PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846230

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846230

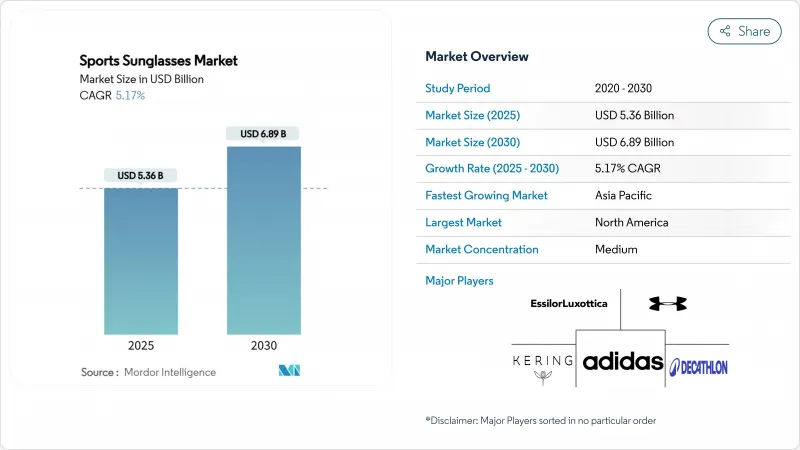

Sports Sunglasses - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sports sunglasses market size is projected to be valued at USD 5.36 billion in 2025 and is anticipated to grow to USD 6.89 billion by 2030, registering a compound annual growth rate (CAGR) of 5.17%.

This growth is primarily driven by increasing participation of women in sports, the integration of eyewear with lifestyle fashion trends, and government investments in developing new sports facilities. North America continues to lead in terms of market volume, while the Asia-Pacific region is expected to witness the fastest growth due to government policies promoting sports and the expansion of local manufacturing capabilities. By consumer group, athletes remain the primary users of sports sunglasses, but there is a noticeable increase in demand from lifestyle consumers who use these products for everyday activities. In terms of product categories, the premium segment is growing rapidly, even though the mass-market segment still holds the majority share. The shift towards e-commerce is transforming how companies reach their customers, making online platforms a crucial sales channel. The market is highly concentrated, with a few key players dominating. EssilorLuxottica, for instance, is expanding its global manufacturing footprint. The company has established a lens production hub in Thailand and is expanding its high-index lens facility in Mexico.

Global Sports Sunglasses Market Trends and Insights

Increasing participation in outdoor and sports activities

More people around the world are taking part in sports and outdoor activities, which is increasing the demand for performance gear like sports sunglasses. In 2024, around 247.1 million Americans, or about 80% of the population, participated in at least one sport, fitness, or outdoor activity . Popular activities such as hiking, running, cycling, and water sports have seen significant growth. For example, over 37 million people are cycling, 40 million are camping, and activities like paddleboarding, climbing, and mountain biking are steadily growing each year. Similarly, visits to U.S. national parks reached nearly 331.9 million in 2024, the highest ever recorded, showing a clear rise in outdoor recreation . Globally, more young people are also getting involved in sports, especially outdoor activities. With this increased participation in outdoor environments where sun exposure is high, there is a growing awareness of the need for protective and functional eyewear. Sports sunglasses are now seen as more than just a fashion statement; they are essential gear that provides UV protection, reduces glare, and protects against impacts.

Favorable government initiatives to boost sports culture

Governments worldwide are increasingly prioritizing safety and performance gear, such as sports sunglasses, as part of their strategies to enhance sports ecosystems. For instance, India's National Sports Policy 2024 emphasizes the use of protective equipment across all levels of sports training, from grassroots programs to elite competitions, ensuring high-performance eyewear becomes a standard part of sports gear . Similarly, Japan's Sports Agency is upgrading sports infrastructure with stricter safety regulations, which indirectly promote the use of UV-protective sunglasses for outdoor activities. In Australia, Sport Australia has increased funding for youth and community-level outdoor recreation, focusing on safety standards that include protective gear. Germany's Federal Ministry of the Interior and Community has also implemented similar initiatives to support outdoor sports while emphasizing the importance of standardized safety practices. These efforts establish the consistent use and regular replacement of performance-grade sunglasses, driving sustained demand across both amateur and professional sports sectors.

