PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833393

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833393

Automotive Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

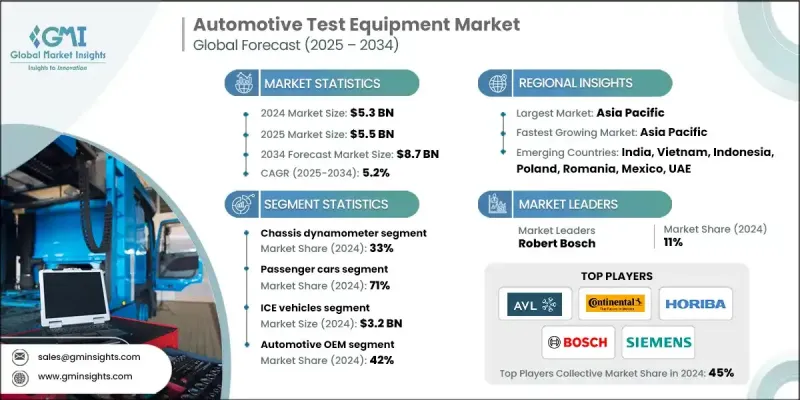

The Global Automotive Test Equipment Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 8.7 billion by 2034.

Rising integration of advanced electronics and next-gen driver assistance technologies is reshaping the role of test equipment, transforming it from traditional diagnostic tools into highly advanced systems capable of replicating real-world driving conditions. Automakers and Tier-1 suppliers are increasingly investing in high-performance test benches to simulate various driving scenarios, especially as the industry pushes forward with ADAS development, vehicle connectivity, and autonomous functionality. The demand for cutting-edge testing solutions continues to grow, driven by rising vehicle complexity, the expansion of electric mobility, and a growing need for precision in development and regulatory compliance. Electrification, along with evolving regulations, is prompting OEMs and aftermarket players to adopt modular, scalable, and intelligent testing platforms. Automated and cloud-enabled diagnostics are also becoming mainstream, improving product development speed, accuracy, and efficiency across both R&D and production lines. The market's trajectory reflects a shift toward smarter, more flexible systems that meet evolving vehicle architecture and global emission standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 5.2% |

Powertrain testing remains the largest application area, underpinned by the shift toward electric powertrains. OEMs are demanding greater accuracy in evaluating battery range, motor functionality, and inverter reliability, which has fueled interest in adaptive and scalable test setups that align with changing EV technologies and regional charging norms. This segment continues to evolve as vehicle electrification becomes more widespread.

The chassis dynamometers segment held 33% in 2024, with a 3% CAGR through 2034. These systems remain central to full vehicle testing under simulated road conditions, supporting fuel efficiency assessments, emissions monitoring, and dynamic performance testing. As international emissions regulations grow stricter, there's increased demand for dynamometers compatible with hybrid and electric vehicles. These systems are also expanding their utility with regenerative braking assessments and high-voltage EV testing capabilities.

The passenger cars segment held a 71% share in 2024 and is projected to maintain growth at 6% CAGR between 2025 and 2034. Increasing system complexity, particularly in hybrid and electric vehicles, is encouraging OEMs and service providers to enhance testing with advanced emissions analyzers, battery testing systems, and multi-functional diagnostic tools. The rising integration of ADAS and infotainment platforms is also encouraging the adoption of automated, software-driven testing environments. Among aftermarket tools, battery testers are experiencing the strongest growth, driven by the global expansion of EV fleets and service requirements.

United States Automotive Test Equipment Market was valued at USD 962.9 million in 2024. The country remains a key market player in North America, backed by a mature automotive production landscape and a robust aftermarket ecosystem. With high vehicle ownership levels and growing interest in electric vehicles, demand remains strong for emissions testers, brake testing systems, and digital diagnostic equipment. The prevalence of SUVs and light trucks adds further momentum to testing equipment needs in both OEM and aftermarket sectors.

Prominent companies shaping the Automotive Test Equipment Market include Moog, Softing, Horiba, AVL List, Siemens, ABB, Actia, Continental, Robert Bosch, and Honeywell. Key strategies adopted by leading players in the automotive test equipment market center around accelerating innovation to meet the evolving demands of electric, hybrid, and software-defined vehicles. Companies are investing in the development of modular and AI-enabled test platforms that allow for real-time diagnostics and predictive analytics. Emphasis is also being placed on cloud connectivity and remote testing capabilities, enabling scalability across various applications. Strategic collaborations with OEMs and research centers are helping expand product capabilities, while regulatory compliance and sustainability are driving the creation of eco-efficient systems. Companies are further strengthening global service and support infrastructure to enhance user experience and long-term value.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Propulsion

- 2.2.5 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

- 2.6.1 For equipment manufacturers

- 2.6.2 For end users

- 2.6.3 For testing service providers

- 2.6.4 For investors & financial institutions

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent regulatory standards & compliance requirements

