PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822580

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822580

China Hempcrete and Other Plant-Based Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

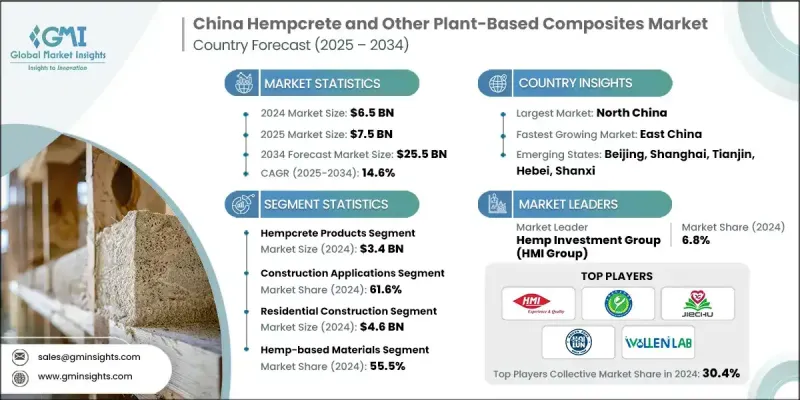

China hempcrete and other plant-based composites market was valued at USD 6.5 billion in 2024 and is projected to grow from USD 7.5 billion in 2025 to USD 25.5 billion by 2034, at a CAGR of 14.6%, according to the latest report published by Global Market Insights, Inc.

Market expansion is being fueled by China's initiative towards low-carbon construction materials, green construction activities, and access to hemp-based raw materials. Demand for hempcrete and other natural fiber composites is growing on residential and commercial construction sites, driven by their thermal insulation, fireproofing, carbon capture, and eco-friendliness properties.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $25.5 Billion |

| CAGR | 14.6% |

Key Drivers:

1. State support for green building: China's plans for carbon neutrality are speeding up market demand for green, plant-based construction materials such as hempcrete.

2. Acoustic and thermal insulation performance: Hempcrete's capacity for temperature control and sound insulation underpins its increasing application in domestic buildings.

3. Biodegradable and harmless composition: Plant-based composites provide a healthier alternative to synthetic insulation materials, particularly in low-rise dwellings.

4. Development of green buildings and eco-villages: Bio-based materials are being incorporated into new designs by architects and developers to comply with LEED and green building specifications.

Key Players:

The leading 7 players in the China hempcrete and other plant-based composites market-Hemp Investment Group (Hmi Group), Yunnan Academy of Agricultural Sciences, Zhejiang Hailun Rope and Net Co., Ltd., Huizhou Jiajia Craft Co., Ltd., Zhengzhou Wollen Instrument Equipment Co., Ltd., Isohemp, and Americhanvre together hold around 30.4% of the market share.

Key Challenges:

- Lack of standardized regulations and testing: Limited recognition for building codes regarding hempcrete limits scalability in both the construction and manufacturing sectors.

- High processing costs: The prices of converting raw hemp into a usable building material are still cost-prohibitive.

- Contractor/market experience: Developers, builders, and contractors do not want to switch from their traditional materials because they do not know how to use hempcrete.

1. By Product Type - Hempcrete Products Lead

In 2024, the largest market share for hemp was not an unexpected result. Hempcrete panels and blocks were the largest product piece because they are used for infill walls, insulation, and in modulars. Being lightweight, they both fit within new construction and retrofits. They are easier to install than traditional materials.

2. By Application - Construction Sector Drives Demand

Construction had the largest market share in 2024, as the demand for hempcrete walls, hempcrete floors, and hempcrete roofs grew. The perceived fireproof porous characteristics of hempcrete enable builders to comfortably adopt this material, as internal air quality and conservation of energy is guaranteed to comply with their internal specifications.

3. By End Use - Residential Segment

Residential housing captured the highest market share in 2024. Particularly in low-rise, single-family housing and off-grid small dwellings. With an increasing interest because of sustainability and with consumers looking for non-toxin homes, hempcrete is becoming popular with environmentally friendly developers.

4. By Raw Material - Hemp Material Stays Dominant

In 2024, hemp shiv and hemp fiber remained the dominant raw material inputs for the industry. With the existing farming base in China, Hemp is a low-input crop for composites, especially composites that are combinations of lime or clay binders.

North China dominated the market in 2024, with green construction practices going mainstream, pilot eco-villages, and government subsidies encouraging renewable building materials. The region has access to extensive hemp production, robust research support, and growing recognition of low-emission housing solutions.

The leading companies in the hempcrete and plant-based composites market in China include Zhengzhou Wollen Instrument Equipment Co., Ltd., Zhejiang Hailun Rope and Net Co., Ltd., Huizhou Jiajia Craft Co., Ltd., Yunnan Academy of Agricultural Sciences, Hemp Investment Group (HMI Group), IsoHemp, Americhanvre, Hempitecture, Tradical Hemcrete, and HempFlax.

