PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822649

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822649

U.S. Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

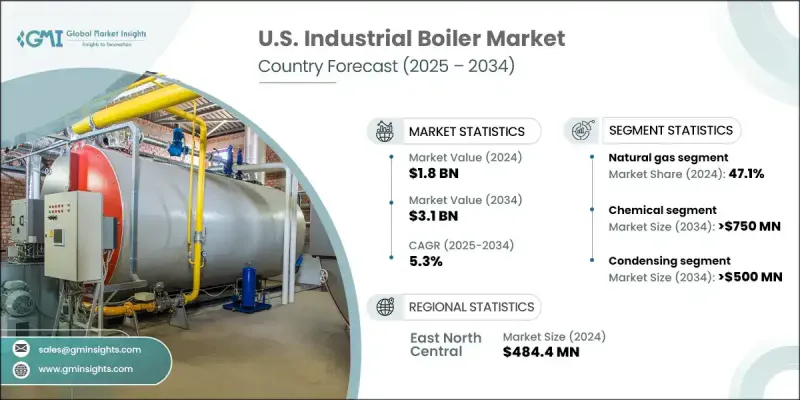

U.S. Industrial Boiler Market was valued at USD 1.8 billion and is estimated to grow at a CAGR of 5.3% to reach USD 3.1 billion by 2034 driven by the growing adoption of energy-efficient and sustainable boiler solutions. According to the World Economic Forum, in 2023, the clean energy sector experienced a significant boom, with renewable energy capacity worldwide increasing by 50% compared to the previous year. Innovations in boiler technology, such as advanced combustion systems, high-efficiency heat exchangers, and smart controls, are enhancing the performance and environmental footprint of industrial boilers. These advancements help businesses lower fuel consumption, cut greenhouse gas emissions, and achieve compliance with stringent environmental regulations.

Additionally, the integration of renewable energy sources and waste heat recovery systems further supports sustainability goals, making energy-efficient and eco-friendly boiler solutions highly attractive to a broad range of industrial sectors. As industries face mounting pressure to enhance operational efficiency and meet stringent environmental regulations, many are turning to modernization projects to improve the performance and sustainability of their aging boiler infrastructure. Upgrading existing systems often involves incorporating advanced technologies such as improved combustion control, enhanced heat recovery systems, and state-of-the-art emission control mechanisms. These investments not only extend the lifespan of older boilers but also enable industries to achieve better energy efficiency, reduce operational costs, and comply with evolving environmental standards. The U.S. Industrial Boiler Industry is classified based on fuel, capacity, technology, application, and region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.3% |

The primary metal segment will grow rapidly through 2032, as it requires high-capacity and highly efficient boilers to meet its stringent operational demands. Industrial boilers in this sector are integral to processes such as metal smelting, refining, and alloying, where precise temperature control and energy efficiency are critical. As the U.S. continues to focus on revitalizing its manufacturing base, the need for robust and efficient industrial boilers in the primary metal sector is expected to surge, contributing to the overall growth of the market. The non-condensing boilers segment will witness decent growth through 2032, owing to their simplicity, reliability, and cost-effectiveness, remaining a preferred choice for many industrial applications. These boilers operate by using the heat generated from fuel combustion to heat water or produce steam without condensing the water vapor produced in the process.

As a result, they offer a more straightforward design with lower upfront costs, making them attractive to industries looking to balance operational efficiency with budget constraints. The coal segment will witness decent growth through 2032, as coal-fired boilers, traditionally known for their high efficiency and ability to generate large amounts of heat, continue to be utilized in various industries, particularly in regions with abundant coal resources. The ongoing use of coal as a primary fuel source in industrial boilers is driven by its cost-effectiveness and availability, especially in energy-intensive sectors such as power generation, chemicals, and manufacturing. Primary metal production relies heavily on efficient and high-capacity boilers to ensure consistent and reliable energy supply.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial boilers

- 3.8 Price trend analysis

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 Future market outlook & emerging opportunities

- 3.10 Technology trends & innovations

- 3.10.1 Smart boiler integration & IoT connectivity

- 3.10.2 Advanced materials & durability improvements

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 East North Central

- 4.2.2 West South Central

- 4.2.3 South Atlantic

- 4.2.4 North East

- 4.2.5 East South Central

- 4.2.6 West North Central

- 4.2.7 Pacific States

- 4.2.8 Mountain States

- 4.3 Strategic dashboard

- 4.3.1 Major M&A activities

- 4.3.2 Key partnerships and collaborations

- 4.3.3 Product innovations and launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 0.3 - 2.5 MMBTU/hr

- 6.3 2.5 - 10 MMBTU/hr

- 6.4 10 - 50 MMBTU/hr

- 6.5 50 - 100 MMBTU/hr

- 6.6 100 - 250 MMBTU/hr

- 6.7 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Food processing

- 8.3 Pulp & paper

- 8.4 Chemical

- 8.5 Refining

- 8.6 Primary metal

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 East North Central

- 9.2.1 Illinois

- 9.2.2 Indiana

- 9.2.3 Michigan

- 9.2.4 Ohio

- 9.2.5 Wisconsin

- 9.3 West South Central

- 9.3.1 Arkansas

- 9.3.2 Louisiana

- 9.3.3 Oklahoma

- 9.3.4 Texas

- 9.4 South Atlantic

- 9.4.1 Delaware

- 9.4.2 Florida

- 9.4.3 Georgia

- 9.4.4 Maryland

- 9.4.5 North Carolina

- 9.4.6 South Carolina

- 9.4.7 Virginia

- 9.4.8 West Virginia

- 9.4.9 Washington D.C.

- 9.5 North East

- 9.5.1 Connecticut

- 9.5.2 Maine

- 9.5.3 Massachusetts

- 9.5.4 New Hampshire

- 9.5.5 Rhode Island

- 9.5.6 Vermont

- 9.5.7 New Jersey

- 9.5.8 New York

- 9.5.9 Pennsylvania

- 9.6 East South Central

- 9.6.1 Alabama

- 9.6.2 Kentucky

- 9.6.3 Mississippi

- 9.6.4 Tennessee

- 9.7 West North Central

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 Pacific States

- 9.8.1 Alaska

- 9.8.2 California

- 9.8.3 Hawaii

- 9.8.4 Oregon

- 9.8.5 Washington

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 AERCO

- 10.2 Acme Engineering Product

- 10.3 Babcock & Wilcox Enterprises

- 10.4 Bosch Industriekessel

- 10.5 Burnham Commercial Boilers

- 10.6 Clayton Industries

- 10.7 Cleaver-Brooks

- 10.8 Doosan Corporation

- 10.9 Fulton

- 10.10 Groupe Atlantic

- 10.11 Hurst Boiler & Welding

- 10.12 IHI Corporation

- 10.13 John Cockerill

- 10.14 John Wood Group

- 10.15 Johnston Boiler

- 10.16 Mitsubishi Heavy Industries

- 10.17 Miura America

- 10.18 Rentech Boiler Systems

- 10.19 Sofinter

- 10.20 Superior Boiler

- 10.21 Thermax

- 10.22 Victory Energy Operations

- 10.23 VIESSMANN