PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801933

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801933

Adhesives and Sealants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

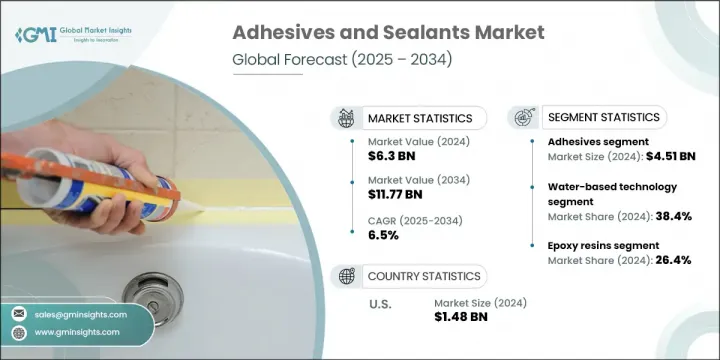

The Global Adhesives and Sealants Market was valued at USD 6.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 11.77 billion by 2034. This market revolves around the development and use of bonding and sealing materials that enhance the strength, longevity, and resistance of products across multiple industries. These materials play a key role in construction, automotive, electronics, and packaging applications, where they provide protection against weather, leakage, and external contaminants. With the global push toward infrastructure modernization and lightweight, energy-efficient vehicles, demand continues to accelerate.

Innovations focused on performance, eco-compliance, and material versatility are helping manufacturers meet evolving industry standards while improving product reliability and efficiency. Companies are increasingly developing advanced adhesive and sealant formulations that deliver stronger bonding under extreme conditions, resist chemicals and temperature fluctuations, and reduce cure times to support faster assembly processes. These improvements not only boost operational efficiency but also extend the lifecycle of end-use products. Simultaneously, the push for eco-friendly solutions is driving the shift toward low-VOC, bio-based, and recyclable materials that align with global sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.3 Billion |

| Forecast Value | $11.77 Billion |

| CAGR | 6.5% |

The adhesives segment accounted for USD 4.51 billion in 2024 and is expected to maintain a strong CAGR of 6.5% through 2034. Structural adhesives such as epoxy and polyurethane lead the market due to their superior bonding in automotive and aerospace applications. The adhesives segment includes pressure-sensitive adhesives, hot melts, and both solvent- and water-based variants.

Among technologies, the water-based adhesives segment held 38.4% share in 2024, driven by the rise of sustainable, low-VOC products. Their safer application and environmental compatibility have increased adoption across furniture, automotive, packaging, and construction sectors. As manufacturers aim to align with air quality regulations, water-based adhesives continue to gain popularity for both industrial and commercial applications.

United States Adhesives and Sealants Market held an 88.5% share and generated USD 1.48 billion in 2024. The U.S. market is set for continued growth through 2034, supported by robust investments in advanced manufacturing, EV production, and national infrastructure upgrades. Federal funding initiatives targeting transportation networks and public buildings are boosting the demand for high-performance adhesive and sealing products. Additionally, the rise of aerospace, electronics, and sustainable construction is reinforcing the country's role as a key market for adhesive technologies.

Prominent players in the Global Adhesives and Sealants Market include BASF SE, Dow Inc., Henkel AG & Co. KGaA, Sika AG, and 3M Company. Major companies in the adhesives and sealants industry are enhancing their market position through targeted R&D investments, eco-friendly product development, and regional expansion. There's a strategic shift toward low-VOC and bio-based adhesives to address environmental regulations and consumer sustainability demands. Companies are strengthening supply chains and expanding manufacturing capabilities in high-growth regions to reduce lead times and boost operational efficiency. Strategic mergers, acquisitions, and partnerships are enabling broader product portfolios and market access. Custom adhesive solutions tailored for electric vehicles, electronics, and smart infrastructure are also a focus, helping meet next-gen industrial demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Resin type

- 2.2.5 Application

- 2.2.6 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift toward lightweight manufacturing

- 3.2.1.2 Green building and eco-friendly formulations

- 3.2.1.3 Growth of e-mobility and electronics

- 3.2.1.4 Packaging innovation and safety requirements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental and regulatory pressure

- 3.2.2.2 Raw material price volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Demand for sustainable and bio-based alternatives

- 3.2.3.2 Rise in modular and prefabricated construction

- 3.2.3.3 Expanding healthcare and medical devices market

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Adhesives market

- 5.2.1 Structural adhesives

- 5.2.1.1 Epoxy adhesives

- 5.2.1.2 Polyurethane adhesives

- 5.2.1.3 Acrylic adhesives

- 5.2.1.4 Methyl methacrylate adhesives

- 5.2.1.5 Cyanoacrylate adhesives

- 5.2.2 Pressure sensitive adhesives

- 5.2.2.1 Acrylic PSA

- 5.2.2.2 Rubber-based PSA

- 5.2.2.3 Silicone PSA

- 5.2.3 Hot melt adhesives

- 5.2.3.1 EVA hot melts

- 5.2.3.2 Polyamide hot melts

- 5.2.3.3 Polyolefin hot melts

- 5.2.3.4 Reactive hot melts

- 5.2.4 Water-based adhesives

- 5.2.5 Solvent-based adhesives

- 5.2.6 Other adhesive types

- 5.2.1 Structural adhesives

- 5.3 Sealants market

- 5.3.1 Silicone sealants

- 5.3.1.1 RTV silicone sealants

- 5.3.1.2 Structural glazing sealants

- 5.3.2 Polyurethane sealants

- 5.3.3 Acrylic sealants

- 5.3.4 Polysulfide sealants

- 5.3.5 Butyl sealants

- 5.3.6 Other sealant types

- 5.3.1 Silicone sealants

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Water-based technology

- 6.3 Solvent-based technology

- 6.4 Hot melt technology

- 6.5 Reactive technology

- 6.6 UV/light curable technology

- 6.7 Pressure sensitive technology

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Epoxy resins

- 7.3 Polyurethane resins

- 7.4 Acrylic resins

- 7.5 Silicone resins

- 7.6 Polyvinyl acetate (PVA)

- 7.7 Ethylene vinyl acetate (EVA)

- 7.8 Styrenic block copolymers

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Structural bonding

- 8.3 Assembly operations

- 8.4 Sealing and gasketing

- 8.5 Surface protection

- 8.6 Electrical insulation

- 8.7 Thermal management

- 8.8 Vibration damping

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Building and construction

- 9.2.1 Residential construction

- 9.2.2 Commercial construction

- 9.2.3 Infrastructure projects

- 9.3 Automotive and transportation

- 9.3.1 Passenger vehicles

- 9.3.2 Commercial vehicles

- 9.3.3 Electric vehicles

- 9.3.4 Aftermarket

- 9.4 Packaging

- 9.4.1 Flexible packaging

- 9.4.2 Rigid packaging

- 9.4.3 Labels and tapes

- 9.5 Electronics and electrical

- 9.5.1 Consumer electronics

- 9.5.2 Semiconductor packaging

- 9.5.3 PCB assembly

- 9.5.4 Display technologies

- 9.6 Aerospace and defense

- 9.6.1 Commercial aviation

- 9.6.2 Military applications

- 9.6.3 Space applications

- 9.7 Medical and healthcare

- 9.7.1 Medical devices

- 9.7.2 Surgical applications

- 9.7.3 Pharmaceutical packaging

- 9.8 Footwear and leather

- 9.9 Woodworking and furniture

- 9.10 Marine applications

- 9.11 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 3M Company

- 11.2 Arkema Group (Bostik)

- 11.3 Ashland Global Holdings Inc.

- 11.4 Avery Dennison Corporation

- 11.5 BASF SE

- 11.6 Dow Inc.

- 11.7 DuPont de Nemours, Inc.

- 11.8 H.B. Fuller Company

- 11.9 Henkel AG & Co. KGaA

- 11.10 Huntsman Corporation

- 11.11 Illinois Tool Works Inc. (ITW)

- 11.12 Momentive Performance Materials Inc.

- 11.13 RPM International Inc.

- 11.14 Sika AG

- 11.15 Wacker Chemie AG