PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1833291

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1833291

Connected Motorcycle Market by Two-wheeler Type, Hardware Type, Propulsion Type, Network Type, End User, Application, and Region - Global Forecast to 2032

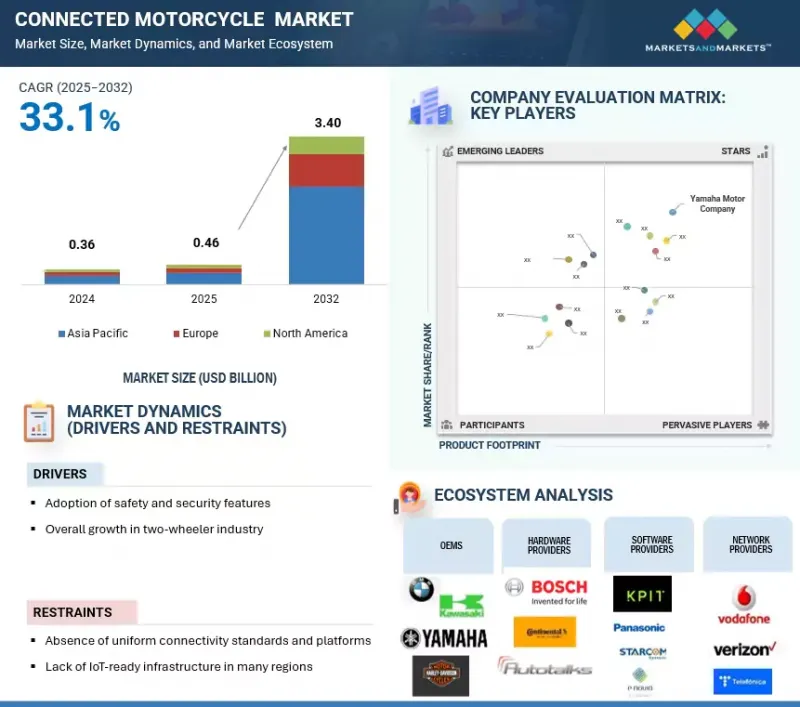

The global connected motorcycle market is projected to reach USD 3.40 billion by 2032, growing from USD 0.46 billion in 2025 at a CAGR of 33.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | Two-wheeler Type, Hardware Type, Propulsion Type, Network Type, End User, Application, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

The connected motorcycle market is rapidly expanding, with safety and security features leading to adoption. Rising accident rates, regulatory pushes such as CEN/TS 17249-compliant eCall mandate in Europe, and growing insurer incentives are making features like eCall, stolen vehicle tracking, geo-fencing, and rider assistance alerts central to two-wheeler OEM strategies. Besides premium models, mid-range and fleet operators increasingly integrate these systems to improve rider protection, asset security, and operational uptime. Backed by IoT, V2X, and 4G/5G advances, safety-related connected services are expected to remain the largest revenue contributor in the connected motorcycle market.

"The safety & security segment is projected to capture the largest share during the forecast period."

By application, the safety & security segment is projected to account for the largest share during the forecast period. The growing rider awareness about road hazards, government regulations for safer two-wheeler mobility, and rapid advances in connected emergency response features drive the segment's growth. Major OEMs like Yamaha Motor Company, BMW Group, and Harley Davidson provide safety & security features, such as eCall, crash detection, and theft tracking as standard in their product offerings. Asia Pacific remains the segment's growth engine, with safety and security revenues projected to jump from USD 63.6 million in 2024 to USD 729.5 million in 2032, helped by aggressive urbanization and supportive regulations.

While the navigation segment is projected to reach USD 917.5 million by 2032 (29.6% CAGR), due to increased adoption of services like turn-by-turn guidance, traffic alerts, and route optimization, OEMs are prioritizing investments in safety functions that deliver immediate, measurable reductions in fatalities and theft. Safety and security features are being provided across all tiers of motorcycles, from affordable commuter bikes in emerging markets to premium touring models in developed markets, reinforcing safety and security as the basic layer of connected-motorcycle ecosystems.

"The ICE segment is projected to achieve significant growth during the forecast period."

