PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844344

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844344

Europe Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

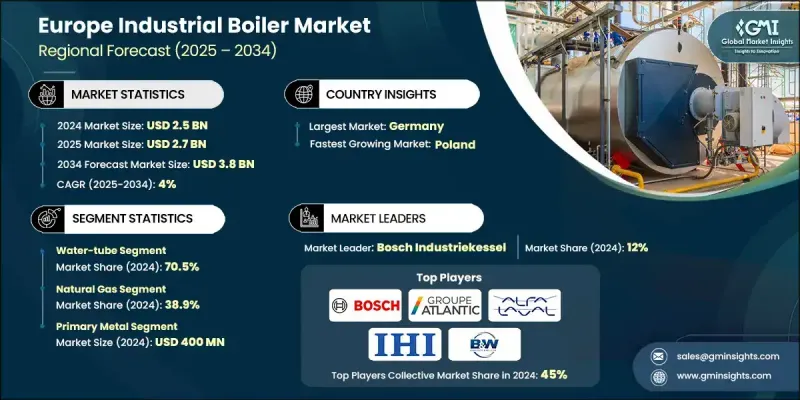

Europe Industrial Boiler Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 3.8 billion by 2034.

Market expansion is fueled by continued investments in industrial infrastructure and the modernization of legacy energy systems. The growing push toward low-emission, fuel-flexible boilers that run on hydrogen blends, biofuels, and natural gas is significantly shaping industry trends. Industrial boilers, sealed units used to produce hot water or steam, are essential in delivering thermal energy for large-scale operations. These systems are powered by various energy sources, including electricity, coal, oil, biomass, and gas. Europe's increasing focus on decarbonization is driving the adoption of hybrid boiler systems, while advances in electrification supported by renewables continue to shift industrial heating practices. Demand for biomass and waste-fueled boilers is rising as feedstock become secure and regulations tighten. The region's strict emission laws are accelerating upgrades to high-efficiency, condensing boiler systems. Integration of boilers with advanced thermal storage, CHP units, and energy recovery systems is supporting optimal fuel use and enhanced performance across facilities. These combined factors are shaping a more sustainable and energy-conscious industrial boiler landscape in Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 4% |

The water-tube boiler segment held a 70.5% share in 2024 and is expected to grow at a CAGR of 4.2% through 2034. These boilers are favored for their efficiency in producing high-pressure steam across industrial facilities, including chemical plants and energy production units. Increasing emphasis on cleaner fuel alternatives, emission reductions, and industrial energy efficiency is boosting their market traction. Additionally, widespread industrial growth across developing regions continues to present new expansion opportunities for water-tube boiler technologies.

The oil-based industrial boiler segment generated USD 650 million in 2024. Rising energy requirements in areas lacking extensive gas distribution networks, combined with the reliability of oil-fired systems for uninterrupted operations, are boosting adoption. Modernization of aging boiler systems, particularly within growing small and mid-sized manufacturing facilities, is reinforcing demand and supporting segmental growth across the region.

Germany Industrial Boiler Market held a 28.5% share and generated USD 727.8 million in 2024. The country's strong regulatory framework promoting emissions compliance and its continued shift toward efficient heating technologies are key growth drivers. Industrial sectors in Germany are increasingly replacing legacy boilers with high-performance alternatives, encouraged by environmental standards and rising energy efficiency goals.

Leading manufacturers and technology providers in the Europe Industrial Boiler Market include Mitsubishi Heavy Industries, Clayton Industries, Groupe Atlantic, John Wood Group, Hoval, Forbes Marshall, Bosch Industriekessel, John Cockerill, Fulton, AERCO, Doosan, IHI Corporation, ALFA LAVAL, Hurst Boiler & Welding, Viessmann, Miura America, Thermax, FERROLI, Rentech Boilers, Burnham Commercial Boilers, Babcock & Wilcox Enterprises, and Cochran. Companies active in the Europe Industrial Boiler Market are prioritizing product innovation and fuel flexibility to comply with evolving emission standards. Manufacturers are investing in the development of low-NOx, hydrogen-ready, and hybrid systems that align with EU decarbonization goals. Expanding manufacturing footprints in high-growth regions and strengthening aftersales service networks remain key for customer retention. Strategic collaborations with energy solution providers and utility firms are helping brands improve system integration and value-added offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of industrial boiler

- 3.8 Price trend analysis (USD/Unit)

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 New growth avenues & industry developments