As a means to gain market share in China, these major players have been actively pursuing R&D partnerships, product localization, and supply chain vertical integration. Hemp Investment Group HMI has established, expanded, and increased domestic hemp processing plants, and Zhengzhou Wollen has been conducting composite innovation research projects with universities. Global companies such as HempFlax and Tradical Hemcrete are looking into local joint ventures and distribution agreements. Various regional stakeholders are now concentrating on prefabricated hempcrete panels and multi-family green eco-housing projects, consonant with China's affordable green housing initiative.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 State trends

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Raw material type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Square Feet)

- 5.1 Key trend

- 5.2 Hempcrete products

- 5.2.1 Hempcrete blocks and panels

- 5.2.2 Hempcrete insulation materials

- 5.2.3 Hempcrete mortars and renders

- 5.3 Hemp fiber composites

- 5.3.1 Structural hemp composites

- 5.3.2 Non-structural hemp composites

- 5.3.3 Hemp-reinforced plastics

- 5.4 Other plant-based composites

- 5.4.1 Bamboo-based composites

- 5.4.2 Flax fiber composites

- 5.4.3 Mixed plant fiber composites

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Square Feet)

- 6.1 Key trends

- 6.2 Construction applications

- 6.2.1 Wall systems and insulation

- 6.2.2 Roofing and flooring materials

- 6.2.3 Prefabricated building components

- 6.3 Automotive applications

- 6.3.1 Interior components

- 6.3.2 Body panels and structural parts

- 6.3.3 Acoustic insulation materials

- 6.4 Packaging applications

- 6.4.1 Food packaging materials

- 6.4.2 Industrial packaging solutions

- 6.4.3 Consumer goods packaging

- 6.5 Other applications

- 6.5.1 Furniture and home furnishing

- 6.5.2 Textile and apparel

- 6.5.3 Agricultural applications

Chapter 7 Market Estimates & Forecast, By end use Industry, 2021-2034 (USD Billion) (Square Feet)

- 7.1 Key trend

- 7.2 Residential construction

- 7.2.1 Single-family homes

- 7.2.2 Multi-family housing

- 7.2.3 Affordable housing projects

- 7.3 Commercial construction

- 7.3.1 Office buildings

- 7.3.2 Retail and hospitality

- 7.3.3 Educational and healthcare facilities

- 7.4 Infrastructure development

- 7.4.1 Transportation infrastructure

- 7.4.2 Utilities and energy projects

- 7.4.3 Public buildings and facilities

- 7.5 Automotive industry

- 7.5.1 Passenger vehicles

- 7.5.2 Commercial vehicles

- 7.5.3 Electric vehicle applications

- 7.6 Other end use industries

- 7.6.1 Consumer goods manufacturing

- 7.6.2 Electronics and appliances

- 7.6.3 Agricultural and rural applications

Chapter 8 Market Estimates & Forecast, By Raw Material Type, 2021-2034 (USD Billion) (Square Feet)

- 8.1 Key trend

- 8.2 Hemp-based materials

- 8.2.1 Industrial hemp fiber

- 8.2.2 Hemp hurds and shivs

- 8.2.3 Hemp seeds and oil

- 8.3 Bamboo-based materials

- 8.3.1 Bamboo fiber

- 8.3.2 Bamboo chips and particles

- 8.4 Flax-based materials

- 8.4.1 Flax fiber

- 8.4.2 Flax straw and waste

- 8.5 Other plant-based materials

- 8.5.1 Rice husk and straw

- 8.5.2 Wheat straw

- 8.5.3 Coconut fiber

Chapter 9 Market Estimates & Forecast, By States, 2021-2034 (USD Billion) (Square Feet)

- 9.1 Key trends

- 9.2 North China

- 9.2.1 Beijing

- 9.2.2 Tianjin

- 9.2.3 Hebei

- 9.2.4 Shanxi

- 9.2.5 Inner Mongolia

- 9.3 Northeast China

- 9.3.1 Liaoning

- 9.3.2 Jilin

- 9.3.3 Heilongjiang

- 9.4 East China

- 9.4.1 Shanghai

- 9.4.2 Jiangsu

- 9.4.3 Zhejiang

- 9.4.4 Anhui

- 9.4.5 Fujian

- 9.4.6 Jiangxi

- 9.4.7 Shandong

- 9.5 South Central China

- 9.5.1 Henan

- 9.5.2 Hubei

- 9.5.3 Hunan

- 9.5.4 Guangdong

- 9.5.5 Guangxi

- 9.5.6 Hainan

- 9.6 Southwest China

- 9.6.1 Chongqing

- 9.6.2 Sichuan

- 9.6.3 Guizhou

- 9.6.4 Yunnan

- 9.6.5 Tibet

- 9.7 Northwest China

- 9.7.1 Shaanxi

- 9.7.2 Gansu

- 9.7.3 Qinghai

- 9.7.4 Ningxia

- 9.7.5 Xinjiang

Chapter 10 Company Profiles

- 10.1 Hemp Investment Group (HMI Group)

- 10.2 Yunnan Academy of Agricultural Sciences

- 10.3 Zhejiang Hailun Rope and Net Co., Ltd.

- 10.4 Huizhou Jiajia Craft Co., Ltd.

- 10.5 Zhengzhou Wollen Instrument Equipment Co., Ltd.

- 10.6 IsoHemp

- 10.7 Americhanvre

- 10.8 Hempitecture

- 10.9 Tradical Hemcrete

- 10.10 HempFlax