PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801953

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801953

Residential Solar PV Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

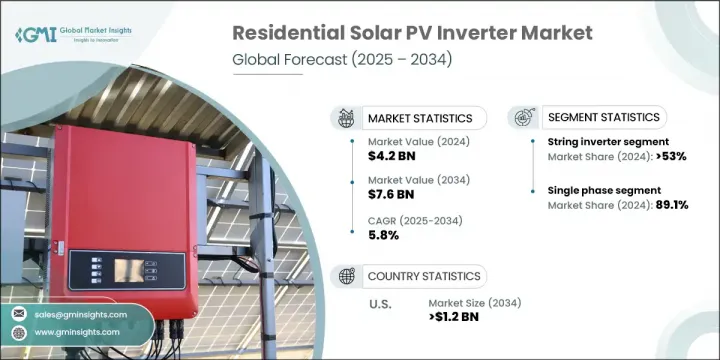

The Global Residential Solar PV Inverter Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 7.6 billion by 2034. A steady rise in solar energy adoption is being fueled by declining prices of panels and associated technologies, along with increasing availability of financial support through grants, rebates, and tax incentives. Escalating utility costs tied to conventional power grids are motivating homeowners to explore energy alternatives, pushing up demand for solar-powered systems and supporting products like PV inverters.

These inverters play a critical role in converting direct current from solar panels into alternating current used by residential electrical grids, while also providing essential safety and monitoring features. Regulatory frameworks promoting cleaner energy and awareness campaigns that showcase long-term savings are further encouraging residential installations. Industry leaders are increasingly adopting cutting-edge inverter technologies to meet the growing energy demands of households aiming for sustainability and energy independence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 5.8% |

The micro inverter segment is poised for a CAGR of 6% through 2034, driven by its panel-level optimization, which ensures enhanced performance even in partially shaded installations. The simplified installation, low-voltage design, and scalable architecture make micro inverters ideal for small and mid-size homes, promoting wider market adoption.

The single-phase inverters captured 89.1% share in 2024 and is projected to grow at a CAGR of 5.6% through 2034. These units are widely favored due to their compact design, ease of installation, and compatibility with average residential power demands. Their integration with energy storage systems and intelligent energy platforms also supports growing interest from households looking to reduce utility bills and minimize their carbon footprint. As solar-plus-storage solutions gain traction, the demand for single-phase inverters that seamlessly operate within modern smart homes continues to rise.

United States Residential Solar PV Inverter Market held a 99.3% share in 2024 and is anticipated to reach USD 1.2 billion by 2034. The country's strong momentum is driven by favorable policies such as renewable energy mandates, tax incentives, net metering programs, and utility-level rebate offerings. These measures are encouraging the installation of residential solar systems at scale. The presence of major market players investing in advanced product development further supports long-term growth across US households transitioning toward renewable power solutions.

Prominent companies operating in the Residential Solar PV Inverter Market include Sungrow, Solar Edge Technologies, Inc., Siemens, Schneider Electric, Panasonic Corporation, INVERGY, Huawei Technologies Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, GoodWe, Goldi Solar, Ginlong Technologies, General Electric, Fronius International GmbH, Fimer Group, Eaton, Enphase Energy, Delta Electronics, Inc., Darfon Electronics Corp., Canadian Solar, and Servotech Power Systems. Leading players are strengthening their market foothold by advancing product innovation, focusing on compact, high-efficiency, and smart inverters compatible with storage and IoT applications. Firms are actively investing in R&D to enhance safety features, integrate AI-based monitoring, and increase energy yield per panel. Collaborations with battery manufacturers and smart home platforms are creating value-added offerings that align with evolving residential energy needs. Companies are also expanding their geographic footprint through regional manufacturing units, distribution partnerships, and digital sales networks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Industry Insights

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Phase trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw materials & component suppliers

- 3.1.2 Inverter manufacturers

- 3.1.3 EPC & system integrators

- 3.1.4 Project developers & IPPs

- 3.2 Price trend analysis, 2021-2034

- 3.2.1 By product

- 3.2.2 By region

- 3.3 Cost structure analysis

- 3.4 Regulatory landscape

- 3.5 Industry impact forces

- 3.5.1 Growth drivers

- 3.5.2 Industry pitfalls & challenges

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 String

- 5.3 Micro

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 UK

- 7.3.7 France

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Israel

- 7.5.2 Saudi Arabia

- 7.5.3 UAE

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.5.6 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Canadian Solar

- 8.2 Darfon Electronics Corp.

- 8.3 Delta Electronics, Inc.

- 8.4 Enphase Energy

- 8.5 Eaton

- 8.6 Fimer Group

- 8.7 Fronius International GmbH

- 8.8 General Electric

- 8.9 Ginlong Technologies

- 8.10 Goldi Solar

- 8.11 GoodWe

- 8.12 Hitachi Hi-Rel Power Electronics Private Limited

- 8.13 Huawei Technologies Co., Ltd.

- 8.14 INVERGY

- 8.15 Panasonic Corporation

- 8.16 Schneider Electric

- 8.17 Siemens

- 8.18 SMA Solar Technology AG

- 8.19 Servotech Power Systems

- 8.20 Solar Edge Technologies, Inc.

- 8.21 Sungrow