PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822563

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822563

Digital Twin in Automotive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

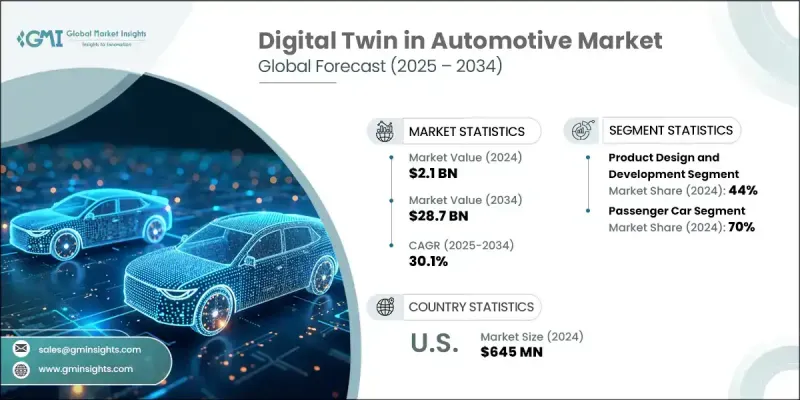

The Global Digital Twin in Automotive Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 30.1% to reach USD 28.7 billion by 2034.

This significant growth is being fueled by the ongoing digital transformation across the automotive sector. Increasing reliance on connected technologies, IoT, IIoT, and Industry 4.0 principles is transforming traditional vehicles into intelligent, data-driven machines. As vehicles evolve from mechanical hardware to complex software platforms, digital twin technology is being used to manage large-scale data from sensors, systems, and onboard computers. Automakers are leveraging this data to improve performance, prevent breakdowns, and enable predictive maintenance using AI, machine learning, and advanced analytics. Digital twins are proving vital not only in simulating design and engineering changes but also in enhancing operational efficiency, guiding workforce training, and streamlining production. The surge in demand for electric and autonomous vehicles is further accelerating the need for virtual replicas that support faster prototyping and real-time monitoring. As the industry pushes toward sustainability, zero-emission mobility, and smart infrastructure, digital twin adoption is expected to rise rapidly. Companies are responding with strong investment and strategic initiatives to remain competitive in this high-growth environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $28.7 Billion |

| CAGR | 30.1% |

Within this market, the product design and development segment held a 44% share in 2024 and is set to grow at a CAGR of 29% between 2025 and 2034. Automakers are using digital twin technology to develop and validate vehicle components before manufacturing. This allows teams to reduce prototyping costs, shorten development cycles, and speed up innovation for complex systems like EV batteries, powertrains, and vehicle aerodynamics. The simulation of intricate elements at an early stage enables faster testing, accurate iteration, and quicker time-to-market. These benefits are helping OEMs meet growing consumer demands for performance and customization while staying ahead of regulatory timelines.

The passenger car segment held a 70% share in 2024 and is expected to grow at a CAGR of 29% through 2034. Automotive companies are using digital twins to evaluate how EV batteries behave under diverse driving patterns and environmental conditions. This approach helps optimize key parameters such as thermal efficiency, energy density, and battery safety. By improving the performance and lifespan of EV power systems, digital twins contribute directly to reducing emissions and encouraging broader adoption of electric passenger vehicles. The growing global push toward sustainable transport solutions is further intensifying the use of digital twin platforms in this segment.

United States Digital Twin in Automotive Market held a 90% share in 2024, generating USD 645 million. The US automotive ecosystem continues to push the boundaries of vehicle innovation, especially in the electric and autonomous space. Companies are using digital twin environments to test components virtually, fine-tune performance, and address challenges like battery management all without waiting for real-world failures. These solutions are significantly cutting down product development time while increasing dependability. The growing demand for rapid design-to-deployment cycles is playing a critical role in accelerating market momentum across the region.