- 3.2.1.2 Electric vehicle market growth & testing needs

- 3.2.1.3 Autonomous vehicle development & validation

- 3.2.1.4 Connected vehicle technology integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment & equipment costs

- 3.2.2.2 Regulatory compliance complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Electric vehicle testing equipment expansion

- 3.2.3.2 Autonomous vehicle validation market growth

- 3.2.3.3 Digital transformation & automation

- 3.2.3.4 Cloud-based testing platform development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 IoT integration & connected testing equipment

- 3.7.1.2 Big data analytics & predictive maintenance

- 3.7.2 Emerging technologies

- 3.7.2.1 AI & machine learning implementation

- 3.7.2.2 Digital twin technology integration

- 3.7.3 Technology evolution timeline

- 3.7.1 Current technological trends

- 3.8 Digital transformation & industry 4.0 integration

- 3.8.1 IoT integration in testing equipment

- 3.8.2 Artificial intelligence & machine learning

- 3.8.3 Big data analytics & cloud computing

- 3.8.4 Digital twin technology

- 3.8.5 Cloud-based testing platforms

- 3.8.6 Cybersecurity in testing equipment

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Patent analysis

- 3.12.1 Active patents by technology category & testing

- 3.12.2 Patent filing trends in EV & AV testing equipment

- 3.12.3 IP licensing & technology transfer models

- 3.12.4 Patent litigation risk assessment

- 3.13 Investment & funding analysis

- 3.13.1 R&D investment by equipment category

- 3.13.2 Venture capital & private equity activity

- 3.13.3 Government funding & research grants

- 3.13.4 Corporate investment & acquisition activity

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Future outlook & industry transformation timeline

- 3.15.1 Near-term disruptions (2025-2027)

- 3.15.2 Medium-term disruptions (2028-2030)

- 3.15.3 Long-term disruptions (2031-2034)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product portfolio & technology comparison

- 4.8 Innovation leadership & technology development

- 4.8.1 Patent filing & IP portfolio analysis

- 4.8.2 Research collaboration & partnerships

- 4.8.3 Startup ecosystem & innovation

- 4.9 Market entry strategies & barriers

- 4.9.1 Technology barrier analysis

- 4.9.2 Capital investment requirements

- 4.9.3 Regulatory & certification barriers

- 4.9.4 Brand recognition & customer trust

- 4.10 Customer decision criteria & vendor selection

- 4.10.1 Technology performance requirements

- 4.10.2 Cost & total ownership considerations

- 4.10.3 Vendor reliability & support

- 4.10.4 Integration & compatibility factors

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Chassis dynamometer

- 5.3 Engine dynamometer

- 5.4 Wheel alignment tester

- 5.5 Emission analyzer

- 5.6 Vehicle exhaust gas analyzer

- 5.7 Battery testers

- 5.8 Other diagnostic tools

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Heavy commercial vehicles (HCV)

- 6.3.3 Medium commercial vehicles (MCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ICE vehicles

- 7.3 Electric vehicles

- 7.3.1 Battery electric vehicles (BEV)

- 7.3.2 Plug-in hybrid vehicles (PHEV)

- 7.3.3 Hybrid electric vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Automotive OEM

- 8.3 Tier-1 & tier-2 suppliers

- 8.4 Automotive service centers & workshops

- 8.5 Regulatory bodies & testing agencies

- 8.6 Research & development centers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.3.8 Poland

- 9.3.9 Romania

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Vietnam

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global companies

- 10.1.1 AVL List

- 10.1.2 Horiba

- 10.1.3 MTS Systems

- 10.1.4 National Instruments (NI)

- 10.1.5 Keysight Technologies

- 10.1.6 Robert Bosch

- 10.1.7 dSPACE

- 10.1.8 ETAS

- 10.1.9 ABB

- 10.1.10 Actia

- 10.1.11 Continental

- 10.1.12 Honeywell

- 10.1.13 Moog

- 10.1.14 Softing

- 10.2 Technology providers

- 10.2.1 ANSYS

- 10.2.2 Bruel & Kjar Sound & Vibration

- 10.2.3 HBK (Hottinger Bruel & Kjar)

- 10.2.4 IPG Automotive

- 10.2.5 MathWorks

- 10.2.6 Rohde & Schwarz

- 10.2.7 Siemens

- 10.2.8 Tektronix

- 10.2.9 Vector Informatik

- 10.3 Testing service providers

- 10.3.1 Applus+

- 10.3.2 Bureau Veritas

- 10.3.3 DEKRA

- 10.3.4 Element Materials Technology

- 10.3.5 Intertek

- 10.3.6 Millbrook Proving Ground

- 10.3.7 SGS

- 10.3.8 TUV SUD