By propulsion type, the ICE segment is projected to achieve significant growth during the forecast period. Global shipments of connected ICE models are forecast to rise from 5.25 million units in 2025 to roughly 23.15 million units by 2032, registering a robust 23.6% CAGR. Asia Pacific underpins this surge of sales in the ICE segment, and annual ICE volumes in Asia Pacific will climb from 4.51 million units in 2025 to more than 21.30 million units by 2032, driven by a massive commuter-bike base, affordable telematics packages, and tightening safety mandates that encourage factory-fitted connectivity. Europe and North America also contribute to this rise. Widespread low data-plan prices bundled by telecom operators, and insurers' uptake of usage-based premiums plans further reinforce ICE momentum. Although electrification benefits from falling battery costs and zero-emission zones, the sheer installed base and continuing affordability of ICE motorcycles ensure they will command a significant share of connected two-wheeler volumes for at least the next decade.

"Asia Pacific is projected to be the dominant region for the connected motorcycle market during the forecast period."

Asia Pacific is projected to be the fastest-growing connected motorcycle market, supported by a massive two-wheeler user base, many commuters, and accelerating digital infrastructure rollouts. Annual connected two-wheeler sales in the region are forecast to leap from about 7.07 million units in 2025 to nearly 29.13 million units by 2032, translating to a vigorous 22.4% CAGR during the forecast period. The market growth in Asia Pacific is well ahead of the growth rates projected in North America and Europe.

This momentum is underpinned by government safety mandates, affordable 4G/5G data plans, and OEM strategies that bundle turn-by-turn navigation, e-call, and theft tracking on even entry-level models. China, India, and Southeast Asian nations lead the surge as urban congestion fuels the demand for smarter commuting solutions and last-mile delivery fleets.

Regulatory mandates, such as India's AIS-140 telematics standard and Indonesia's push for connected EV scooters, create a fertile environment for large-scale deployments of connected motorcycle technology. With OEMs investing in cloud-based service platforms and over-the-air update frameworks, Asia Pacific's ecosystem is set to outpace all other regions, cementing its status as the primary growth engine for connected motorcycles over the coming decade.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMS: 74%, Hardware & Software Providers: 26%

- By Designation: Directors: 15%, C-Level Executives: 33%, Others: 52%

- By Region: Asia Pacific: 60%, Europe: 15%, and North America: 25%

Major players dominating the connected motorcycle market include Honda (Japan), Yamaha (Japan), BMW Motorrad (Germany), and Harley-Davidson (US). These companies are expanding their portfolios to strengthen their connected motorcycle market position.

Research Coverage:

The report covers the connected motorcycle market by two-wheeler type (motorcycle, scooter/moped), hardware type (embedded, integrated), propulsion type (ICE, electric), network type (3G/4G, 5G, and other network types), end user (private, commercial), application (safety & security, navigation, vehicle health & diagnostics, infotainment & communication, and other applications), and region (Asia Pacific, Europe, and North America). The report also covers the competitive landscape and company profiles of significant connected motorcycle market players. The study further includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the connected motorcycle market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will help stakeholders understand the current and future pricing trends of the connected motorcycle market.

The report provides insight into the following pointers:

- Market Dynamics: Analysis of key drivers (adoption of safety & security features and growth in the two-wheeler industry), restraints (absence of connected standards & uniform platform and lack of IoT-enabled infrastructure), opportunities (growing communication technology & network innovations and integration of payment services), and challenges (cybersecurity vulnerabilities and software maintenance & OTA challenges)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the connected motorcycle market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the connected motorcycle market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, namely Honda (Japan), Yamaha (Japan), BMW Motorrad (Germany), Harley Davidson (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONNECTED MOTORCYCLE MARKET

- 4.2 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE

- 4.3 CONNECTED MOTORCYCLE MARKET, BY HARDWARE

- 4.4 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE

- 4.5 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE

- 4.6 CONNECTED MOTORCYCLE MARKET, BY END USER

- 4.7 CONNECTED MOTORCYCLE MARKET, BY APPLICATION

- 4.8 CONNECTED MOTORCYCLE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for safety and security features in motorcycles

- 5.2.1.2 Growth in two-wheeler industry

- 5.2.1.3 Need for advanced connected features in two-wheelers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of connected standards and uniform platforms

