PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822635

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822635

Industrial Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

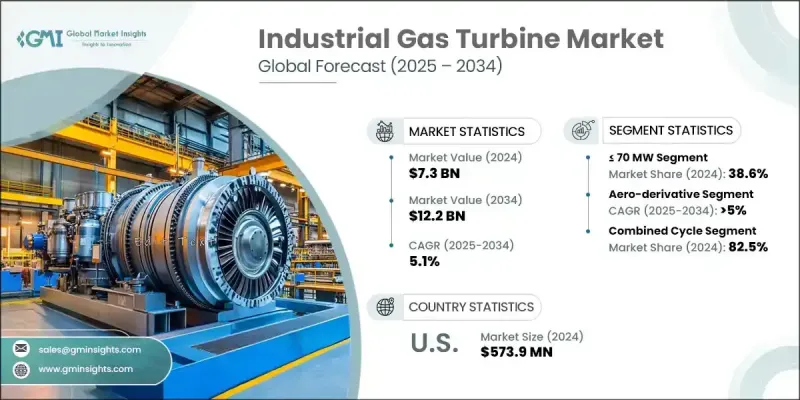

The Global Industrial Gas Turbine Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 12.2 billion by 2034.

As renewable energy sources continue to expand, the need for rapid response backup power is fueling demand for gas turbines capable of quick ramp-ups. These turbines play a critical role in ensuring grid stability when solar and wind output is inconsistent. The gradual phase-out of coal plants, combined with the availability of legacy infrastructure, is expected to accelerate turbine replacement and repowering projects, particularly across developing economies. Their ability to provide firm, flexible generation makes gas turbines a strategic asset in modern energy systems increasingly defined by variability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.1% |

Industrial gas turbines are high-performance engines built to deliver electricity or mechanical power across various industrial sectors. They operate on the Brayton cycle by compressing air, mixing it with fuel, and combusting it to create high-speed gas flow through turbine blades, producing rotational energy. The rising demand for grid-stabilizing assets due to electrification trends in heating and transport sectors is advancing investments in flexible gas turbine solutions. The ongoing surge in data center development and urban power congestion also supports turbine installations at commercial or industrial sites where uptime is vital. Meanwhile, growing support for hydrogen as a cleaner fuel alternative and upgrades enabling turbines to run on hydrogen or blended fuels are strengthening the case for advanced, future-ready gas turbine technologies.

The turbines with <= 70 MW capacity held 38.6% share in 2024 and is anticipated to grow at a CAGR of 5% through 2034. This segment benefits from rising interest in distributed power solutions aimed at delivering electricity to localized zones, including industrial parks and remote communities. Increased deployment in peak-load and standby generation roles is also contributing to segment expansion, especially among small-scale utility providers and industrial operators.

The combined cycle segment held 82.5% share in 2024 and is forecast to grow at 4.5% CAGR from 2025 to 2034. The shift toward open cycle turbines is notable in regions with high renewable integration, as they provide fast-start capabilities to help stabilize the grid during periods of renewable intermittency. Their operational flexibility makes them an indispensable tool for balancing short-term supply and demand fluctuations, especially as clean energy sources scale.

United States Industrial Gas Turbine Market held a 53.3% share, generating USD 573.9 million in;2024. Utilities in the country are increasingly turning to gas turbines to reinforce power reliability and respond to fluctuating renewable output. The trend of replacing old coal assets with gas-fired systems continues to gain momentum, particularly in states pursuing aggressive decarbonization goals. Aeroderivative turbines are also seeing increased demand for decentralized power generation across military installations, airports, and industrial facilities where grid independence is a growing concern.

Major players shaping the Global Industrial Gas Turbine Market include Siemens Energy, Doosan, Vericor, MAN Energy Solutions, Flex Energy Solutions, Mitsubishi Heavy Industries, MTU Aero Engines, Solar Turbines, Wartsila, IHI Corporation, Harbin Electric, Baker Hughes, GE Vernova, JSC United Engine, Bharat Heavy Electricals, Destinus Energy, Rolls Royce, Ansaldo Energia, Capstone Green Energy, Kawasaki Heavy Industries, and Nanjing Turbine and Electric Machinery. Leading companies in the industrial gas turbine market are accelerating innovation through hydrogen-compatible technologies and fuel-flexible turbine systems. Strategic investments are focused on R&D for low-emission combustion systems and digital performance optimization platforms. OEMs are also engaging in retrofitting older turbine fleets with upgraded burners and control systems to meet clean energy targets. Partnerships with utilities and government bodies enable access to demonstration projects showcasing hydrogen and ammonia-based solutions. Further, companies are expanding their global service networks to offer long-term maintenance and performance contracts, increasing customer retention.;

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Capacity trends

- 2.4 Product trends

- 2.5 Technology trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial gas turbine

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.8.2 By capacity

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 70 MW

- 5.3 > 70 MW - 300 MW

- 5.4 ≥ 300 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Power generation

- 8.3 Oil & gas

- 8.4 Other manufacturing

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Russia

- 9.3.3 Italy

- 9.3.4 Germany

- 9.3.5 France

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Egypt

- 9.5.4 Algeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Ansaldo Energia

- 10.2 Baker Hughes

- 10.3 Bharat Heavy Electricals

- 10.4 Capstone Green Energy

- 10.5 Destinus Energy

- 10.6 Doosan

- 10.7 Flex Energy Solutions

- 10.8 GE Vernova

- 10.9 Harbin Electric

- 10.10 IHI Corporation

- 10.11 JSC United Engine

- 10.12 Kawasaki Heavy Industries

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 MTU Aero Engines

- 10.16 Nanjing Turbine and Electric Machinery

- 10.17 Rolls Royce

- 10.18 Siemens Energy

- 10.19 Solar Turbines

- 10.20 Vericor

- 10.21 Wartsila