- 3.10 Investment analysis & future prospects

- 3.11 Smart technologies & industry 4.0 adoption

- 3.12 Sustainability initiatives & compliances

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 France

- 4.2.2 UK

- 4.2.3 Poland

- 4.2.4 Italy

- 4.2.5 Spain

- 4.2.6 Austria

- 4.2.7 Germany

- 4.2.8 Sweden

- 4.2.9 Russia

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 Fire-tube

- 5.2.1 By capacity

- 5.2.1.1 < 10 MMBTU/hr

- 5.2.1.2 10 - 25 MMBTU/hr

- 5.2.1.3 25 - 50 MMBTU/hr

- 5.2.1.4 50 - 75 MMBTU/hr

- 5.2.1.5 75 - 100 MMBTU/hr

- 5.2.1.6 100 - 175 MMBTU/hr

- 5.2.1.7 175 - 250 MMBTU/hr

- 5.2.1.8 > 250 MMBTU/hr

- 5.2.2 By application

- 5.2.2.1 Food processing

- 5.2.2.2 Pulp & paper

- 5.2.2.3 Chemical

- 5.2.2.4 Refinery

- 5.2.2.5 Primary metal

- 5.2.2.6 Others

- 5.2.3 By technology

- 5.2.3.1 Condensing

- 5.2.3.2 Non-condensing

- 5.2.4 By fuel

- 5.2.4.1 Natural gas

- 5.2.4.2 Oil

- 5.2.4.3 Coal

- 5.2.4.4 Others

- 5.2.1 By capacity

- 5.3 Water-tube

- 5.3.1 By capacity

- 5.3.1.1 < 10 MMBTU/hr

- 5.3.1.2 10 - 25 MMBTU/hr

- 5.3.1.3 25 - 50 MMBTU/hr

- 5.3.1.4 50 - 75 MMBTU/hr

- 5.3.1.5 75 - 100 MMBTU/hr

- 5.3.1.6 100 - 175 MMBTU/hr

- 5.3.1.7 175 - 250 MMBTU/hr

- 5.3.1.8 > 250 MMBTU/hr

- 5.3.2 By application

- 5.3.2.1 Food processing

- 5.3.2.2 Pulp & paper

- 5.3.2.3 Chemical

- 5.3.2.4 Refinery

- 5.3.2.5 Primary metal

- 5.3.2.6 Others

- 5.3.3 By technology

- 5.3.3.1 Condensing

- 5.3.3.2 Non-condensing

- 5.3.4 By fuel

- 5.3.4.1 Natural gas

- 5.3.4.2 Oil

- 5.3.4.3 Coal

- 5.3.1 By capacity

- 5.4 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 < 10 MMBTU/hr

- 6.3 10 - 25 MMBTU/hr

- 6.4 25 - 50 MMBTU/hr

- 6.5 50 - 75 MMBTU/hr

- 6.6 75 - 100 MMBTU/hr

- 6.7 100 - 175 MMBTU/hr

- 6.8 175 - 250 MMBTU/hr

- 6.9 > 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Food processing

- 7.3 Pulp & paper

- 7.4 Chemical

- 7.5 Refinery

- 7.6 Primary metal

- 7.7 Others

Chapter 8 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 Oil

- 8.4 Coal

- 8.5 Others

Chapter 9 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Condensing

- 9.3 Non-condensing

Chapter 10 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 France

- 10.3 UK

- 10.4 Poland

- 10.5 Italy

- 10.6 Spain

- 10.7 Austria

- 10.8 Germany

- 10.9 Sweden

- 10.10 Russia

Chapter 11 Company Profiles

- 11.1 AERCO

- 11.2 ALFA LAVAL

- 11.3 Babcock & Wilcox Enterprises

- 11.4 Bosch Industriekessel

- 11.5 Burnham Commercial Boilers

- 11.6 Clayton Industries

- 11.7 Cochran

- 11.8 Doosan

- 11.9 FERROLI

- 11.10 Forbes Marshall

- 11.11 Fulton

- 11.12 Groupe Atlantic

- 11.13 Hoval

- 11.14 Hurst Boiler & Welding

- 11.15 IHI Corporation

- 11.16 John Cockerill

- 11.17 John Wood Group

- 11.18 Miura America

- 11.19 Mitsubishi Heavy Industries

- 11.20 Rentech Boilers

- 11.21 Thermax

- 11.22 Viessmann