Leading companies in the Global Digital Twin in Automotive Market include Capgemini, Siemens, General Electric, Microsoft, IBM, Bosch, and Dassault Systemes. These players are key contributors to the advancement of simulation and modeling technologies tailored for the automotive landscape. Top companies in the digital twin automotive space are expanding their market presence through continuous innovation, collaborative partnerships, and focused acquisitions. Many are integrating AI and advanced analytics into their platforms to offer predictive diagnostics and real-time monitoring features. Organizations are also developing customizable, scalable solutions that cater to different stages of the vehicle lifecycle from concept to operation. To enhance competitiveness, firms are forming strategic alliances with automakers and software developers to streamline the implementation of digital twin tools across global operations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Deployment Mode

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of AI & automation in recruitment

- 3.2.1.2 Increasing need for centralized recruitment platforms

- 3.2.1.3 Growing remote & hybrid work culture

- 3.2.1.4 Integration with CRM and HRIS systems

- 3.2.1.5 Shift toward data-driven hiring decisions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial setup and subscription costs

- 3.2.2.2 Data privacy & compliance concerns

- 3.2.2.3 Integration complexity with legacy systems

- 3.2.2.4 Candidate experience issues from automation overuse

- 3.2.2.5 Limited customization for niche industries

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven candidate sourcing & skill-matching

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 Integration with video interviewing & assessment tools

- 3.2.3.4 Freelance & gig economy recruitment

- 3.2.3.5 Mobile-first ATS adoption

- 3.2.3.6 HR tech ecosystem partnerships

- 3.2.1 Growth drivers

- 3.3 Digital Twin Technology Foundation and Architecture

- 3.3.1 Digital Twin Fundamentals and Evolution

- 3.3.2 Types of Digital Twins: Product, Process, Performance, Asset, System

- 3.3.3 Digital Thread and Data Interoperability

- 3.3.4 Model-Based Systems Engineering (MBSE)

- 3.3.5 Physical-Digital-Physical (PDP) Loop

- 3.3.6 Real-Time Data Synchronization and Feedback

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology innovation and advanced features

- 3.8.1 Simulation Engines and Solver Technology

- 3.8.2 IoT Sensor Integration and Data Acquisition

- 3.8.3 Edge Computing, 5G, and Real-Time Digital Twins

- 3.8.4 AI/ML Model Management and Simulation Automation

- 3.8.5 AR/VR and Immersive Visualization

- 3.8.6 Cloud, On-Premises, and Hybrid Architectures

- 3.8.7 API and System Integration Capabilities

- 3.9 Price trend analysis

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.11.1 Patent Portfolio Analysis by Technology Area

