PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844286

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844286

U.S. Carbon-Sequestering Building Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

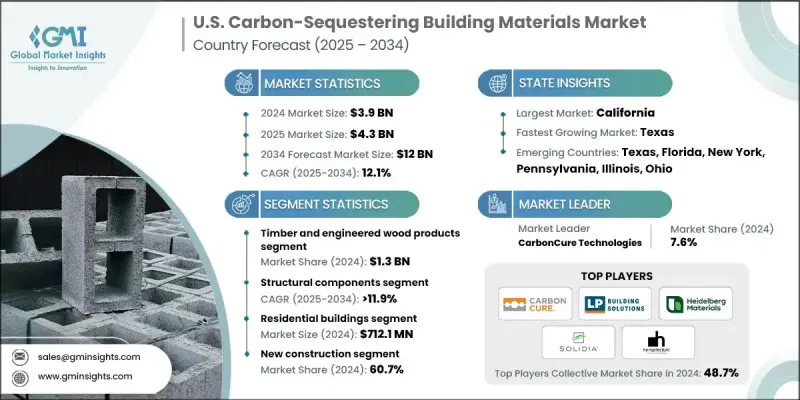

U.S. Carbon-Sequestering Building Materials Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 12 billion by 2034.

This market is gaining momentum due to strong government support, a surge in sustainable construction, and continuous advancements in eco-friendly technologies. Legislative measures and financial incentives are helping accelerate the transition to greener materials, aligning with national goals to reduce carbon emissions. New-generation carbon-sequestering products have become more efficient, affordable, and widely available, encouraging adoption across both residential and commercial construction. As public and industry awareness of climate-related challenges grows, demand for environmentally responsible building practices is rising. Builders, architects, and developers are now actively integrating sustainable materials into their designs, driven by certification programs that reward low-carbon construction choices. Innovations in carbon-capturing technologies, along with the growing preference for materials that support energy efficiency and environmental safety, are reshaping construction trends across the country. Ongoing shifts in consumer preferences, state-level sustainability mandates, and improvements in material performance will continue to support growth across all segments of the U.S. carbon-sequestering building materials market in the years to come.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $12 Billion |

| CAGR | 12.1% |

The timber and engineered wood products segment generated USD 1.3 billion in 2024, registering a CAGR of 12.3% through 2034. These materials are gaining popularity due to their natural carbon storage benefits and increasing demand for green alternatives in construction. Technological developments in structural wood systems, including products like glulam and other laminated wood solutions, are enhancing the structural integrity and versatility of these materials. Their ease of use, sustainability, and lower environmental impact make them ideal for both commercial and residential projects.

The structural components segment generated a 29.5% share in 2024 and is expected to grow at a CAGR of 11.9% through 2034. These elements play a pivotal role in supporting sustainable construction by incorporating innovative and carbon-storing materials into key building frameworks. The segment's growth is supported by increasing investment in high-performance products like fiber-reinforced composites and engineered timber, which improve strength while contributing to carbon reduction efforts. The widespread focus on durability, building resilience, and environmental compliance further propels the demand for sustainable structural materials.

Texas Carbon-Sequestering Building Materials Market will grow at a CAGR of 11.5% by 2034. The state's construction industry is increasingly turning toward innovative and low-carbon building practices as part of a broader strategy to promote renewable energy and eco-conscious urban development. High investment in sustainable housing and commercial infrastructure is reinforcing the uptake of carbon-sequestering materials, especially in fast-developing regions across the state.

