PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876531

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876531

Automotive Digital Twin Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

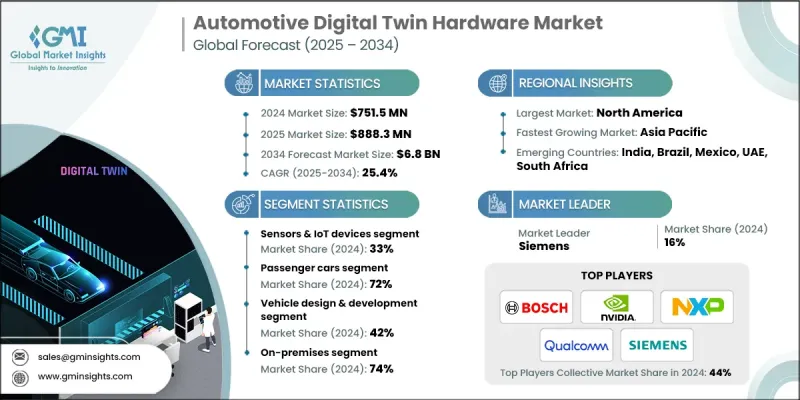

The Global Automotive Digital Twin Hardware Market was valued at USD 751.5 million in 2024 and is estimated to grow at a CAGR of 25.4% to reach USD 6.8 billion by 2034.

The demand for digital twin hardware is accelerating as automotive OEMs and Tier-1 suppliers embrace advanced systems, including high-performance computing (HPC) units, sensors, GPUs, and edge servers. These hardware components replicate real-world vehicle behavior in virtual settings, allowing manufacturers to analyze production outcomes, streamline assembly processes, and improve resource utilization. Digital twin platforms also enhance workforce efficiency by enabling engineers to test and validate assembly workflows virtually before implementing them on production lines. The rising adoption of IoT/IIoT, artificial intelligence, and Industry 4.0 technologies is transforming automotive manufacturing, driving the need for robust digital twin hardware solutions. As vehicles evolve into software-defined systems that generate massive sensor data, digital twin hardware facilitates real-time data processing, predictive analytics, and operational optimization. With Industry 4.0 initiatives emphasizing automation, precision, and predictive maintenance, the integration of IoT sensors, edge computing devices, and industrial controllers within automotive plants continues to grow, creating strong demand for powerful computing infrastructure capable of simulating and processing real-time factory data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $751.5 Million |

| Forecast Value | $6.8 Billion |

| CAGR | 25.4% |

The sensors and IoT devices segment held a 33% share in 2024 and is anticipated to grow at a CAGR of 25.5% from 2025 to 2034. This segment plays a critical role in capturing real-time metrics such as temperature, vibration, and pressure to replicate the physical performance of automotive assets. With the increasing adoption of autonomous driving technologies, the use of advanced sensors including LiDAR, radar, and MEMS components is accelerating, supporting enhanced predictive modeling and fault diagnostics.

The passenger cars segment held 72% share in 2024 and will grow at a CAGR of 25.7% between 2025 and 2034. This dominance is attributed to greater system connectivity, electrification trends, and advancements in driver assistance systems. Automotive manufacturers are deploying GPUs, IoT-enabled sensors, and edge computing systems to conduct real-time vehicle simulations, improving both design precision and production efficiency. The growing shift toward software-defined vehicles is reinforcing the need for digital twin technologies that support predictive maintenance, virtual validation, and over-the-air software updates.

North America Automotive Digital Twin Hardware Market held 34% share in 2024. The region's growth is driven by the strong adoption of connected, autonomous, and electric vehicle technologies. Automotive OEMs and component suppliers are heavily investing in GPU-powered computing, low-latency edge hardware, and IoT sensor networks to enable digitalized factory environments and real-time simulation. The rapid development of AI-accelerated processors and modular hardware systems is further enhancing design accuracy, operational efficiency, and production reliability across the regional automotive ecosystem.