- 3.11.2 Patent Filing Trends and Innovation Activity

- 3.11.3 Competitive Patent Intelligence

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon Footprint Considerations

- 3.13 Use cases

- 3.13.1 Product Design and Virtual Prototyping

- 3.13.1.1 Concept Design, Simulation, and Testing

- 3.13.1.2 Lightweighting and Material Optimization

- 3.13.1.3 Crash and Impact Simulation

- 3.13.2 Manufacturing and Smart Factory

- 3.13.2.1 Production Planning and Scheduling

- 3.13.2.2 Robotics and Automation Integration

- 3.13.2.3 Quality Control and Real-Time Monitoring

- 3.13.2.4 Factory Layout and Process Optimization

- 3.13.3 Vehicle Performance and Lifecycle Management

- 3.13.3.1 Predictive Maintenance and Condition Monitoring

- 3.13.3.2 Warranty Analytics and Recall Management

- 3.13.3.3 Fleet Management and Usage Analytics

- 3.13.3.4 OTA Updates and In-Service Upgrades

- 3.13.4 Supply Chain and Logistics Optimization

- 3.13.4.1 Supply Chain Digital Twin and Visibility

- 3.13.4.2 Inventory Optimization and Demand Forecasting

- 3.13.4.3 Supplier Collaboration and Risk Management

- 3.13.4.4 Logistics Network Simulation

- 3.13.5 Customer Experience and Aftersales

- 3.13.5.1 Personalized Vehicle Configuration and Sales

- 3.13.5.2 Digital Showroom and VR/AR Visualization

- 3.13.5.3 Connected Services and Remote Diagnostics

- 3.13.5.4 Customer Feedback Loop and Product Improvement

- 3.13.6 Regulatory, Warranty, and Compliance Digital Twins

- 3.13.6.1 Regulatory Compliance and Digital Reporting

- 3.13.6.2 Warranty Claims and Root Cause Analysis

- 3.13.6.3 Safety Certification and Audit Trail

- 3.13.1 Product Design and Virtual Prototyping

- 3.14 Best-case scenario

- 3.15 End-of-Life, Recycling, and Circular Economy

- 3.15.1 Digital Twin for Dismantling and Recycling

- 3.15.2 Remanufacturing, Reuse, and Circular Supply Chains

- 3.15.3 Regulatory Reporting and Compliance

- 3.15.4 Lifecycle Assessment and Carbon Impact

- 3.16 Business Model Innovation & Monetization

- 3.16.1 Digital Twin as a Service (DTaaS)

- 3.16.2 Pay-per-Use and Subscription Models

- 3.16.3 Value-Based Pricing and Outcome-Based Models

- 3.16.4 Digital Twin Monetization and Data Licensing

- 3.17 Organizational Change, Workforce, and Process Transformation

- 3.17.1 Change Management and Digital Twin Adoption

- 3.17.2 Workforce Reskilling and Talent Development

- 3.17.3 Digital Twin Maturity Models and Organizational Readiness

- 3.17.4 Process Reengineering and Agile Transformation

- 3.18 Ecosystem, Standards, and Consortia

- 3.18.1 Industry Standards and Reference Architectures

- 3.18.2 Digital Twin Consortium, ASAM, and Other Alliances

- 3.18.3 Open Source vs Proprietary Solutions

- 3.18.4 Ecosystem Partnerships and Interoperability

- 3.19 Sustainability, ESG, and Lifecycle Assessment

- 3.19.1 Carbon Footprint Analytics and Reporting

- 3.19.2 ESG Metrics and Compliance

- 3.19.3 Sustainable Design and Green Manufacturing

- 3.19.4 Circular Economy and Resource Optimization

- 3.20 ROI, Cost-Benefit, and Payback Analysis

- 3.20.1 Implementation Cost Structure and Investment Requirements

- 3.20.2 Operational and Financial Benefits

- 3.20.3 Strategic Benefits and Competitive Advantage

- 3.20.4 ROI Frameworks and Payback Period Analysis

- 3.21 Future Scenarios and Disruption Analysis

- 3.21.1 Autonomous Vehicles and Digital Twin Integration

- 3.21.2. MaaS, Smart Cities, and V2 X

- 3.21.3 Regulatory Evolution and Policy Impact

- 3.21.4 Technology Disruption and Industry Transformation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Deployment Mode, 2021-2034 ($Bn)

- 5.1 Key trends

- 5.2 Cloud

- 5.3 On-premises

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger car

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 Light duty

- 6.3.2 Medium-duty

- 6.3.3 Heavy-duty

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 System digital twin

- 7.3 Product digital twin

- 7.4 Process digital twin

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 Product design and development

- 8.3 Machine and equipment health monitoring

- 8.4 Process support and service

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Tier 1 suppliers

- 9.4 Automotive software and technology companies

- 9.5 Mobility service providers

- 9.6 Aftermarket and service centers

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Leaders

- 11.1.1 Altair

- 11.1.2 Ansys

- 11.1.3 Autodesk

- 11.1.4 Capgemini

- 11.1.5 Dassault Systemes

- 11.1.6 General Electric

- 11.1.7 IBM

- 11.1.8 Microsoft

- 11.1.9 Oracle

- 11.1.10 PTC

- 11.1.11 SAP

- 11.1.12 Siemens

- 11.2 Regional Champions

- 11.2.1 AVL

- 11.2.2 Bentley Systems

- 11.2.3 Bosch

- 11.2.4 Cognizant

- 11.2.5 Hexagon

- 11.2.6 KPIT Technologies

- 11.2.7 Tata Technologies

- 11.3 Emerging Players / Disruptors

- 11.3.1 Bosch

- 11.3.2 General Electric

- 11.3.3 Siemens Energy