PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822647

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822647

Europe Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

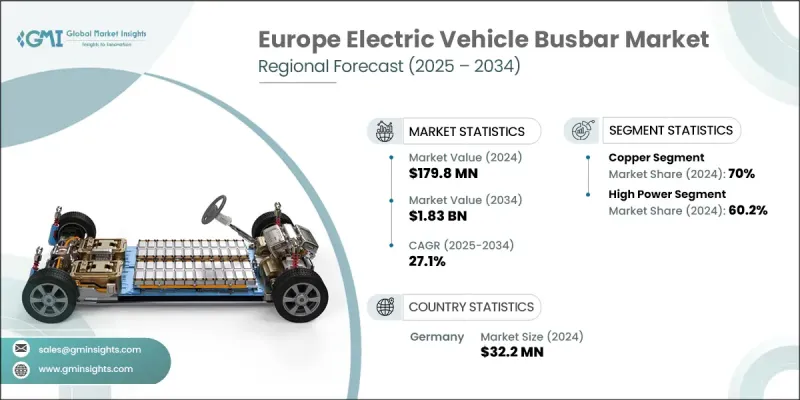

Europe Electric Vehicle (EV) Busbar Market was valued at USD 179.8 million in 2024 and is estimated to grow at a CAGR of 27.1% to reach USD 1.83 billion by 2034, backed by stringent environmental regulations and policies in Europe aimed at reducing GHG emissions. Governments are mandating lower emissions standards and offering incentives for EV purchases. For instance, the European Union aims to reduce CO2 emissions from new cars by 37.5% by 2030. This has encouraged manufacturers to innovate and incorporate advanced busbar technologies, boosting the demand for efficient power distribution solutions crucial for the performance and safety of electric drivetrains.

Additionally, the emergence of high-capacity, fast-charging batteries is making electric vehicles more practical and attractive to consumers. For example, according to IEA, the sales-weighted average range of battery electric cars surged by almost 75% from 2015 to 2023. Simultaneously, the expansion of a robust charging network in Europe is alleviating range anxiety. This harmony between technological advancements and infrastructure development is strengthening the market for electric vehicle busbars in Europe.

Europe electric vehicle busbar industry classified based on material, power rating, and country.

The aluminum segment is slated to record a notable CAGR through 2032. The material's inherent properties, such as its lightweight nature, excellent conductivity, and resistance to corrosion, make it an ideal choice for electric vehicle applications. Its lower density compared to copper reduces the overall weight of the busbars, which is crucial for enhancing the efficiency and range of electric vehicles. Additionally, the cost-effectiveness of aluminum, combined with its favorable thermal and electrical conductivity, allows manufacturers to balance performance and budget constraints effectively. These advantages, along with ongoing advancements in aluminum processing technologies, contribute to its growing preference.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $179.8 Million |

| Forecast Value | $1.83 Billion |

| CAGR | 27.1% |

The medium power-rated segment is gaining traction due to the rising popularity of mid-range EVs that balance performance and affordability. Medium power-rated busbars provide the necessary power distribution and management required for optimal performance without the high cost associated with high-power components. Additionally, as European manufacturers focus on developing a diverse range of EV to cater to varying consumer needs, the demand for busbars that can efficiently handle moderate power levels has grown.

France EV busbar industry size will expand at a rapid pace through 2032, driven by supportive government policies, technological advancements, and increasing consumer demand for electric vehicles. French government initiatives aimed at reducing carbon emissions, such as subsidies for EV purchases and investments in charging infrastructure, are significantly boosting the EV sales. Concurrently, advancements in busbar technology, including innovations in materials and design, enhance the efficiency and reliability of electric vehicles. As French consumers and businesses increasingly adopt EVs, the demand for high-performance busbars that ensure optimal power distribution and safety is rising, further propelling the industry expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Electric vehicle adoption trend

- 3.4.1 BEV sales, (Units)

- 3.4.2 PHEV sales, (Units)

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technology factors

- 3.7.5 environmental factors

- 3.7.6 Legal factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization and IoT integration

- 3.8.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024, by country

- 4.2.1 Norway

- 4.2.2 Germany

- 4.2.3 France

- 4.2.4 Netherlands

- 4.2.5 UK

- 4.2.6 Sweden

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Norway

- 7.3 Germany

- 7.4 France

- 7.5 Netherlands

- 7.6 UK

- 7.7 Sweden

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Brar Elettromeccanica SpA

- 8.3 Eaton

- 8.4 EMS Group

- 8.5 EAE Group

- 8.6 EG Electronics

- 8.7 Gindre Duchavany

- 8.8 Littelfuse, Inc.

- 8.9 Infineon Technologies AG

- 8.10 Legrand

- 8.11 Luvata

- 8.12 Mitsubishi Electric Corporation

- 8.13 Nexans

- 8.14 Rogers Corporation

- 8.15 Mersen SA

- 8.16 Samuel Taylor Limited (STL)

- 8.17 Siemens

- 8.18 Schneider Electric

- 8.19 TE Connectivity

- 8.20 Weidmuller Interface GmbH & Co. KG