PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833427

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833427

Connected Motorcycle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

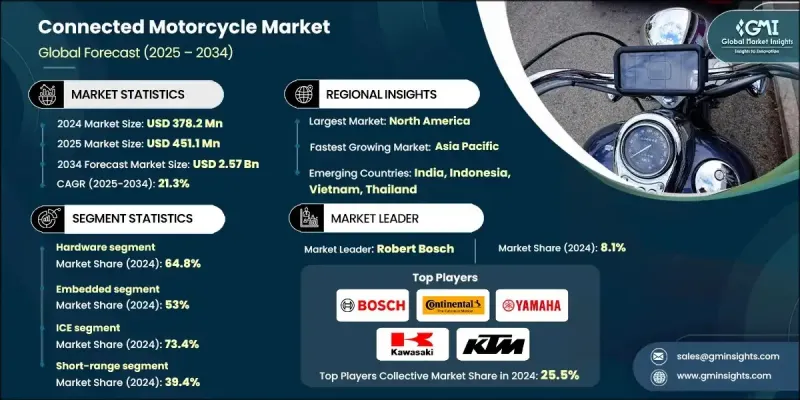

The Global Connected Motorcycle Market was valued at USD 378.2 million in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 2.57 billion by 2034.

The growing adoption of connected motorcycles is driven by safety features, such as collision warnings, blind-spot monitoring, and real-time traffic updates. These advancements reduce accidents, increase rider adoption, and create demand for embedded connectivity solutions across both consumer and fleet markets. The expansion of electric motorcycles and scooters further fuels the demand for connectivity, allowing for better battery management, performance monitoring, and over-the-air updates. Connected motorcycles also support urban delivery services, ride-hailing companies, and logistics fleets by enabling route optimization, predictive maintenance, and real-time tracking. The subscription-based telematics services have opened avenues for recurring revenue, promoting the use of tethered or embedded connectivity, which is accelerating the commercial market for these vehicles. Motorcycle manufacturers are focusing on integrating sensors, cameras, and Vehicle-to-Everything (V2X) communication to improve rider safety, enhance operational efficiency, and increase the adoption of advanced connectivity features. These systems are increasingly being designed to work seamlessly with smart infrastructure, such as smart cities, to offer always-connected capabilities globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $378.2 Million |

| Forecast Value | $2.57 Billion |

| CAGR | 21.3% |

The hardware segment held a 64.8% share in 2024 and is anticipated to grow at a CAGR of 20.7% through 2034. The integration of sensors like GNSS/GPS, accelerometers, and components of Advanced Rider Assistance Systems (ARAS) is transforming motorcycles into highly connected vehicles. These sensors not only provide safety features but also enable predictive maintenance and real-time diagnostics, offering a more sophisticated experience for riders. Manufacturers are now focusing on developing compact, low-power telematics control units (TCUs), displays, and communication modules to ensure connectivity while minimizing the impact on battery life and vehicle performance, especially in the electric motorcycle sector.

The embedded systems segment held a share of 53% in 2024 and is expected to grow at a CAGR of 22.6% from 2025 to 2034. Motorcycle manufacturers are increasingly embedding telematics units that incorporate advanced features like collision alerts, blind-spot detection, and V2X communication in their new models. These systems demand constant, high-bandwidth connectivity and have become essential for safety and compliance features as well as for enhancing the rider experience. Smartphone-based solutions, particularly on electric motorcycles, also allow for functions such as bike navigation, ride logging, and performance analytics, further contributing to the segment's growth.

U.S. Connected Motorcycle Market held 87.4% in 2024, with a forecasted CAGR of 23.2% from 2025 to 2034. The U.S. leads this market due to the strong presence of key companies such as BMW Motorrad, Harley-Davidson, Robert Bosch, and Continental, which have extensive R&D, distribution, and integration of connected motorcycle solutions. The popularity of electric motorcycles is also rising, with models featuring advanced connectivity capabilities, designed to meet the demands of environmentally conscious consumers who seek seamless integration with mobile apps and navigation systems, as well as real-time diagnostic features.

Prominent players in the Connected Motorcycle Market include companies like BMW Motorrad, Ducati, Yamaha, Kawasaki, Honda, Harley-Davidson, KTM, Piaggio, Robert Bosch, and Continental. These companies are driving innovation in connected motorcycle technologies, focusing on safety and performance features that enhance the riding experience. To strengthen their market position, companies in the connected motorcycle industry are investing heavily in research and development to integrate cutting-edge technologies such as telematics, V2X communication, and ARAS into their motorcycles. By embedding advanced safety systems and connectivity solutions, they are offering a higher value proposition to consumers. In addition, many companies are focusing on creating seamless integration with mobile apps and telematics platforms, allowing riders to monitor and optimize their motorcycles' performance.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Connectivity

- 2.2.4 Propulsion

- 2.2.5 Network

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

- 2.6.1 Supply chain diversification strategy

- 2.6.2 Product portfolio enhancement

- 2.6.3 Partnership and alliance opportunities

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising safety and rider assistance adoption.

