PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801886

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801886

North America Oil Filled Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

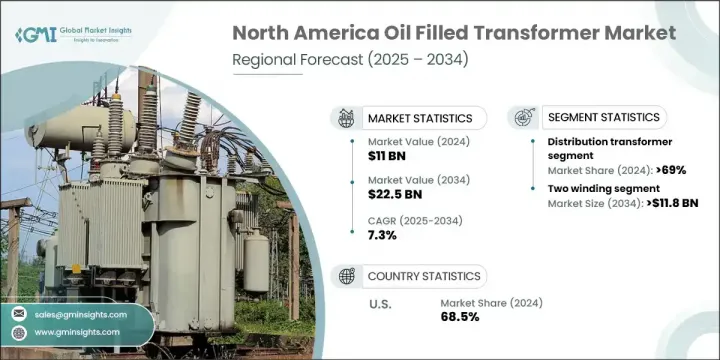

North America Oil Filled Transformer Market was valued at USD 11 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 22.5 billion by 2034. Rapid urbanization, infrastructure upgrades, and the push for electrification are strengthening market fundamentals across the region. Mexico is seeing a surge in power demand due to industrial expansion, creating the need for transformer upgrades and network reliability improvements. In Canada, initiatives supporting industrial energy efficiency are indirectly fueling demand for high-efficiency oil-filled transformers. Programs promoting retrofitting and technical improvements, especially those that align with net-zero emission goals, are encouraging the adoption of modern energy equipment. These market dynamics are setting the stage for consistent growth across industrial, commercial, and utility sectors.

In 2024, the distribution transformer category accounted for 69% share and is forecasted to grow at a CAGR of 7.8% through 2034. The rising deployment of advanced metering infrastructure (AMI) across the region is generating greater demand for smart-ready distribution transformers. These systems, which support real-time energy usage data and dynamic load balancing, require transformers that can facilitate efficient two-way communication. This evolution in grid infrastructure demands next-generation transformers capable of delivering stability, reliability, and digital compatibility for improved network control and energy savings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 7.3% |

Two-winding oil-filled transformers held 54.9% share in 2024 and is projected to reach USD 11.8 billion by 2034. Expansion in interregional transmission projects is contributing significantly to the segment's outlook. These transformers are integral to safe operation within utility-scale facilities by managing voltage levels and maintaining separation between transmission and distribution networks. Their use supports grid integrity and system reliability, particularly when dealing with faults or surge events. Modern transmission infrastructure relies on such configurations to manage the increasing complexity of power generation from diversified sources, including renewable energy, while meeting regulatory standards for operational safety and performance.

U.S. Oil Filled Transformer Market was valued at USD 7.5 billion in 2024, holding 68.5% share. The nation's push toward electrification, especially in residential and commercial heating, cooling, and cooking, is sharply increasing energy consumption. This growth in electrical load is placing pressure on the aging distribution infrastructure, necessitating investment in robust transformer systems capable of sustaining heavy use. As neighborhoods and commercial districts scale up power use, the need for high-performance oil-filled transformers becomes essential for ensuring voltage stability and energy delivery across wider service areas.

The leading companies in the North America Oil Filled Transformer Market include Eaton, Siemens Energy, GE Vernova, Hitachi Energy, and Schneider Electric. Top manufacturers in the oil filled transformer sector are strengthening their market presence through strategic innovation, targeted investments, and customer-centric service models. A primary focus has been on developing high-efficiency transformers designed to meet new energy standards and smart grid compatibility. Many companies are expanding their regional manufacturing capabilities to enhance supply chain resilience and reduce delivery lead times. Strategic collaborations with utilities and grid operators help accelerate deployment in modernization projects. Additionally, firms are investing in digital monitoring tools, predictive maintenance systems, and remote diagnostics to offer value-added services post-installation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Core trends

- 2.1.3 Product trends

- 2.1.4 Winding trends

- 2.1.5 Modes of cooling trends

- 2.1.6 Mounting trends

- 2.1.7 Rating trends

- 2.1.8 Substation connectivity trends

- 2.1.9 Application trends

- 2.1.10 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import export trade analysis

- 3.3.1 Key importing countries

- 3.3.2 Key exporting countries

- 3.4 Price trend analysis, (USD/Unit)

- 3.4.1 By product

- 3.5 Cost analysis of oil filled transformers

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.8.1 Bargaining power of suppliers

- 3.8.2 Bargaining power of buyers

- 3.8.3 Threat of new entrants

- 3.8.4 Threat of substitutes

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Core, 2021 - 2034 (‘000 Units & USD Million)

- 5.1 Key trends

- 5.2 Closed

- 5.3 Shell

- 5.4 Berry

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (‘000 Units & USD Million)

- 6.1 Key trends

- 6.2 Distribution transformer

- 6.3 Power transformer

- 6.4 Instrument transformer

- 6.5 Others

Chapter 7 Market Size and Forecast, By Winding, 2021 - 2034 (‘000 Units & USD Million)

- 7.1 Key trends

- 7.2 Two winding

- 7.3 Auto-transformer

Chapter 8 Market Size and Forecast, By Modes of Cooling, 2021 - 2034 (‘000 Units & USD Million)

- 8.1 Key trends

- 8.2 Oil Natural Air Natural (ONAN)

- 8.3 Oil Natural Water Forced (ONWF)

- 8.4 Oil Natural Air Forced (ONAF)

- 8.5 Others

Chapter 9 Market Size and Forecast, By Mounting, 2021 - 2034 (‘000 Units & USD Million)

- 9.1 Key trends

- 9.2 Pad

- 9.3 Pole

- 9.4 Foundation

- 9.5 Others

Chapter 10 Market Size and Forecast, By Rating, 2021 - 2034 (‘000 Units & USD Million)

- 10.1 Key trends

- 10.2 ≤ 5 MVA

- 10.3 > 5 MVA to ≤ 10 MVA

- 10.4 > 10 MVA

Chapter 11 Market Size and Forecast, By Substation Connectivity, 2021 - 2034 (‘000 Units & USD Million)

- 11.1 Key trends

- 11.2 Distribution

- 11.3 Transmission

Chapter 12 Market Size and Forecast, By Application, 2021 - 2034 (‘000 Units & USD Million)

- 12.1 Key trends

- 12.2 Residential

- 12.3 Commercial & industrial

- 12.4 Utility

Chapter 13 Market Size and Forecast, By Country, 2021 - 2034 (‘000 Units & USD Million)

- 13.1 Key trends

- 13.2 U.S.

- 13.3 Canada

- 13.4 Mexico

Chapter 14 Company Profiles

- 14.1 CG Power & Industrial Solutions

- 14.2 Celme S.r.l.

- 14.3 Elsewedy Electric

- 14.4 Eaton

- 14.5 Emerald Transformer

- 14.6 GE Vernova

- 14.7 Hyosung Heavy Industries

- 14.8 Kitashiba Electric

- 14.9 LS ELECTRIC

- 14.10 Lemi Trafo Transformers

- 14.11 MGM Transformer Company

- 14.12 Neeltran

- 14.13 Niagara Power Transformer

- 14.14 Northern Transformer

- 14.15 Ormazabal

- 14.16 Siemens Energy

- 14.17 Schneider Electric

- 14.18 Toshiba International

- 14.19 Virginia Transformer

- 14.20 WEG