- 5.2.2.2 Lack of IoT-enabled infrastructure

- 5.2.2.3 Lack of connectivity in small cities and outskirts

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of CAN & Ethernet-based architecture

- 5.2.3.2 Real-time cloud integration for fleets

- 5.2.3.3 Integration of payment services

- 5.2.3.4 Advancements in IoT, connected technology, and real-time diagnostics

- 5.2.3.5 Advancements in communication and networking technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity vulnerabilities

- 5.2.4.2 Software maintenance & OTA challenges

- 5.2.5 CONNECTED MOTORCYCLE MARKET: IMPACT OF MARKET DYNAMICS

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 HARDWARE PROVIDERS

- 6.3.2 SOFTWARE PROVIDERS

- 6.3.3 SERVICE PLATFORM PROVIDERS

- 6.3.4 NETWORK PROVIDERS

- 6.3.5 OEMS

- 6.3.6 END USERS

- 6.4 INVESTMENT & FUNDING SCENARIO

- 6.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 KEY CONFERENCES & EVENTS, 2025-2026

- 6.6.1 KEY CONFERENCES & EVENTS, 2025-2026

- 6.7 OEM-CONNECTED SERVICE OFFERINGS

- 6.8 BUSINESS MODELS

- 6.8.1 SUBSCRIPTION-BASED CONNECTIVITY SERVICES

- 6.8.2 BATTERY-AS-A-SERVICE (BAAS) AND SWAPPING MODEL

- 6.8.3 PAY-PER-USE PLATFORMS

- 6.8.4 DATA MONETIZATION

- 6.9 GROWTH OPPORTUNITIES IN TWO-WHEELER INDUSTRY

- 6.10 GLOBAL MOTORCYCLE AND SCOOTER SALES

- 6.10.1 EUROPE

- 6.10.2 ASIA PACIFIC

- 6.10.3 NORTH AMERICA

- 6.11 ICE AND ELECTRIC VEHICLE SALES, 2025 VS. 2032

- 6.12 CONNECTED TECHNOLOGY PENETRATION, 2025 VS. 2032

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 EUROPEAN OEM DEPLOYED SIBROS' DEEP CONNECTED PLATFORM (DCP) TO OFFER EXCEPTIONAL OFF-ROADING EXPERIENCE TO CUSTOMERS

- 6.13.2 ZERO MOTORCYCLES DEPLOYED T42'S HELIOS PLATFORM AND ESEYE'S ANYNET+ ESIMS TO CAPTURE AND ANALYZE HIGH-QUALITY REAL-TIME DATA FROM EVERY ECU IN ITS FLEET

- 6.13.3 ATHER PARTNERED WITH GOOGLE CLOUD TO REDEFINE URBAN MOBILITY IN INDIA'S DYNAMIC ECONOMY

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 TECHNOLOGY ANALYSIS

- 7.1.1 KEY TECHNOLOGIES

- 7.1.1.1 Embedded telematics systems

- 7.1.1.2 ECU and sensor integration

- 7.1.1.3 Advanced rider assistance system (ARAS)

- 7.1.2 COMPLEMENTARY TECHNOLOGIES

- 7.1.2.1 Smartphone connectivity platforms

- 7.1.2.2 Human machine interface (HMI) systems

- 7.1.2.3 Navigation and geo-fencing modules

- 7.1.2.4 Integration of smart helmets with wearables

- 7.1.3 ADJACENT TECHNOLOGIES

- 7.1.3.1 Over-the-air (OTA) update systems

- 7.1.3.2 Battery management systems (BMS) for connected EVs

- 7.1.3.3 Predictive maintenance

- 7.1.1 KEY TECHNOLOGIES

- 7.2 PATENT ANALYSIS

- 7.3 IMPACT OF AI/GEN AI

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGULATORY LANDSCAPE

- 8.1.1 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY FRAMEWORK

- 8.1.2.1 Canada

- 8.1.2.2 US

- 8.1.2.3 European Union

- 8.1.2.3.1 General Data Protection Regulation (GDPR)

