PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822577

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822577

North America Mobile Gas Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

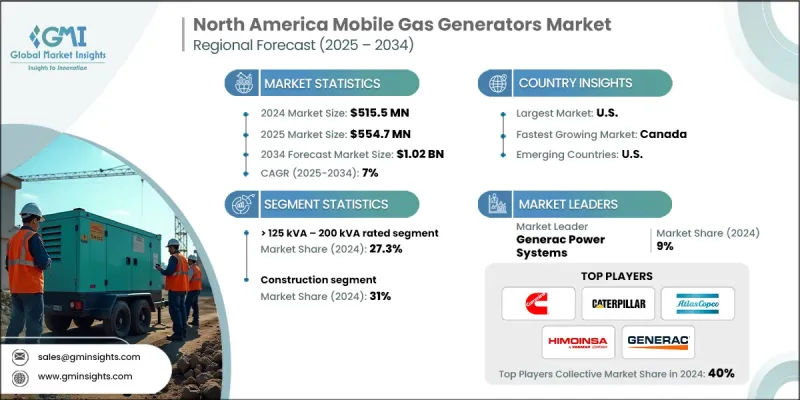

The North America Mobile Gas Generators Market was valued at USD 515.5 million in 2024 and is estimated to grow at a CAGR of 7% to reach USD 1.02 billion by 2034.

Mobile gas generators provide critical power in remote or temporary locations such as construction sites, disaster zones, or outdoor events. As activities in these areas increase across North America, so does the demand for portable, quick-deploy power solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $515.5 Million |

| Forecast Value | $1.02 Billion |

| CAGR | 7% |

Rising Adoption of more than 125 kVA - 200 kVA Segment

The mobile gas generator segment, more than 125 kVA - 200 kVA, held a notable share in 2024, driven by portability and mid-range power. These units serve as an ideal solution for industries needing reliable backup or temporary power without over-investing in higher-capacity systems. Their use spans from commercial buildings and small industrial facilities to temporary installations and emergency response operations. Manufacturers are increasingly focused on improving fuel efficiency, emission compliance, and load management capabilities within this capacity range to meet the evolving needs of end users.

Construction to Gain Traction

The construction segment held a significant share in 2024, as generators have become an essential asset for powering tools, lighting, and equipment at sites that often lack grid connectivity. The unpredictable nature of construction schedules and location shifts makes mobility and reliability critical. Contractors prefer gas generators for their lower emissions compared to diesel alternatives, especially in urban environments where environmental regulations are strict.

Regional Insights

U.S. to Emerge as a Lucrative Region

United States mobile gas generators market generated notable revenues in 2024, fueled by rising demand across construction, events, industrial applications, and emergency response. As climate-related disruptions become more frequent, businesses and municipalities are investing in mobile gas generators to ensure continuity. Additionally, the push for cleaner alternatives to diesel has led to a sharp rise in the adoption of natural gas-powered units.

Major players in the North America mobile gas generators market are VoltaGrid, DuroMax Power Equipment, Cummins, Blue Star Power Systems, HIMOINSA POWER SYSTEMS, Kirloskar, Caterpillar, BE POWER EQUIPMENT, Mesa Solutions, CENTRAL POWER, Alliance North America, Generac Power Systems, WINCO, PowerTech Generators, TAYLOR GROUP, HIMOINSA, Atlas Copco, GRAVITY, Aggreko, Yanmar Holdings, American Honda Motor, Sommers Generator Systems, Waukesha-Pearce Industries, and Baseline Energy Services.

To strengthen their foothold in the North America mobile gas generators market, leading companies are adopting a multi-pronged strategy centered on product innovation, strategic partnerships, and geographic expansion. A primary focus is on enhancing generator efficiency, portability, and environmental compliance by integrating cleaner-burning fuels, hybrid systems, and advanced emission control technologies. Many players are investing in smart features such as remote monitoring, real-time diagnostics, and predictive maintenance to increase equipment uptime and operational control. Additionally, manufacturers are forming alliances with construction firms, disaster management agencies, and rental service providers to ensure consistent demand and long-term contracts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Application trends

- 2.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of mobile gas generators

- 3.8 Price trend analysis

- 3.8.1 By capacity

- 3.8.2 By application

- 3.9 Future market outlook & emerging opportunities

- 3.10 Technology trends & innovations

- 3.10.1 Digitalization & IoT integration

- 3.10.2 Advanced materials & durability improvements

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Data centers

- 6.3 Mining

- 6.4 Bitcoin mining

- 6.5 Construction

- 6.6 Small industries

- 6.7 Agriculture

- 6.8 Oil & gas

- 6.9 Disaster relief

- 6.10 Military & defense

- 6.11 Transportation hubs & ports

- 6.12 Others

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Alliance North America

- 8.3 American Honda Motor

- 8.4 Atlas Copco

- 8.5 Baseline Energy Services

- 8.6 BE POWER EQUIPMENT

- 8.7 Blue Star Power Systems

- 8.8 Caterpillar

- 8.9 CENTRAL POWER

- 8.10 Cummins

- 8.11 DuroMax Power Equipment

- 8.12 Generac Power Systems

- 8.13 GRAVITY

- 8.14 HIMOINSA

- 8.15 HIMOINSA POWER SYSTEMS

- 8.16 Kirloskar

- 8.17 Mesa Solutions

- 8.18 PowerTech Generators

- 8.19 Sommers Generator Systems

- 8.20 TAYLOR GROUP

- 8.21 VoltaGrid

- 8.22 Waukesha-Pearce Industries

- 8.23 WINCO

- 8.24 Yanmar Holdings