PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801929

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801929

Data Center Interconnect Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

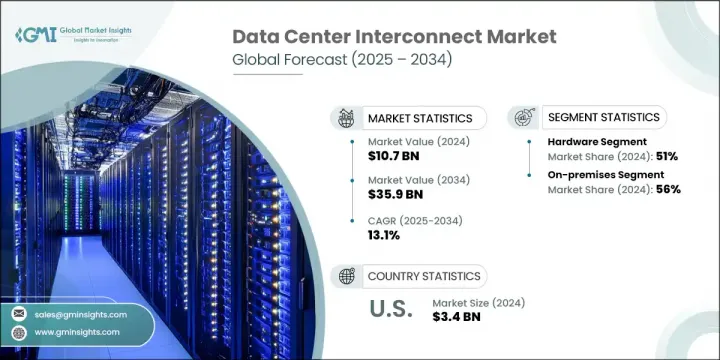

The Global Data Center Interconnect Market was valued at USD 10.7 billion in 2024 and is estimated to grow at a CAGR of 13.1% to reach USD 35.9 billion by 2034. As digital transformation accelerates and data volumes continue to surge, the need for advanced interconnect solutions becomes critical. The rise of hybrid cloud strategies and AI-driven applications has shifted focus toward high-speed, programmable optical networks. Enterprises are rapidly moving to 400G and 800G optical solutions to ensure low-latency, scalable, and secure data transfers between data centers. These technologies offer adaptive bandwidth control, encryption capabilities, and latency optimization.

Competitive differentiation now requires intent-based networking, advanced automation, and tiered service models tailored to enterprise and cloud-native clients. Providers are offering intelligent DCI solutions with real-time telemetry, SLA tracking, and network programmability, aligning infrastructure with compliance standards and critical workloads. North America continues to lead the DCI landscape, supported by dense cloud infrastructure, robust internet exchanges, and large-scale hyperscale deployments. With cross-border fiber connectivity and sophisticated optical backbones, the region remains a focal point for innovation and expansion in this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 13.1% |

In 2024, the hardware segment accounted for 51% share and is expected to grow at a CAGR of 12% through 2034. Physical infrastructure remains the backbone of DCI implementations, enabling reliable and high-speed data movement between facilities. Core components like optical transceivers, routers, multiplexers, and switches are seeing increased demand-especially those supporting 400G and 800G coherent optics. These elements are vital for powering cloud computing, artificial intelligence, and IoT use cases, although they also command a significant portion of data center investment.

The on-premises segment led the DCI market in 2024 with 56% share and is anticipated to grow at a CAGR of 12% during 2025-2034. On-premise deployments offer hyperscalers and enterprises direct control over their networking environment, which is essential for mission-critical, low-latency applications. These configurations also allow deeper customization and performance optimization for compute-intensive operations such as AI model training, financial algorithms, and scientific computing. Moreover, industries like government, BFSI, and healthcare continue to prefer on-premise DCI to meet strict regulatory and data residency requirements.

United States Data Center Interconnect Market generated USD 3.4 billion in 2024, capturing around 85% of the North American market. The country's leadership in digital infrastructure is driven by its large presence of hyperscale providers, enterprise data centers, and colocation facilities. Demand for high-speed interconnection across metro and regional networks remains strong across key industries such as healthcare, e-commerce, and finance. The US is also at the forefront of upgrading to 400G and 800G optical technologies and adopting open networking standards, further accelerating DCI deployment across the nation.

The leading players in the Global Data Center Interconnect Market include Arista Networks, Huawei, Cisco, Fujitsu, Nokia, Extreme Networks, and Juniper. Top companies in the data center interconnect market are focusing on innovation, scalability, and network intelligence to solidify their market position. Major vendors are investing in high-capacity optical transport systems that support 400G/800G technology to meet growing data demands. Strategic partnerships with hyperscale cloud providers are expanding solution reach and improving interoperability. Firms are integrating AI and telemetry tools to deliver real-time analytics, SLA compliance, and automated network adjustments. Modular hardware and software-defined solutions are being developed to ensure flexibility and quick deployment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Bandwidth

- 2.2.6 Deployment mode

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in AI and machine learning workloads

- 3.2.1.2 Rapid cloud adoption and edge computing expansion

- 3.2.1.3 Surge in global data traffic and storage demands

- 3.2.1.4 Increasing hyperscale data center deployments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital expenditure for DCI infrastructure.