Key players active in the Global Automotive Digital Twin Hardware Market include Bosch, Continental, General Electric, IBM, Molex, NVIDIA, NXP Semiconductors, PTC, Qualcomm, and Siemens. Leading companies in the Global Automotive Digital Twin Hardware Market are focusing on several strategic initiatives to expand their global presence. They are investing heavily in R&D to develop scalable, high-performance computing platforms and integrating AI-driven simulation tools to deliver real-time analytics and predictive insights. Strategic collaborations and partnerships with automakers and technology providers are helping them co-develop customized digital twin solutions for production and design optimization. Companies are also emphasizing the expansion of manufacturing capabilities and regional distribution networks to strengthen their supply chains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Deployment Mode

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration of high-performance computing (HPC) and GPU hardware

- 3.2.1.2 Adoption of edge computing and IoT/IIoT devices

- 3.2.1.3 Advancements in AI and machine learning hardware

- 3.2.1.4 Expansion of autonomous and connected vehicle development

- 3.2.1.5 Industry 4.0 and smart manufacturing adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High hardware and infrastructure costs

- 3.2.2.2 Data interoperability across heterogeneous systems

- 3.2.3 Market opportunities

- 3.2.3.1 AI-accelerated simulation hardware

- 3.2.3.2 Integration of edge and cloud computing infrastructure

- 3.2.3.3 Expansion of digital twin hardware in EV and battery systems

- 3.2.3.4 Adoption of 5G and ultra-low latency networks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Federal regulatory environment

- 3.4.2 International standards (ISO, SAE)

- 3.4.3 Cybersecurity requirements

- 3.4.4 Safety and compliance standards

- 3.4.5 Data privacy regulations

- 3.4.6 Environmental standards

- 3.4.7 Regional regulatory variations

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Artificial intelligence integration

- 3.7.2 Synthetic data and simulation

- 3.7.3 Quantum computing applications

- 3.7.4 Advanced security technologies

- 3.7.5 Edge computing evolution

- 3.7.6 5G and beyond connectivity

- 3.7.7 Sustainability technologies

- 3.8 Price trend analysis

- 3.9 Total cost of ownership (TCO) analysis

- 3.9.1 Hardware acquisition costs

- 3.9.2 Implementation and integration costs

- 3.9.3 Operational and maintenance costs

- 3.9.4 Training and support costs

- 3.10 Patent analysis

- 3.10.1 Patent portfolio analysis by technology area

- 3.10.2 Patent filing trends and innovation activity

- 3.10.3 Competitive patent intelligence

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Customer journey mapping

- 3.13.1 Awareness and discovery phase

- 3.13.2 Evaluation and selection phase

- 3.13.3 Implementation and integration phase

- 3.13.4 Operation and optimization phase

- 3.14 Return on investment (ROI) framework

- 3.14.1 ROI calculation methodologies

- 3.14.2 Payback period analysis

- 3.14.3 Net present value (NPV) models

- 3.14.4 Risk-adjusted returns

- 3.15 Investment and funding analysis

- 3.15.1 Venture capital trends

- 3.15.2 Strategic corporate investment

- 3.15.3 Government funding programs

- 3.15.4 M&A activity and valuations

- 3.15.5 IPO market dynamics

- 3.15.6 Private equity involvement

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Sensors & IoT devices

- 5.3 Edge computing devices

- 5.4 Connectivity & networking hardware

- 5.5 Actuators & control systems

- 5.6 High-performance computing / simulation hardware

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Vehicle design & development

- 7.3 Manufacturing & production optimization

- 7.4 Predictive maintenance

- 7.5 Autonomous vehicle testing

- 7.6 Supply chain & fleet management

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Cloud

- 8.3 On-premises

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Siemens

- 10.1.2 DSpace

- 10.1.3 NVIDIA

- 10.1.4 PTC

- 10.1.5 IBM

- 10.1.6 Bosch

- 10.1.7 Intel

- 10.1.8 NXP Semiconductors

- 10.1.9 General Electric

- 10.2 Regional Players

- 10.2.1 Keysight Technologies

- 10.2.2 Altair Engineering

- 10.2.3 ETAS

- 10.2.4 Vector Informatik

- 10.2.5 National Instruments

- 10.2.6 Ansys

- 10.2.7 Qualcomm

- 10.2.8 Continental

- 10.2.9 Molex

- 10.3 Emerging Players

- 10.3.1 Threedy

- 10.3.2 Neural Concept

- 10.3.3 Applied Intuition

- 10.3.4 Cognata

- 10.3.5 Luminar Technologies

- 10.3.6 Mobileye Global