIV, tuberculosis, and cardiovascular conditions-which are increasing the demand for accurate diagnostic tools. Alongside this, the volume of surgical interventions is growing across the region, prompting greater reliance on reliable blood collection methods. Blood collection devices serve as essential tools in medical diagnostics, research, and transfusion procedures, ensuring accurate sampling in healthcare facilities, laboratories, and blood banks.

Continued investments in healthcare innovation and the development of streamlined clinical practices have accelerated adoption across various care settings. The introduction of advanced solutions-such as automated systems, digital tracking, and safety-focused needles-has elevated procedural safety and sample accuracy while reducing risks for both patients and professionals. With a strong push toward preventive healthcare, North America is witnessing a surge in demand for high-quality blood collection technologies. Accurate and timely diagnostic sampling plays a crucial role in managing chronic diseases, which remain among the leading causes of death in the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 6.2% |

In 2024, the consumables segment held the largest share at 76.6%, primarily due to their critical role in ensuring accurate sample acquisition and compatibility with a broad range of diagnostic assays. The demand for pre-validated, efficient consumables is increasing in high-volume clinical settings, particularly as laboratories in North America shift toward more standardized workflows. These products are fundamental to laboratory procedures involving blood testing and contribute significantly to operational consistency and sample quality.

The automated blood collection segment is growing at a CAGR of 6.4% through 2034, driven by its integration into advanced healthcare infrastructures. Automation supports precise sampling, lowers error rates, and boosts safety in high-throughput environments. These systems are utilized for various applications, including venipuncture, component separation, and apheresis procedures. Their consistent performance and ability to streamline clinical workflows make them indispensable across hospitals, diagnostic centers, and donor facilities. Automation in blood collection ensures efficiency and helps maintain stringent quality control standards across every phase of diagnostic operations.

U.S. Blood Collection Market was valued at USD 3.2 billion in 2024, fueled by growing healthcare demands related to aging populations, chronic conditions, and increasing donor activity. The market is supported by an efficient regulatory framework and continuous advancements in R&D that help drive the deployment of innovative collection devices. The U.S. continues to lead in the integration of both manual and automated collection technologies across diverse healthcare settings. In addition, rising public health awareness and robust public-private sector collaborations are playing a significant role in sustaining long-term market growth and technological development in this space.

Prominent companies operating in the North America Blood Collection Market include Haemonetics Corporation, Thermo Fisher Scientific, FL MEDICAL, Nipro Corporation, Becton, Dickinson and Company, Sarstedt AG & Co, Fresenius SE & Co, QIAGEN, Abbott Laboratories, Siemens Healthineers, Greiner, Terumo Corporation, McKesson Corporation, Streck, and Cardinal Health. To strengthen their market position in North America, leading blood collection companies are prioritizing innovation in safety-engineered devices and automation-compatible solutions. Many are expanding their product portfolios to include single-use, contamination-resistant consumables that align with stringent regulatory and clinical guidelines. Strategic partnerships with hospitals, diagnostics labs, and research institutions are helping increase product reach and brand loyalty. Companies are also focusing on regional manufacturing and distribution networks to ensure supply chain resilience and reduce lead times. Investments in smart tracking technologies and integration with electronic health records are further enhancing procedural efficiency and traceability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product type

- 2.2.3 Method

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of chronic and infectious diseases

- 3.2.1.2 Growing demand for diagnostic testing

- 3.2.1.3 Increasing number of surgical procedures

- 3.2.1.4 Rising technological advancements in blood collection systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Needle-stick injuries and safety concerns

- 3.2.2.2 Stringent regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising government-led campaigns for promoting blood donation and disease screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 System

- 5.2.1 Automated systems

- 5.2.2 Manual systems

- 5.3 Consumables

- 5.3.1 Venous

- 5.3.1.1 Needles and syringes

- 5.3.1.1.1 Double-ended needles

- 5.3.1.1.2 Winged blood collection sets

- 5.3.1.1.3 Standard hypodermic needles

- 5.3.1.1.4 Other blood collection needles

- 5.3.1.2 Blood collection tubes

- 5.3.1.2.1 Serum-separating

- 5.3.1.2.2 EDTA

- 5.3.1.2.3 Heparin

- 5.3.1.2.4 Plasma-separating

- 5.3.1.3 Blood bags

- 5.3.1.4 Other venous products

- 5.3.1.1 Needles and syringes

- 5.3.2 Capillary

- 5.3.2.1 Lancets

- 5.3.2.2 Micro-container tubes

- 5.3.2.3 Micro-hematocrit tubes

- 5.3.2.4 Warming devices

- 5.3.2.5 Other capillary products

- 5.3.1 Venous

Chapter 6 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual blood collection

- 6.3 Automated blood collection

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Treatment

- 7.4 Research

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 1.1 Key trends

- 1.2 Hospitals and clinics

- 1.3 Diagnostic centers

- 1.4 Blood banks

- 1.5 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Becton, Dickinson, and Company

- 10.3 Cardinal Health

- 10.4 FL MEDICAL

- 10.5 Fresenius SE & Co

- 10.6 Greiner

- 10.7 Haemonetics Corporation

- 10.8 McKesson Corporation

- 10.9 Nipro Corporation

- 10.10 QIAGEN

- 10.11 Sarstedt AG & Co

- 10.12 Siemens Healthineers

- 10.13 Streck

- 10.14 Terumo Corporation

- 10.15 Thermo Fisher Scientific