PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848329

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848329

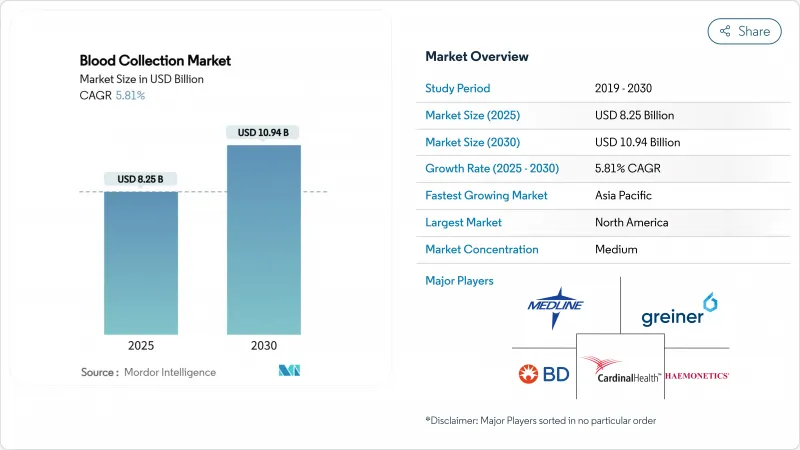

Blood Collection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The blood collection devices market size reached USD 8.25 billion in 2025 and is forecast to climb to USD 10.94 billion by 2030 at a 5.81% CAGR, underscoring the sector's resilience and steady expansion.

Growth is anchored in mounting chronic disease prevalence, the surge in surgical procedures, and widening diagnostic capacity. Regulatory pressure to reduce needlestick injuries is accelerating the switch to safety-engineered products, while labor shortages are steering laboratories toward automation that guarantees sampling precision. Mature economies are investing in robotic phlebotomy and needle-free platforms, whereas emerging regions focus on scaling basic collection infrastructure. Competitive intensity is heightening as incumbents defend share through product refreshes and alliances with technology start-ups.

Global Blood Collection Market Trends and Insights

Growing Prevalence of Chronic Diseases

Chronic disorders now affect 76.4% of US adults, and incidence among younger cohorts is climbing, pushing routine venous and capillary testing demand upward. Healthcare providers are scaling automated analyzers and decentralized sampling kits to manage rising specimen volumes without proportionally increasing headcount. Value-based care contracts tie reimbursement to timely monitoring, prompting hospitals to embed point-of-care (POC) coagulation and HbA1c panels inside primary-care clinics. Device makers respond by miniaturizing tubes pre-filled with optimized anticoagulants that preserve biomarkers for extended transport windows. These shifts collectively reinforce sustained revenue visibility for the blood collection devices market.

Rising Incidence of Trauma and Accidents

Urbanization correlates with higher trauma presentations that require immediate type-and-screen and coagulation work-ups. Level-I trauma centers are outfitting emergency bays with cartridge-based POC analyzers fed by 2 mL arterial draws, delivering results inside 3 minutes. The strategy reduces door-to-intervention time and improves survival metrics, nudging regional hospitals to replicate the model. Suppliers have introduced vacuum-assisted winged infusion sets with integrated flash-visibility to shorten first-stick time and minimize redraws under chaotic conditions. Emerging-market facilities are leapfrogging to these safety-optimized kits as donor agencies underwrite procurement.

Risk of Blood-Borne Infections and Contamination

In 2025 the FDA issued updated hepatitis-B screening guidance that tightens performance criteria for donor testing platforms, raising compliance costs for collection centers. Facilities adopt double-sterility barriers and prefabricated closed-loop collection systems to mitigate contamination, but these safeguards elevate per-unit expense. Laboratories in infrastructure-poor regions struggle to fund such upgrades, deferring purchases and dampening near-term demand. Continuous surveillance for emerging pathogens maintains the pressure to upgrade devices, yet reimbursement schemes seldom offset added overhead, tempering the blood collection devices market's expansion rate.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Volume of Surgical Procedures

- Expansion of Diagnostic and Point-of-Care Testing Infrastructure

- Needlestick Injuries and Associated Liability Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Needles and syringes controlled 38.54% of 2024 revenue, underlining their ubiquity for venous access across care settings. Tubes, however, constitute the fastest-advancing niche, set to log a 7.45% CAGR through 2030 as clinicians demand additive-coded vacutainers tailored for genetics, proteomics, and oncology panels. This trajectory highlights how assay sophistication reconfigures consumable mix within the blood collection devices market.

Demand for safety needles rises steadily thanks to OSHA standards, yet premium pricing moderates adoption speed in low-margin outpatient labs. Capillary lancets win favor in retail clinics where fingertip sampling suffices for metabolic and infectious-disease screens. BD MiniDraw exemplifies capillary innovation, matching venous-draw accuracy with six-drop volumes, broadening consumer access. Blood bags retain stable hospital demand for transfusion services, though synthetic substitutes and optimized inventory systems curb volume growth. Emerging robotic and needle-free products, currently a small slice, could capture outsized share post-2030 as clinical validation accumulates.