Prevalence of counterfeit and low-quality products

The global market for sports sunglasses faces a significant challenge due to the rise of counterfeit and low-quality products, which undermine consumer trust and damage the reputation of premium brands. For instance, in Southeast Asia, authorities are actively combating this issue. In the Philippines, the National Bureau of Investigation seized over 1,000 fake Oakley sunglasses valued at PHP 1.6 million in May 2025. In 2024, the Customs Preventive, Cochin, and Kerala Police busted a major racket dealing with replicas of global brands, including sunglasses, to be smuggled into the country from China. These counterfeit products often fail to meet safety standards, lacking proper UV protection and impact resistance, which poses risks to consumers. This growing prevalence of fake products not only raises safety concerns but also discourages consumers from investing in authentic, high-quality performance eyewear, ultimately hindering the growth of the market.

Other drivers and restraints analyzed in the detailed report include:

- Influence of social media platforms and celebrity endorsements

- Significant growth in women sports participation rate

- High cost of premium sports sunglasses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polarized lenses led the sports sunglasses market in 2024, capturing 74.90% of the market share. Their dominance is attributed to their ability to effectively reduce glare, making them highly suitable for activities like water and snow sports. This trend is expected to continue through 2030, although non-polarized lenses are anticipated to grow at a faster CAGR of 5.54%. Innovations such as Transitions Optical's XTRActive Polarized photochromic lenses, which adapt to outdoor lighting conditions while preserving color accuracy, are driving advancements in this segment. These technological developments not only support premium pricing but also help sustain the market's position in the high-value category.

Meanwhile, non-polarized lenses are finding opportunities in emerging niches, expanding the market beyond traditional sports applications. For example, Oakley's Prizm Gaming 2.0 lenses are specifically designed to reduce blue-light strain, catering to the growing gaming community. This diversification is opening up new consumer segments and broadening the appeal of sports sunglasses. By addressing varied consumer needs, from outdoor sports enthusiasts to indoor gamers, the market is evolving to offer tailored solutions that align with changing lifestyles and preferences. This dynamic approach is expected to drive further growth and innovation in the coming years.

In 2024, adults accounted for 78.54% of the sports sunglasses market revenue, driven by their consistent demand for high-performance lenses and regular replacement cycles. However, the children's segment is projected to grow at a faster CAGR of 5.87%, as parents increasingly prioritize injury prevention for young athletes. For instance, Yamamoto Kogaku's upcoming launch of PIVOTE kids' frames in June 2025 demonstrates a focus on youth-specific needs. These frames are designed with dual-layer construction and anti-fog vents, ensuring both safety and comfort for children. The World Health Organization's (WHO) Blindness Data Bank notes that approximately 55 million eye injuries occur worldwide annually.

While adults remain the primary consumers of sports sunglasses due to their purchasing power and preference for premium products, the rising adoption among school-age athletes is creating new growth opportunities. The increasing focus on youth-oriented designs and safety features is diversifying the market, ensuring it caters to a broader age group. This shift not only reflects the evolving consumer base but also underscores the importance of addressing the unique requirements of younger users. As a result, the sports sunglasses market is poised for sustained growth across both adult and children's segments.

The Sports Sunglasses Market Report is Segmented by Product Type (Polarized Sunglasses and Non-Polarized Sunglasses), by End User (Adult and Kids/Children), by Consumer Group (Amateur and Professional Athletes and More), by Category (Mass and More), by Distribution Channel (Offline and Online), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 33.65% of global revenue in 2024, driven by its robust USD 639.5 billion outdoor recreation economy, which represents 2.3% of the U.S. GDP. The region also benefits from a strong workforce in parks and recreation, with over 447,000 jobs recorded in 2024. This well-established infrastructure supports the growth of the sports sunglasses market. Additionally, strict FDA and ANSI regulations create high entry barriers for low-quality products, enabling premium brands to maintain strong profit margins. EssilorLuxottica reported record sales in its North American segment in FY 2024, reflecting favorable market conditions.

