PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801891

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801891

Smart Electric Meter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

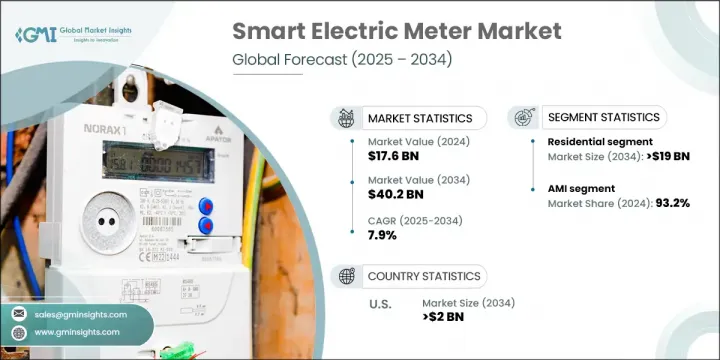

The Global Smart Electric Meter Market was valued at USD 17.6 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 40.2 billion by 2034. This growth is largely propelled by increasing global investments in advanced grid technologies. As nations work to modernize outdated power infrastructure, reduce blackouts, and support renewable integration, smart meters are becoming a core component of these modern systems. These meters provide utilities with granular consumption data that helps optimize grid efficiency, identify service issues in real time, and lower overall operating expenses.

Continuous innovation in IoT, wireless technology, and data analytics is improving the affordability and performance of smart meters. Consumers now benefit from real-time insights into energy usage, leading to better demand management, reduced energy costs, and greater support for grid balancing. Smart meters are also being adopted alongside home automation and demand-response platforms, further increasing their role in modern energy ecosystems. As the urgency to cut carbon emissions grows, these devices are becoming instrumental in enabling efficient power distribution and promoting cleaner energy. Financial incentives, policy mandates, and utility-driven rollouts continue to accelerate adoption across global regions, reinforcing the overall smart electric meter market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.6 Billion |

| Forecast Value | $40.2 Billion |

| CAGR | 7.9% |

The residential sector will reach USD 19 billion by 2034, driven by the rising demand for smart meters in individual homes and multifamily dwellings. Increasing emphasis on energy efficiency, solar energy integration, and accurate billing are major factors behind this segment's expansion. As solar PV installations rise, particularly in residential spaces, smart meters help streamline energy monitoring and allow users to make data-driven consumption decisions. Utilities are also increasingly installing smart meters to enhance communication with customers and meet growing sustainability goals across neighborhoods.

Technologically, the market is split into advanced metering infrastructure (AMI) and automatic meter reading (AMR). The AMI segment held a 93.2% share in 2024 and continues to lead due to its ability to provide two-way communication, real-time data transmission, and seamless integration with utility management systems. While AMR improves efficiency and reduces human error, AMI enables full digital transformation of energy networks and enhances control over energy flows.

United States Smart Electric Meter Market will reach USD 2 billion by 2034, supported by evolving regulations that require modern grid systems to manage growing renewable energy inputs. With one of the world's most sophisticated economies, the US plays a major role in global trade, which also influences the development and deployment of smart grid technologies like these meters. The push for stable power delivery, especially in states with rising electric vehicle adoption and renewable integration, is driving broader meter installations.

Key players actively shaping the Global Smart Electric Meter Market include Siemens, Landis + Gyr, Schneider Electric, Honeywell International, and Itron. Leading companies in the smart electric meter industry are focusing on expanding their geographic reach through partnerships with utility providers and smart grid projects. Firms are investing heavily in R&D to enhance the accuracy, connectivity, and functionality of their meters, integrating AI, edge computing, and IoT capabilities to stay competitive. Customization for regional compliance and interoperability with grid infrastructure is also a core priority. Players like Itron and Schneider Electric are prioritizing AMI-based solutions to cater to demand for real-time monitoring and digital grid management. Strategic acquisitions, long-term contracts with government bodies, and participation in renewable energy rollouts are further strengthening market positions. Additionally, businesses are emphasizing cybersecurity and data privacy to build trust among utilities and end consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Import/Export trade analysis

- 3.4 Price trend analysis, by region (USD/Unit)

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Residential

- 5.2.1 Single family

- 5.2.2 Multi family

- 5.3 Commercial

- 5.3.1 Education

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Logistics & transportation

- 5.3.5 Offices

- 5.3.6 Hospitality

- 5.3.7 Others

- 5.3.8 Utility

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 AMI

- 6.2.1 RF

- 6.2.2 PLC

- 6.2.3 Cellular

- 6.3 AMR

Chapter 7 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Single

- 7.3 Three

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 Saudi Arabia

- 8.5.3 South Africa

- 8.5.4 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Aclara Technologies LLC

- 9.3 Advanced Electronics Company (AEC)

- 9.4 Apator SA

- 9.5 Circutor

- 9.6 Cisco Systems, Inc.

- 9.7 CyanConnode

- 9.8 Enel Spa.

- 9.9 General Electric

- 9.10 Honeywell International Inc.

- 9.11 Iskraemeco Group

- 9.12 Itron Inc.

- 9.13 Kamstrup

- 9.14 Landis + Gyr

- 9.15 Larsen & Toubro Limited

- 9.16 Mitsubishi Electric Corporation

- 9.17 Osaki Electric Co., Ltd.

- 9.18 Schneider Electric

- 9.19 Sensus

- 9.20 Siemens

- 9.21 Toshiba

- 9.22 Trinity Energy Systems