- 3.2.2.2 Complex network management and integration issues.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of AI-optimized DCI platforms

- 3.2.3.2 Growth in 5G and edge data center deployments

- 3.2.3.3 Expansion of digital infrastructure in emerging markets

- 3.2.3.4 Rising demand for energy-efficient and green DCI solutions

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Pricing trends and economic analysis

- 3.8.1 Historical pricing analysis and market evolution (2019-2024)

- 3.8.2 Current DCI pricing landscape (2024-2025)

- 3.8.3 Total cost of ownership (TCO) and economic analysis

- 3.8.4 Future pricing projections and market trends (2025-2034)

- 3.9 DCI network architecture and topology design

- 3.9.1 Network topology models and design principles

- 3.9.1.1 Point-to-point DCI architecture

- 3.9.1.2 Hub-and-spoke dci models

- 3.9.1.3 Mesh and any-to-any connectivity

- 3.9.1.4 Hybrid and multi-topology designs

- 3.9.2 Distance-based DCI solution architecture

- 3.9.2.1 Metro DCI (0-100km) solutions

- 3.9.2.2 Regional DCI (100-1000km) solutions

- 3.9.2.3 Long-haul DCI (1000km+) solutions

- 3.9.3 Application-specific dci architecture

- 3.9.3.1 Cloud provider DCI architecture

- 3.9.3.2 Enterprise DCI architecture

- 3.9.3.3 Financial services dci architecture

- 3.9.1 Network topology models and design principles

- 3.10 DCI capacity management and performance optimization

- 3.10.1 Network capacity planning and management

- 3.10.2 Performance monitoring and analytics

- 3.10.3 Quality of service and traffic management

- 3.11 Use cases

- 3.12 Energy efficiency and sustainability

- 3.12.1 Energy consumption analysis in DCI networks

- 3.12.2 Green networking and sustainability initiatives

- 3.12.3 Energy efficiency technologies and innovations

- 3.12.4 Sustainability ROI and business benefits

- 3.13 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Optical transceivers

- 5.2.2 Switches & routers

- 5.2.3 Cables & connectors

- 5.2.4 Optical amplifiers

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Software-Defined Networking (SDN)

- 5.3.2 Network management software

- 5.3.3 Analytics & optimization software

- 5.3.4 Others

- 5.4 Service

- 5.4.1 Professional

- 5.4.2 Managed

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Synchronous optical network (SONET)

- 6.3 Dense wavelength division multiplexing (DWDM)

- 6.4 Ethernet

- 6.5 Optical transport network (OTN)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Cloud-based

- 7.3 On-premises

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Bandwidth, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Low bandwidth (Up to 1 Gbps)

- 8.3 Medium bandwidth (1-10 Gbps)

- 8.4 High bandwidth (10-100 Gbps)

- 8.5 Ultra-high bandwidth (Above 100 Gbps)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Disaster recovery

- 9.3 Content delivery

- 9.4 Data replication

- 9.5 Load balancing

- 9.6 Cloud connectivity

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Communications service providers (CSPs)

- 10.3 Internet content providers and carrier-neutral providers (ICPs/CNPs)

- 10.4 Government

- 10.5 Enterprises

- 10.5.1 BFSI

- 10.5.2 Healthcare

- 10.5.3 Media & Entertainment

- 10.5.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.3.7 Nordics

- 11.3.8 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.4.8 Singapore

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 ADVA Optical Networking

- 12.1.2 Arista Networks

- 12.1.3 Broadcom

- 12.1.4 Ciena

- 12.1.5 Cisco

- 12.1.6 Fujitsu

- 12.1.7 Huawei

- 12.1.8 IBM

- 12.1.9 Infinera

- 12.1.10 Juniper

- 12.1.11 Nokia

- 12.1.12 ZTE

- 12.2 Regional Players

- 12.2.1 Brocade Communication Systems

- 12.2.2 Colt Technology Services

- 12.2.3 CoreSite Realty

- 12.2.4 Digital Realty Trust

- 12.2.5 Evoque Data Center Solutions

- 12.2.6 Fiber Mountain

- 12.2.7 Flexential

- 12.2.8 Megaport

- 12.2.9 Zayo Group

- 12.3 Emerging Players

- 12.3.1 Cologix

- 12.3.2 Cyxtera Technologies

- 12.3.3 Dolphin Interconnect Solutions

- 12.3.4 Ekinops

- 12.3.5 Eoptolink

- 12.3.6 Innolight

- 12.3.7 Macom Technology Solutions

- 12.3.8 Pluribus Networks

- 12.3.9 XKL