Asia-Pacific is projected to achieve the highest growth rate, with a 7.63% CAGR expected through 2030. China's Fengjie county has become a major manufacturing hub, producing 143 million pairs of glasses and 220 million lenses annually, contributing RMB 2.3 billion in output. Meanwhile, India's National Sports Policy 2024 focuses on upgrading sports infrastructure, which is expected to increase demand for protective eyewear. Regional collaborations, such as Bolle Safety's partnership with Megane Super in Japan to offer prescription safety eyewear, highlight how innovation and compliance are driving market growth.

Europe continues to show steady growth, supported by the EN ISO 12312-1 solar protection standard, which influences global product requirements. Initiatives like the U.K.'s GBP 1 billion Women's Sport Investment Accelerator demonstrate long-term funding commitments to sports development. Sustainability trends are also shaping the market, with brands like Nike introducing frames made from recycled materials. With its strong regulatory framework and established heritage brands, Europe remains a key region for profitability in the sports sunglasses market.

- Adidas AG

- Decathlon SA

- Under Armour Inc.

- EssilorLuxottica SA

- Kering SA

- Prohero Group Co., LTD.

- Columbia Sportswear Co.

- Rudy Project SpA

- Yiwu Conchen Glasses Co., Ltd.

- Tifosi Optics Inc.

- 100% Speedlab LLC

- ROKA Sports Inc.

- Bolle Brands Group

- Gatorz Eyewear Inc.

- POC Sweden AB

- Julbo SA

- Guangzhou Xunqi Glasses Co.

- Panda Optics Ltd.

- Forever Sunglasses

- UVEX Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Significant Growth in Women Sports Participation Rate

- 4.2.2 Aggressive Marketing by Reputed Brands

- 4.2.3 Influence of Social Media Platforms and Celebrity Endorsements

- 4.2.4 Favourable Government Initiatives to Boost Sports Culture

- 4.2.5 Increasing Participation in Outdoor and Sports Activities

- 4.2.6 Fashion and Lifestyle Integration

- 4.3 Market Restraints

- 4.3.1 Prevalence of Counterfeit and Low-Quality Products

- 4.3.2 Lack of Standardized Regulations Restricts Growth

- 4.3.3 High Cost of Premium Sports Sunglasses

- 4.3.4 Seasonality and Weather Dependence

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Polarized Sunglasses

- 5.1.2 Non-polarized Sunglasses

- 5.2 By End User

- 5.2.1 Adult

- 5.2.2 Kids/Children

- 5.3 By Consumer Group

- 5.3.1 Amateur and Professional Athletes

- 5.3.2 Outdoor Lifestyle/Athleisure Consumers

- 5.4 By Category

- 5.4.1 Mass Products

- 5.4.2 Premium Products

- 5.5 By Distribution Channel

- 5.5.1 Online Stores

- 5.5.2 Offline Stores

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 Japan

- 5.6.3.3 Australia

- 5.6.3.4 China

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 Decathlon SA

- 6.4.3 Under Armour Inc.

- 6.4.4 EssilorLuxottica SA

- 6.4.5 Kering SA

- 6.4.6 Prohero Group Co., LTD.

- 6.4.7 Columbia Sportswear Co.

- 6.4.8 Rudy Project SpA

- 6.4.9 Yiwu Conchen Glasses Co., Ltd.

- 6.4.10 Tifosi Optics Inc.

- 6.4.11 100% Speedlab LLC

- 6.4.12 ROKA Sports Inc.

- 6.4.13 Bolle Brands Group

- 6.4.14 Gatorz Eyewear Inc.

- 6.4.15 POC Sweden AB

- 6.4.16 Julbo SA

- 6.4.17 Guangzhou Xunqi Glasses Co.

- 6.4.18 Panda Optics Ltd.

- 6.4.19 Forever Sunglasses

- 6.4.20 UVEX Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK