PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833394

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833394

Oral Clinical Nutrition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

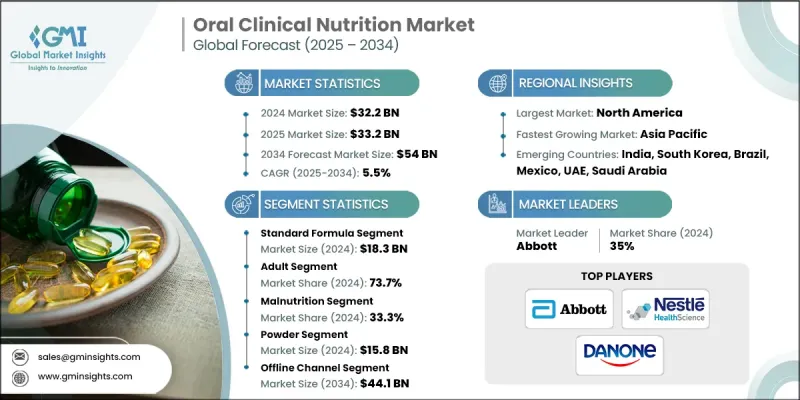

The Global Oral Clinical Nutrition Market was valued at USD 32.2 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 54 billion by 2034.

Conditions like cancer, diabetes, gastrointestinal disorders, and COPD increase the need for nutritional management. Oral clinical nutrition products are commonly used to support recovery and maintain nutritional status.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.2 Billion |

| Forecast Value | $54 Billion |

| CAGR | 5.5% |

Rising Use of Standard Formula

The standard formula segment held a sustainable share in 2024, driven by its versatility in addressing a wide range of general nutritional needs. These formulas are used for patients who do not require condition-specific formulations but still need calorie-dense and nutrient-rich supplements. Hospitals, outpatient clinics, and long-term care facilities routinely prescribe standard formulas for post-operative recovery, short-term malnutrition, and general dietary support.

Increasing Adoption Among Adults

The adult segment held a sizeable share in 2024, owing to the rising incidence of chronic illnesses, aging-related nutritional challenges, and growing awareness around disease-related malnutrition. Adults undergoing cancer therapy, recovering from surgery, or managing conditions like diabetes and gastrointestinal disorders often require oral nutrition support to maintain body mass and functional status.

Malnutrition to Gain Traction

The malnutrition segment generated notable revenues in 2024, backed by clinical and elderly care settings. Despite being a preventable and treatable condition, malnutrition remains underdiagnosed, especially among older adults and patients with chronic illnesses. The market has seen a surge in demand for targeted oral nutrition supplements designed to address protein-energy malnutrition and micronutrient deficiencies.

North America to Emerge as a Lucrative Region

North America oral clinical nutrition market is poised to witness a decent CAGR during 2025-2034, driven by an aging population, high healthcare expenditure, and robust clinical infrastructure. The presence of major market players, combined with favorable reimbursement policies and well-established distribution networks, further fuels regional growth. In addition, increasing public and professional awareness of the importance of nutrition in managing chronic diseases has accelerated the adoption of oral nutrition supplements.

Major players operating in the oral clinical nutrition industry include Meiji Holdings, Pfizer, Nutriset, Abbott Nutrition, Otsuka Pharmaceutical, Kate Farms, B. Braun, GlaxoSmithKline, Nestle Health Science, AYMES Nutrition, Danone, Medifood International, Fresenius Kabi, and Mead Johnson (Reckitt).

To strengthen their foothold in the oral clinical nutrition market, companies are pursuing a mix of product innovation, strategic partnerships, and geographic expansion. Leading manufacturers are investing heavily in R&D to develop condition-specific formulations that cater to the unique dietary needs of patients with diabetes, renal disease, or cancer. Additionally, brands are focusing on taste improvement and convenience, such as ready-to-drink formats, to boost patient compliance. Strategic collaborations with hospitals, home healthcare providers, and insurance companies have helped extend market reach and improve product accessibility. These strategies collectively enable companies to maintain a competitive advantage while addressing the evolving nutritional demands of diverse patient populations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Consumer

- 2.2.4 Application

- 2.2.5 Dosage form

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of disease-related malnutrition and chronic conditions

- 3.2.1.2 Growing elderly population

- 3.2.1.3 Integration into clinical guidelines

- 3.2.1.4 Advancements in personalized nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized products

- 3.2.2.2 Limited awareness and screening

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in home healthcare

- 3.2.3.2 Technological integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the world

- 3.5 Pipeline analysis

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Standard formulas

- 5.3 Disease-specific formulas

Chapter 6 Market Estimates and Forecast, By Consumer, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cancer care

- 7.3 Chronic kidney disease

- 7.4 Diabetes

- 7.5 Gastrointestinal disorders

- 7.6 Malnutrition

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Liquid

- 8.3 Powder

- 8.4 Semi-solid

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Offline channel

- 9.2.1 Hospital pharmacies

- 9.2.2 Retail pharmacies

- 9.2.3 Other offline channels

- 9.3 Online channel

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott Nutrition

- 11.2 AYMES Nutrition

- 11.3 B. Braun

- 11.4 Danone

- 11.5 Fresenius Kabi

- 11.6 GlaxoSmithKline

- 11.7 Kate Farms

- 11.8 Mead Johnson (Reckitt)

- 11.9 Medifood International

- 11.10 Meiji Holdings

- 11.11 Nestle Health Science

- 11.12 Nutriset

- 11.13 Otsuka Pharmaceutical

- 11.14 Pfizer