PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822609

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822609

Renewable Energy Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

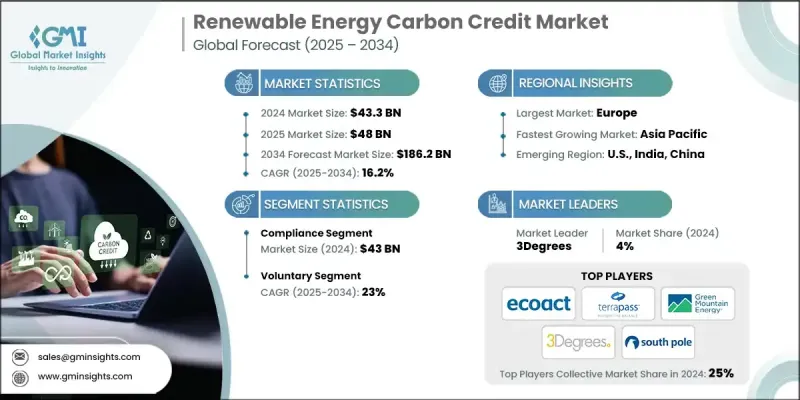

The global renewable energy carbon credit market was estimated at USD 43.3 billion in 2024 and is expected to grow from USD 48 billion in 2025 to USD 186.2 billion by 2034, at a CAGR of 16.2%, according to the latest report published by Global Market Insights Inc.

Governments and corporations worldwide are setting aggressive net-zero targets, creating a surge in demand for carbon credits generated through renewable energy projects. These credits help bridge the gap between current emissions and long-term decarbonization goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.3 Billion |

| Forecast Value | $186.2 Billion |

| CAGR | 16.2% |

Compliance to Gain Traction

The compliance segment held a notable share in 2024, driven by government-mandated emissions reduction targets and regulatory frameworks. Under programs like cap-and-trade and renewable portfolio standards, companies are required to offset a portion of their emissions, fueling steady demand for certified renewable energy credits. This segment benefits from structured oversight and standardized protocols, offering more predictability for market participants.

Rising Adoption Among the Voluntary Segment

The voluntary segment will grow at a decent CAGR during 2025-2034, as corporations, institutions, and individuals take proactive steps toward sustainability beyond regulatory mandates. Businesses are purchasing renewable energy carbon credits to demonstrate climate leadership, meet internal net-zero targets, and enhance ESG reporting. The segment thrives on flexibility, with buyers selecting projects that align with their brand values, such as community-based solar farms or small-scale wind developments.

Regional Insights

Europe to Emerge as a Lucrative Region

Europe renewable energy carbon credit market generated significant revenues in 2024, supported by ambitious climate policies, mature carbon trading systems, and widespread adoption of renewable technologies. The region's strong compliance infrastructure-led by the EU Emissions Trading System (EU ETS)-has set the global standard for carbon pricing and transparency. Simultaneously, voluntary participation is growing, as European corporations push toward net-zero commitments and seek to finance clean energy projects across borders.

Major players in the renewable energy carbon credit market are WayCarbon, Carbon Credit Capital, LLC., TerraPass, Native Energy, Climate Impact Partners, Atmosfair, The Carbon Collective Company, Carbon Better, EcoAct, ClimeCo LLC., South Pole, ALLCOT, Sterling Planet Inc., PwC, Green Mountain Energy Company, 3Degrees, CarbonClear, Ecosecurities, The Carbon Trust, Carbon Direct.

To strengthen their position, companies operating in the renewable energy carbon credit space are focusing on credibility, scalability, and digital innovation. Many are partnering directly with renewable energy developers to secure long-term credit supply from new projects, ensuring both additionality and future revenue streams. Others are investing in advanced monitoring and reporting technologies, including satellite data and AI, to validate credit impact and gain trust with buyers. Market leaders are also entering strategic alliances with fintech firms to streamline trading platforms and offer greater transparency. Additionally, some are expanding internationally by tailoring credit offerings to local climate goals and aligning with global standards such as ICVCM and VCMI to boost their reputation and competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.3 Europe

- 6.4 Asia Pacific

- 6.5 Middle East & Africa

- 6.6 Latin America

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 Atmosfair

- 7.3 ALLCOT

- 7.4 Carbon Better

- 7.5 Carbon Credit Capital, LLC.

- 7.6 Carbon Direct

- 7.7 ClimeCo LLC.

- 7.8 Climate Impact Partners

- 7.9 CarbonClear

- 7.10 Ecosecurities

- 7.11 EcoAct

- 7.12 Green Mountain Energy Company

- 7.13 Native Energy

- 7.14 PwC

- 7.15 Sterling Planet Inc.

- 7.16 South Pole

- 7.17 The Carbon Trust

- 7.18 The Carbon Collective Company

- 7.19 TerraPass

- 7.20 WayCarbon