PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801906

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801906

Medical Adhesive Tapes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

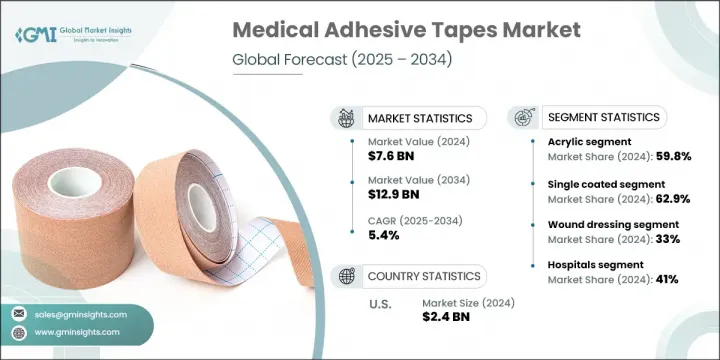

The Global Medical Adhesive Tapes Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 12.9 billion by 2034. Rising demand for efficient wound care solutions is largely fueled by the growing incidence of chronic diseases, a surge in surgical interventions, and a notable increase in trauma-related cases. Medical adhesive tapes play a critical role in modern healthcare for securing bandages, IV lines, and medical devices, and are essential in emergency treatments requiring prompt wound management. The market continues to evolve, with greater emphasis on comfort, skin compatibility, and customization.

Manufacturers are developing advanced skin-friendly and hypoallergenic options that reduce irritation and improve healing outcomes. Innovations in adhesives, including silicone-based and biocompatible materials, are reshaping product standards. The shift toward patient-specific care further influences purchasing behavior, with sensitivity, mobility, and wound site factors considered. Major players such as Flexcon Company, Paul Hartmann, Berry Global Group, Solventum, and Lohmann GmbH are helping shape the market landscape by prioritizing product innovation and clinical efficacy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 5.4% |

In 2024, the acrylic-based medical adhesive tapes accounted for a 59.8% share. Their appeal lies in their breathability, resistance to heat and moisture, and compatibility with both short-term and extended applications. The ability of acrylic adhesives to manage moisture vapor transmission helps reduce the risk of skin breakdown and supports better healing environments. This balance of comfort and durability makes them ideal for use in wound care and surgical settings.

The single-coated tapes held the largest share at 62.9% in 2024, favored for their easy application and consistent adhesion across different surfaces. These tapes are designed for a range of clinical uses, from securing tubing and dressings to medical devices, making them a reliable option in both hospital and home care settings. Their breathable and skin-friendly properties, combined with moisture resistance, allow for safer and quicker patient handling, which is critical in fast-paced care environments.

U.S. Medical Adhesive Tapes Market generated USD 2.4 billion in 2024. This dominance is driven by its advanced healthcare infrastructure and increasing demand for reliable wound care products. A growing elderly population and the high prevalence of conditions like diabetes are major contributors to rising usage. The country's extensive healthcare network continues to promote the use of high-performance tapes that offer enhanced healing and patient comfort.

Key companies actively involved in the Global Medical Adhesive Tapes Market include Johnson & Johnson, Smith & Nephew, Nitto Denko Corporation, McKesson Corporation, Dermarite Industries, Medline Industries, Medtronic, Avery Dennison Corporation, DermaMed Coatings Company, Nichiban, Lintec Corporation, and Cardinal Health. To strengthen their position, companies operating in the medical adhesive tapes market are adopting a variety of growth strategies. They are investing in R&D to engineer more advanced, skin-safe, and breathable adhesive solutions tailored to different skin types and clinical needs. Partnerships with healthcare providers and expansion into high-growth regions allow for improved product reach. Many are focusing on expanding manufacturing capabilities and supply chains to meet increasing global demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Adhesive trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in road accidents and other traumatic incidents

- 3.2.1.2 Increasing prevalence of chronic disorders

- 3.2.1.3 Rising number of surgical procedures

- 3.2.1.4 Growing healthcare sector in emerging economies

- 3.2.1 Growth drivers

Industry pitfalls and challenges

- 3.2.1.5 High cost of raw material

- 3.2.1.6 Stringent regulatory scenario

- 3.2.2 Market opportunities

- 3.2.2.1 Rising technological innovations in medical tapes

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.6 Supply chain analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Acrylic

- 5.3 Silicone

- 5.4 Rubber

Chapter 6 Market Estimates and Forecast, By Adhesive, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single coated

- 6.3 Double coated

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Surgery

- 7.3 Wound dressing

- 7.4 Device fixation

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Avery Dennison Corporation

- 10.2 Berry Global Group

- 10.3 Cardinal Health

- 10.4 DermaMed Coatings Company

- 10.5 Dermarite Industries

- 10.6 Flexcon Company

- 10.7 Johnson & Johnson

- 10.8 Lintec Corporation

- 10.9 Lohmann GmbH

- 10.10 McKesson Corporation

- 10.11 Medline Industries

- 10.12 Medtronic

- 10.13 Nichiban

- 10.14 Nitto Denko Corporation

- 10.15 Paul Hartmann

- 10.16 Smith & Nephew

- 10.17 Solventum