- 3.2.1.2 Growth of electric motorcycles (EVs)

- 3.2.1.3 Expansion of fleet and commercial use

- 3.2.1.4 Government regulations and smart mobility initiatives

- 3.2.1.5 Increasing smartphone and IOT integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of connected systems

- 3.2.2.2 Data security and privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Electric motorcycle growth

- 3.2.3.2 Fleet and commercial applications

- 3.2.3.3 Advanced rider assistance systems (ARAS) integration

- 3.2.3.4 Aftermarket and retrofit market

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.3.1 Artificial Intelligence & Machine Learning Integration

- 3.3.1.1 AI-powered rider assistance systems

- 3.3.1.2 Machine learning analytics

- 3.3.1.3 AI-driven service optimization

- 3.3.2 5G & Edge Computing Revolution

- 3.3.2.1 5G network integration benefits

- 3.3.2.2 Edge computing implementation

- 3.3.2.3 5G infrastructure readiness assessment

- 3.3.3 Blockchain & Distributed Ledger Technology

- 3.3.3.1 Blockchain-based service platforms

- 3.3.3.2 Supply chain & maintenance tracking

- 3.3.3.3 Shared mobility & rental applications

- 3.3.4 Internet of Things (IoT) & Sensor Integration

- 3.3.4.1 Advanced sensor technologies

- 3.3.4.2 IoT platform integration

- 3.3.5 Augmented Reality & Virtual Reality Integration

- 3.3.5.1 AR-enhanced navigation & information

- 3.3.5.2 VR training & simulation applications

- 3.3.6 Autonomous Motorcycle Systems

- 3.3.6.1 Autonomous technology development status

- 3.3.6.2 Self-balancing & stability systems

- 3.3.6.3 Autonomous navigation & control

- 3.3.6.4 Market readiness & adoption timeline

- 3.3.7 Digital Twin & Simulation Technology

- 3.3.7.1 Digital twin implementation

- 3.3.7.2 Simulation-based services

- 3.3.8 Cybersecurity & Data Protection

- 3.3.8.1 Threat assessment & vulnerability analysis

- 3.3.8.2 Security implementation strategies

- 3.3.8.3 Regulatory compliance & standards

- 3.3.8.4 Cost-benefit analysis of security measures

- 3.3.1 Artificial Intelligence & Machine Learning Integration

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Regional regulatory landscape

- 3.5.2 Cybersecurity regulations & compliance

- 3.5.3 Compliance cost analysis & impact

- 3.5.4 Liability & insurance framework evolution

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Future Outlook & Market Disruption

- 3.9.1 Technology Disruption Roadmap

- 3.9.2 Market Evolution Scenarios

- 3.9.2.1 Optimistic Growth Scenario

- 3.9.2.2 Conservative Growth Scenario

- 3.9.2.3 Disruption Scenario

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By Component

- 3.11 Cost breakdown analysis

- 3.12 Production statistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.13.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 TCU

- 5.2.2 Display

- 5.2.3 Sensors

- 5.2.4 Others

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional service

- 5.4.2 Managed service

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Tethered

- 6.4 Aftermarket

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.3.1 PHEV

- 7.3.2 HEV

- 7.3.3 FCEV

- 7.3.4 BEV

Chapter 8 Market Estimates & Forecast, By Network, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Cellular

- 8.3 Short range

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Private

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 Australia

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Indonesia

- 10.4.5 Japan

- 10.4.6 Singapore

- 10.4.7 South Korea

- 10.4.8 Thailand

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1.1 Global Leaders

- 11.1.1.1 BMW Motorrad

- 11.1.1.2 Ducati

- 11.1.1.3 Harley-Davidson

- 11.1.1.4 Honda

- 11.1.1.5 Kawasaki

- 11.1.1.6 KTM

- 11.1.1.7 Yamaha

- 11.1.2 Technology Platform Providers

- 11.1.2.1 Amazon Web Services

- 11.1.2.2 AT&T

- 11.1.2.3 Robert Bosch

- 11.1.2.4 Continental

- 11.1.2.5 Ericsson

- 11.1.2.6 Intel

- 11.1.2.7 Microsoft

- 11.1.2.8 Qualcomm Technologies

- 11.1.2.9 Verizon Communications

- 11.1.3 Regional Champions & Emerging Players

- 11.1.3.1 Bajaj Auto

- 11.1.3.2 Gogoro

- 11.1.3.3 Hero MotoCorp

- 11.1.3.4 Lightning Motorcycles

- 11.1.3.5 Piaggio

- 11.1.3.6 Royal Enfield

- 11.1.3.7 TVS Motor Company

- 11.1.3.8 Zero Motorcycles