PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801920

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801920

HVDC Cables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

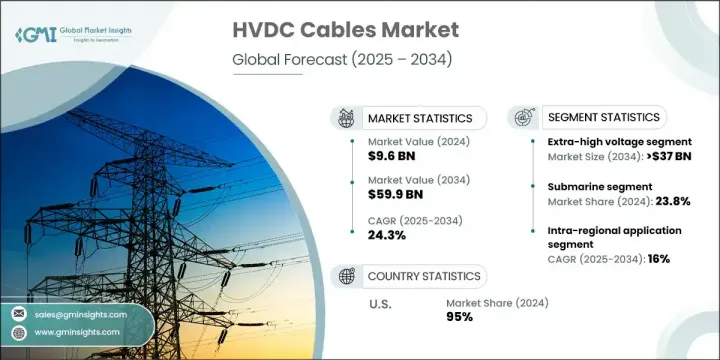

The Global HVDC Cables Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 59.9 billion by 2034. This exceptional growth is being fueled by a worldwide push for sustainable energy infrastructure. As governments and energy providers focus on integrating renewable sources into the grid, HVDC cable systems are emerging as critical tools for efficient, long-distance power transmission. With the ability to minimize energy loss and offer stable transmission across vast areas, these cables are increasingly adopted in modern, low-carbon electricity networks. The transition toward decarbonized energy is reshaping power transmission strategies, boosting investments in advanced HVDC technology.

A major factor accelerating this demand is the continued development of offshore wind farms. As wind projects move farther offshore and turbine capacities increase, the need for durable and high-performance power delivery systems has intensified. HVDC cables are becoming the go-to solution for transmitting electricity from these offshore facilities to onshore grids. Additionally, interconnection and cross-border grid initiatives are gaining traction as countries seek to enhance energy security by sharing electricity via transnational links. HVDC technology's ability to manage energy flow precisely makes it indispensable in these grid projects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $59.9 Billion |

| CAGR | 24.3% |

The 35 kW to 475 kW segment is forecast to grow at a CAGR of 23% through 2034, as the global focus on energy connectivity and high-capacity infrastructure grows stronger. The market with voltage ranges from 35 kW to 475 kW are becoming more widely adopted due to their critical role in bulk power transmission. These cables are ideal for transferring electricity from large renewable sources located in remote areas, including hydropower stations and offshore wind platforms.

The underground segment is expected to grow at a CAGR of 16% by 2034, due to its compatibility with complex terrains and urban expansion zones. The underground HVDC cables see increased demand as urban and industrial regions prioritize space-saving, low-impact power transmission systems. These systems offer practical alternatives to overhead lines in congested or environmentally sensitive locations.

Asia Pacific HVDC Cables Market will reach USD 8 billion by 2034. Rising urban development, higher energy demands, and renewable energy integration are among the major drivers shaping this regional market. China leads the charge with strategic investments in ultra-high-voltage HVDC infrastructure to enhance national grid efficiency and ensure balanced energy distribution between areas rich in renewable generation and those with elevated electricity consumption.

Key companies shaping the Global HVDC Cables Market include Gupta Power Infrastructure Limited, Prysmian Group, TELE-FONIKA Kable S.A., Brugg Kabel AG, Nexans, ILJIN ELECTRIC, ZMS CABLE, Riyadh Cables, ZTT, Elcowire GROUP AB, Furukawa Electric, NKT A/S, Tratos, Mitsubishi Electric Corporation, Sumitomo Electric Industries, Ltd., LS Cable & System Ltd., Hitachi Energy Ltd., Qingdao Hanhe Cable Co., Ltd., Alfanar Group, and Taihan Cable & Solution Co., Ltd.

Companies operating in the HVDC Cables Market are strengthening their positions by investing heavily in R&D to develop advanced, high-capacity cable solutions tailored for offshore, underground, and ultra-long-distance applications. Several players are entering strategic partnerships with energy utilities and EPC firms to secure large-scale transmission projects. Some firms are also expanding their manufacturing capacities and upgrading production technologies to support the growing demand for customized cable systems. To stay competitive, key vendors are focusing on sustainability by producing cables with reduced carbon footprints and recyclable materials.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Price trend analysis (USD/km)

- 3.4.1 By installation

- 3.4.2 By region

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technology factors

- 3.7.5 environmental factors

- 3.7.6 Legal factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034 (km, USD Billion)

- 5.1 Key trends

- 5.2 High (35 kV to 475 kV)

- 5.3 Extra high (> 475 kV to 600 kV)

- 5.4 Ultra-high (> 600 kV)

Chapter 6 Market Size and Forecast, By Installation, 2021 - 2034 (km, USD Billion)

- 6.1 Key trends

- 6.2 Overhead

- 6.3 Submarine

- 6.4 Underground

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (km, USD Billion)

- 7.1 Key trends

- 7.2 Intra-regional

- 7.3 Cross border

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (km, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 Denmark

- 8.3.5 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Thailand

- 8.4.5 Indonesia

- 8.5 Rest of the World

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.5.4 Brazil

Chapter 9 Company Profiles

- 9.1 Alfanar Group

- 9.2 Brugg Kabel AG

- 9.3 Elcowire GROUP AB

- 9.4 Furukawa Electric

- 9.5 Gupta Power Infrastructure Limited

- 9.6 Hitachi Energy Ltd.

- 9.7 ILJIN ELECTRIC

- 9.8 LS Cable & System Ltd.

- 9.9 Mitsubishi Electric Corporation

- 9.10 Nexans

- 9.11 NKT A/S

- 9.12 Prysmian Group

- 9.13 Qingdao Hanhe Cable Co., Ltd.

- 9.14 Sumitomo Electric Industries, Ltd.

- 9.15 Riyadh Cables

- 9.16 Taihan Cable & Solution Co., Ltd.

- 9.17 TELE-FONIKA Kable S.A.

- 9.18 Tratos

- 9.19 ZMS CABLE

- 9.20 ZTT