PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822546

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822546

Ophthalmic Lasers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

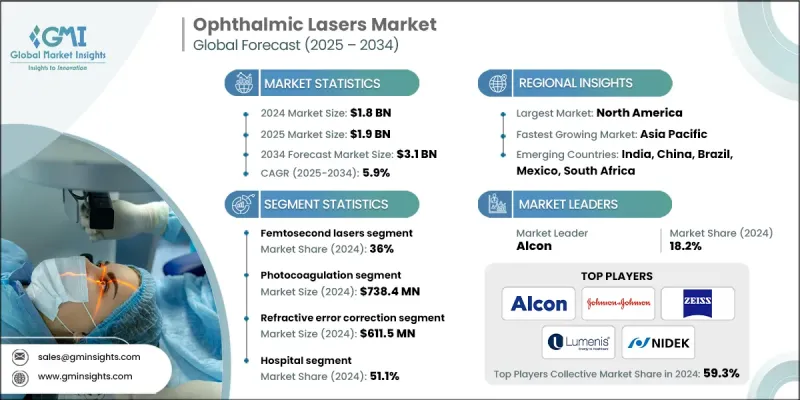

The global ophthalmic lasers market was valued at USD 1.8 billion in 2024 and is projected to grow from USD 1.9 billion in 2025 to USD 3.1 billion by 2034, at a CAGR of 5.9%, according to the latest report published by Global Market Insights, Inc. The market is experiencing significant growth with the growing incidence of vision disorders, the aging population, and technological advancements in laser systems for eye procedures.

Ophthalmic lasers have emerged as vital for the treatment of diseases like glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and refractive errors. Ophthalmic lasers are minimally invasive instruments that deliver precise and effective surgical treatments, and therefore are expected to show increased uptake over the next few years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.9% |

Key Drivers:

1. Rising incidences of eye diseases: Increasing numbers of cataracts, diabetic retinopathy, and glaucoma are favoring the demand for laser-based treatments.

2. Rise in refractive surgeries: Increased interest in LASIK and SMILE surgeries among young generations is driving the usage of femtosecond and excimer lasers.

3. Improved precision and safety of lasers: New ophthalmic lasers provide enhanced control, less thermal damage, and better post-op results, thus gaining traction among ophthalmologists.

4. Aging population: Age-related eye conditions are on the rise worldwide, particularly in high-income and middle-income nations.

Key Players:

- Alcon, Johnson & Johnson, ZEISS, LUMENIS, and NIDEK are some of the key players, together commanding 59.3% of the overall market.

- Alcon captured an 18.2% share of the ophthalmic lasers market in 2024.

Key Challenges:

- High cost of equipment: Ophthalmic lasers are expensive, which hinders their penetration in low-income healthcare facilities.

- Strict regulatory approvals: Device approval delays in various markets may limit launch schedules.

- Scarcity of skilled professionals: Specialized training is needed for the use of sophisticated laser systems, which is still an issue in rural and underdeveloped regions.

By Product Type - Femtosecond Lasers Dominate the Market

Femtosecond lasers led the product category in 2024 with their precision, minimal invasiveness, and efficacy in refractive and cataract surgeries. Their use in LASIK, SMILE, and corneal incisions is increasing rapidly due to the increasing patient interest in vision correction continues to rise worldwide.

By Technology - Photocoagulation witnessed widespread Adoption

The photocoagulation segment sustained a strong position in 2024, particularly because of the increasing usage in the treatment of diabetic retinopathy and retinal vein occlusions. The technology is preferred among retinal specialists as it offers long-term stabilization of vision-threatening disease.

By Application - Refractive Error Correction Remains in Focus

Refractive error correction dominated the market in 2024. Growing demand for permanent vision correction solutions to glasses and contact lenses is propelling the demand for laser-assisted procedures, especially in urban areas.

By End Use - Hospitals Captured the Biggest Share

Hospitals dominated the end-use segment in 2024. Hospital facilities have integrated eye care units, qualified surgeons, and high-tech laser equipment. They also offer reimbursement benefits and have the capacity to treat both elective and emergency ophthalmic surgeries.

North America was the biggest player in the global ophthalmic lasers market in 2024, driven by extensive use of advanced ophthalmic surgeries, high myopia and cataract rates, and the presence of prominent players. The U.S. remains at the forefront in terms of technology adoption, reimbursement schemes, and outpatient surgical facilities with sophisticated laser-based treatments.

Top players are exploring and executing new research and development, strategic partnerships, and new launches for competitive advantage. As an example, Alcon has recently built its portfolio with next-generation femtosecond lasers for cataract and corneal surgery. ZEISS and Johnson & Johnson are focused on artificial intelligence-guided laser platforms to improve surgical precision. Conversely, Lumenis and Glaukos aim to partner with eye clinics and hospitals to better support their distribution channels. BAUSCH + LOMB and NIDEK implement growth strategies focused on emerging markets by exploring local production and also training ophthalmologists. This will further global reach but also advance technology and improve patient care outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Growing demand for minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements in laser systems

- 3.2.1.4 Improved reimbursement landscape in developed markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ophthalmic laser systems

- 3.2.2.2 Risk of postoperative complications and side effects

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets in Asia-Pacific, Latin America, and MEA

- 3.2.3.2 Portable and compact laser platforms for outreach programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis, By product type, 2024

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LATAM and MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Femtosecond lasers

- 5.3 Diode lasers

- 5.4 Excimer lasers

- 5.5 Nd:YAG lasers

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Photocoagulation

- 6.3 Photodisruption

- 6.4 Ablation

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Refractive error correction

- 7.3 Cataract surgery

- 7.4 Diabetic retinopathy

- 7.5 Glaucoma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ophthalmic clinics

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Alcon

- 10.1.2 BAUSCH + LOMB

- 10.1.3 Johnson & Johnson

- 10.1.4 LUMENIS

- 10.1.5 NIDEK

- 10.1.6 ZEISS

- 10.2 Regional Players

- 10.2.1 LIGHTMED

- 10.2.2 LUMIBIRD MEDICAL

- 10.2.3 Meridian Medical

- 10.2.4 TOPCON Healthcare

- 10.3 Emerging Players

- 10.3.1 A.R.C. LASER

- 10.3.2 Glaukos

- 10.3.3 IRIDEX

- 10.3.4 Ziemer Ophthalmology