Manual draws retained 55.73% share in 2024, reflecting entrenched skills and minimal capital requirements, especially in community hospitals and mobile drives. Yet the automated cohort will expand at an 8.76% CAGR, propelled by phlebotomist shortages projected at 19,600 US openings per year. Institutions trial autonomous robots like Vitestro's system, achieving 95% first-stick success and standardizing specimen quality.

High-volume outpatient labs justify robotics through throughput and reduced redraw costs, whereas critical-access hospitals still rely on manual versatility for challenging anatomies. AI-guided ultrasound probes integrate into carts, cutting average collection time to 90 seconds and reducing patient discomfort. Capital expenditure remains a barrier; nonetheless, leasing models and productivity incentives are narrowing the affordability gap, sustaining the blood collection devices market's automation pivot.

The Blood Collection Devices Market Report is Segmented by Product (Needles & Syringes, Safety Needles, and More), Collection Method (Manual, Automated), Application (Diagnostics and Therapeutics/Transfusion), End User (Hospitals & Diagnostic Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD), Based On Availability.

Geography Analysis

North America preserved 42.56% of 2024 revenue, buoyed by stringent OSHA compliance and high per-capita test utilization. Hospitals invest in robotic phlebotomy pilots and transition to fully closed systems to meet tightening donor-screening guidelines that favor high-throughput, error-proof devices. Growth remains moderate given the region's installed base, yet replacement cycles and tech refreshes underpin predictable recurring sales.

Europe follows closely, guided by the 2024 EU Regulation on substances of human origin, which harmonizes safety standards across member states and encourages cross-border sharing of blood products. National health systems allocate modernization funds to vacuum-assisted safety tubes and barcode traceability, underpinning steady expansion. Pilot deployments of AI-enabled vein-finders in Germany and the Netherlands illustrate how clinical performance benchmarks catalyze procurement decisions, supporting revenue uplift across Western Europe.

Asia-Pacific is set to deliver the fastest 6.43% CAGR to 2030, drawing on healthcare infrastructure upgrades and policy initiatives like Australia's Plasma Pathway that add 95,000 donations annually. China's hospital expansion plans integrate fully automated sample-processing lines, magnifying demand for compatible closed-system consumables. India's telehealth surge spurs rural adoption of capillary-based lipid and glucose testing, stretching distribution networks and providing fresh volume streams for the blood collection devices market. Though Middle East & Africa and South America trail in spending power, targeted investments in tertiary centers and trauma facilities signal rising opportunities, especially for safety-engineered needles that satisfy WHO injury-prevention guidelines.

- Beckton Dickinson

- Terumo

- Cardinal Health

- Greiner Bio One International

- Fresenius

- Haemonetics

- Mckesson

- Medline Industries

- Nipro

- Sarstedt

- Thermo Fisher Scientific

- Abbott Laboratories

- Danaher

- ICU Medical

- QIAGEN

- Grifols

- Quest Diagnostics

- Velano Vascular

- Greiner Group AG

- Sol-Millennium Medical Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Diseases

- 4.2.2 Rising Incidence of Trauma And Accidents

- 4.2.3 Increasing Volume of Surgical Procedures

- 4.2.4 Expansion of Diagnostic and Point-of-Care Testing Infrastructure

- 4.2.5 Technological Advancements in Blood Collection Devices

- 4.2.6 Government Initiatives Promoting Blood Donation And Safety

- 4.3 Market Restraints

- 4.3.1 Risk of Blood-Borne Infections and Contamination

- 4.3.2 Needlestick Injuries and Associated Liability Costs

- 4.3.3 Emergence of Alternative Non-Invasive Diagnostic Technologies

- 4.3.4 Shortage of Skilled Phlebotomy Professionals

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers/Consumers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Needles & Syringes

- 5.1.2 Safety Needles

- 5.1.3 Tubes (Vacutainer, EDTA, Serum, Gel, Etc.)

- 5.1.4 Lancets & Capillary Devices

- 5.1.5 Blood Bags (Collection & Transfer)

- 5.1.6 Other Products

- 5.2 By Collection Method

- 5.2.1 Manual

- 5.2.2 Automated

- 5.3 By Application

- 5.3.1 Diagnostics

- 5.3.2 Therapeutics / Transfusion

- 5.4 By End User

- 5.4.1 Hospitals & Diagnostic Centers

- 5.4.2 Blood Banks

- 5.4.3 Point-Of-Care & Home-Care Settings

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Becton, Dickinson & Company

- 6.3.2 Terumo Corporation

- 6.3.3 Cardinal Health

- 6.3.4 Greiner Bio-One International GmbH

- 6.3.5 Fresenius Kabi AG

- 6.3.6 Haemonetics Corporation

- 6.3.7 McKesson Corporation

- 6.3.8 Medline Industries LP

- 6.3.9 Nipro Corporation

- 6.3.10 Sarstedt AG & Co. KG

- 6.3.11 Thermo Fisher Scientific Inc.

- 6.3.12 Abbott Laboratories

- 6.3.13 Danaher (Beckman Coulter)

- 6.3.14 ICU Medical Inc.

- 6.3.15 Qiagen NV

- 6.3.16 Grifols SA

- 6.3.17 Quest Diagnostics

- 6.3.18 Velano Vascular

- 6.3.19 Greiner Group AG

- 6.3.20 Sol-Millennium Medical Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment