PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822638

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822638

Sunglasses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

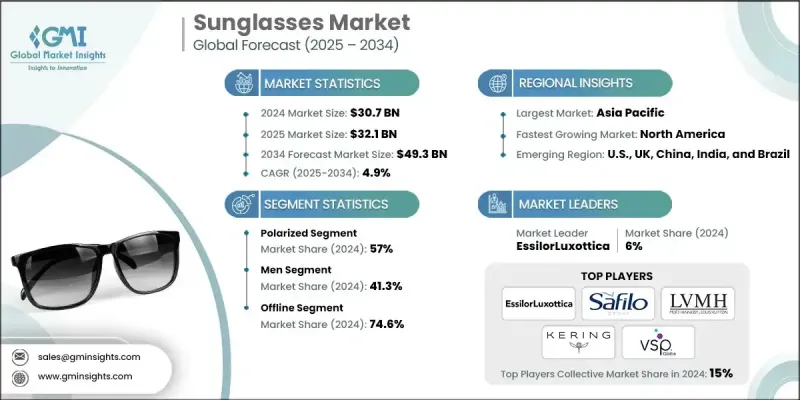

The global sunglasses market was estimated at USD 30.7 billion in 2024 and is expected to grow from USD 32.1 billion in 2025 to USD 49.3 billion by 2034, at a CAGR of 4.9%, according to the report published by Global Market Insights Inc.

Consumers are becoming increasingly aware of the harmful effects of ultraviolet (UV) rays on eye health, driving demand for sunglasses that offer certified UV protection. This shift is positioning sunglasses not just as fashion accessories but also as essential health and wellness products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.7 Billion |

| Forecast Value | $49.3 Billion |

| CAGR | 4.9% |

Rising Adoption of Polarized Lenses

The polarized segment held a notable share in 2024 as consumers increasingly prioritize eye protection and visual clarity, especially during outdoor activities. Polarized lenses help reduce glare from reflective surfaces like water, roads, and snow, making them highly desirable for driving, sports, and travel. As awareness around UV damage and digital eye strain continues to rise, more consumers are shifting toward high-performance eyewear, even in casual settings.

Increasing Demand Among Men

The men segment generated notable revenues in 2024, fueled by a blend of functional needs and evolving fashion consciousness. Men increasingly view sunglasses as a style statement, while also valuing durable designs and lens technology that supports everyday activities like commuting, sports, and travel. Leading brands are responding with tailored collections that combine masculine aesthetics with technical features such as UV400 protection, anti-scratch coatings, and polarized lenses.

Rising preference for Offline

The offline segment will grow at a decent CAGR during 2025-2034. Brick-and-mortar outlets, including optical chains, fashion boutiques, and department stores, continue to attract customers seeking hands-on product experience and personalized service. The ability to try on different styles and receive expert recommendations is particularly important for first-time buyers or premium product purchases. Offline retail is also bolstered by travel retail and seasonal pop-up stores.

Regional Insights

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific sunglasses market held a sizeable share in 2024, driven by rising disposable incomes, expanding middle-class populations, and increased awareness of eye health. Countries like China, India, and South Korea are fueling demand with their growing fashion industries and youthful consumer bases. Additionally, the region's high levels of sun exposure and urban pollution are pushing consumers toward protective eyewear with functional benefits. Both international and local brands are investing heavily in product localization, influencer marketing, and in-store expansion to capture market share.

Major players in the sunglasses market are Michael Kors Holdings, Fielmann, Oakley, Zenni Optical, Marchon Eyewear, Warby Parker, EssilorLuxottica, Quay Australia, VSP Global, Marcolin, LVMH Moet Hennessy Louis Vuitton, Safilo Group, Johnson & Johnson Vision Care, Luxottica Group, and Kering SA.

To strengthen their presence in the global sunglasses market, companies are implementing a mix of product innovation, omnichannel expansion, and brand collaborations. Many are launching eco-friendly collections using recycled or biodegradable materials to align with sustainability trends. Fashion-forward designs, coupled with advanced lens technologies like polarization, photochromic adaptation, and blue light filtering, help brands meet both style and function expectations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Frame material

- 2.2.4 Lens material

- 2.2.5 Coating

- 2.2.6 Design style

- 2.2.7 Price

- 2.2.8 Application

- 2.2.9 End use

- 2.2.10 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer focus on eye health and UV protection

- 3.2.1.2 Growing fashion and lifestyle appeal

- 3.2.1.3 Expansion of e-commerce and omnichannel retailing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition and market saturation

- 3.2.2.2 Economic sensitivity and fluctuating disposable income

- 3.2.3 Opportunities

- 3.2.3.1 Rising focus on eye health and UV protection.

- 3.2.3.2 Demand for eco-friendly sunglasses

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code: 9004100000)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Sunglasses Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Polarized

- 5.3 Non-polarized

Chapter 6 Sunglasses Market Estimates & Forecast, By Frame Material, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Others

Chapter 7 Sunglasses Market Estimates & Forecast, By Lens Material, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 CR-39 (allyl diglycol carbonate)

- 7.3 Polycarbonate

- 7.4 Polyurethane

- 7.5 Others (glass, etc.)

Chapter 8 Sunglasses Market Estimates & Forecast, By Coating, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Anti-reflective coating

- 8.3 Scratch-resistant coating

- 8.4 UV protection

- 8.5 Blue light filtering

- 8.6 Others

Chapter 9 Sunglasses Market Estimates & Forecast, By Design Style, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Full rim

- 9.3 Half rim

- 9.4 Rimless

Chapter 10 Sunglasses Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Sunglasses Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Sports

- 11.3 Fashion

- 11.4 Safety/protective (e.g., industrial, lab)

- 11.5 Prescription eyewear

- 11.6 Reading glasses

- 11.7 Driving glasses

Chapter 12 Sunglasses Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Men

- 12.3 Women

- 12.4 Unisex

- 12.5 Children

Chapter 13 Sunglasses Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Online

- 13.2.1 E-commerce

- 13.2.2 Company websites

- 13.3 Offline

- 13.3.1 Specialty store

- 13.3.2 Hypermarket/supermarket

- 13.3.3 Retailers

Chapter 14 Sunglasses Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.5.3 Argentina

- 14.6 MEA

- 14.6.1 South Africa

- 14.6.2 Saudi Arabia

- 14.6.3 UAE

Chapter 15 Company Profiles

- 15.1 EssilorLuxottica

- 15.2 Fielmann

- 15.3 Johnson & Johnson Vision Care

- 15.4 Luxottica Group

- 15.5 Kering SA

- 15.6 LVMH Moet Hennessy Louis Vuitton

- 15.7 Marchon Eyewear

- 15.8 Marcolin

- 15.9 Michael Kors Holdings

- 15.10 Oakley

- 15.11 Quay Australia

- 15.12 Safilo Group

- 15.13 VSP Global

- 15.14 Warby Parker

- 15.15 Zenni Optical