Companies actively contributing to the U.S. Carbon-Sequestering Building Materials Market include Blue Planet Systems, Prometheus Materials, Fortera, LP Building Solutions, CarbonBuilt, Terra CO2 Technology, Sublime Systems, Carbo Culture, CleanFiber, Brimstone, Hempitecture, Ecovative, CarbonCure Technologies, Solidia Technologies, and Heidelberg Materials. To expand their market presence, major players are investing in research to develop more cost-effective, high-performance materials that offer enhanced carbon storage capabilities. Several companies are also entering into strategic collaborations with construction firms, governments, and green certification bodies to improve product reach and credibility. Scaled manufacturing and regional distribution networks are being strengthened to meet growing demand across urban and suburban developments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Material type

- 2.2.3 Application

- 2.2.4 Price range

- 2.2.5 Project type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, Material Technology, 2021-2034 (USD Billion) (Units)

- 5.1 Key trend

- 5.2 Bio-based carbon storage materials

- 5.3 Timber and engineered wood products

- 5.4 Hemp-based materials (hanfsteine, hanfbauplatten, hanfkalkstein)

- 5.5 Mycelium composites

- 5.6 Cattail (typha) materials

- 5.7 Mineral-based carbon capture materials

- 5.8 Bio-concrete and carbon-capturing concrete

- 5.9 Biochar-enhanced materials

- 5.10 Carbon fiber composites

- 5.11 Hybrid and advanced materials

- 5.12 Wood-mycelium composites

- 5.13 Plant-based carbon fiber systems

- 5.14 Multi-material integrated solutions

Chapter 6 Market Estimates & Forecast, By Building Component, 2021-2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Structural components

- 6.3 Foundation and basement systems

- 6.4 Load-bearing walls and columns

- 6.5 Floor and ceiling systems

- 6.6 Building envelope systems

- 6.6.1 External wall systems (including integrated insulation)

- 6.6.2 Roofing systems (including insulation)

- 6.6.3 Window and door frames

- 6.7 Interior systems

- 6.7.1 Non-load-bearing partitions

- 6.7.2 Interior finishes and panels

- 6.7.3 Flooring systems

- 6.8 Infrastructure components

- 6.8.1 Transportation infrastructure elements

- 6.8.2 Utility infrastructure components

Chapter 7 Market Estimates & Forecast, By End Use Sector, 2021-2034 (USD Billion) (Units)

- 7.1 Key trend

- 7.2 Residential buildings

- 7.2.1 Single-family houses

- 7.2.2 Multi-family buildings

- 7.2.3 Social housing projects

- 7.3 Commercial buildings

- 7.3.1 Office and administrative buildings

- 7.3.2 Retail and hospitality

- 7.3.3 Educational and healthcare facilities

- 7.4 Industrial buildings

- 7.4.1 Manufacturing and production facilities

- 7.4.2 Warehouses and logistics centers

- 7.4.3 Specialized industrial structures

- 7.5 Public infrastructure

- 7.5.1 Transportation infrastructure

- 7.5.2 Utilities and energy infrastructure

- 7.5.3 Public and municipal buildings

Chapter 8 Market Estimates & Forecast, By Construction Type, 2021-2034 (USD Billion) (Units)

- 8.1 Key trend

- 8.2 New construction

- 8.2.1 Greenfield residential projects

- 8.2.2 New commercial developments

- 8.2.3 New infrastructure projects

- 8.3 Renovation and retrofitting

- 8.3.1 Energy efficiency upgrades

- 8.3.2 Structural renovations

- 8.3.3 Heritage building restoration

Chapter 9 Market Estimates & Forecast, By States, 2021-2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 California

- 9.3 Texas

- 9.4 Florida

- 9.5 New York

- 9.6 Pennsylvania

- 9.7 Illinois

- 9.8 Ohio

- 9.9 Georgia

- 9.10 Rest of U.S.

Chapter 10 Company Profiles

- 10.1 CarbonCure Technologies

- 10.2 LP Building Solutions

- 10.3 Heidelberg Materials

- 10.4 Solidia Technologies

- 10.5 Hempitecture

- 10.6 CleanFiber

- 10.7 Terra CO2 Technology

- 10.8 Blue Planet Systems

- 10.9 CarbonBuilt

- 10.10 Fortera

- 10.11 Carbo Culture

- 10.12 Sublime Systems

- 10.13 Ecovative

- 10.14 Prometheus Materials

- 10.15 Brimstone