9 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE

- 9.1 INTRODUCTION

- 9.2 MOTORCYCLE

- 9.2.1 RISING DEMAND FOR CONNECTED MOTORCYCLES AMONG MIDDLE-CLASS TO DRIVE MARKET

- 9.3 SCOOTER/MOPED

- 9.3.1 POPULARITY OF SCOOTERS/MOPEDS BECAUSE OF THEIR SIMPLE FEATURES TO DRIVE MARKET

- 9.4 KEY PRIMARY INSIGHTS

10 CONNECTED MOTORCYCLE MARKET, BY HARDWARE

- 10.1 INTRODUCTION

- 10.2 EMBEDDED

- 10.2.1 EMBEDDED SYSTEM HAS BUILT-IN SIM CARD AND DOES NOT NEED SMARTPHONE TO OPERATE

- 10.3 INTEGRATED

- 10.3.1 INTEGRATED CONNECTIVITY COMBINES FUNCTIONS TO PROVIDE RIDERS WITH VITAL DIGITAL DISPLAY

- 10.4 KEY PRIMARY INSIGHTS

11 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE

- 11.1 INTRODUCTION

- 11.1.1 MODEL NAMES OF POPULAR CONNECTED ICE AND ELECTRIC MOTORCYCLES

- 11.2 ICE

- 11.2.1 < 125 CC

- 11.2.1.1 Rising need for motorcycles for daily commuting to boost demand

- 11.2.2 125-300 CC

- 11.2.2.1 Need for balance of cost savings and performance to drive market

- 11.2.3 > 300 CC

- 11.2.3.1 Demand for performance-oriented motorcycle models to drive market

- 11.2.1 < 125 CC

- 11.3 ELECTRIC

- 11.3.1 < 3 KW

- 11.3.1.1 Demand for connected motorcycles for frequent city rides to boost market

- 11.3.2 3-7 KW

- 11.3.2.1 Demand for two-wheelers offering better performance to boost market

- 11.3.3 > 7 KW

- 11.3.3.1 Increasing demand for premium models to boost market

- 11.3.1 < 3 KW

- 11.4 KEY PRIMARY INSIGHTS

12 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE

- 12.1 INTRODUCTION

- 12.2 3G/4G

- 12.2.1 DEMAND FOR LIVE TRACKING, NAVIGATION, AND OTHER ADVANCED FEATURES TO BOOST MARKET

- 12.3 5G

- 12.3.1 FOCUS OF CUSTOMERS ON IMPROVED CONNECTIVITY TO DRIVE PREFERENCE

- 12.4 OTHERS

- 12.5 KEY PRIMARY INSIGHTS

13 CONNECTED MOTORCYCLE MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.1.1 COMPANIES PROVIDING RIDE-HAILING SERVICES ON MOTORCYCLES

- 13.2 PRIVATE

- 13.2.1 FOCUS OF COMPANIES ON GRANTING ENHANCED SAFETY TO CONSUMERS TO SPUR DEMAND

- 13.3 COMMERCIAL

- 13.3.1 INCREASING USE OF CONNECTED MOTORCYCLES FOR COMMERCIAL USE TO BOOST GROWTH

- 13.4 KEY PRIMARY INSIGHTS

14 CONNECTED MOTORCYCLE MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 SAFETY & SECURITY

- 14.2.1 INCREASED EMPHASIS ON SAFETY AND SECURITY DURING COMMUTE TO DRIVE MARKET

- 14.2.2 ECALL & BCALL

- 14.2.3 GEO-FENCING

- 14.2.4 ADVANCED RIDER ASSISTANCE SYSTEMS (ARAS)

- 14.2.5 RIDER BEHAVIOR MONITORING

- 14.3 NAVIGATION

- 14.3.1 INCREASING POPULARITY OF CONNECTED FEATURES FOR NAVIGATION PURPOSES TO DRIVE DEMAND

- 14.3.2 TURN-BY-TURN NAVIGATION

- 14.3.3 REAL-TIME TRAFFIC UPDATES

- 14.3.4 TRIP PLANNING & ROUTE SHARING

- 14.3.5 PARKING ASSISTANCE & LOCATOR

- 14.4 VEHICLE HEALTH & DIAGNOSTICS

- 14.4.1 EMPHASIS ON MAINTAINING HEALTH OF TWO-WHEELERS TO DRIVE MARKET

- 14.4.2 PREDICTIVE MAINTENANCE ALERTS

- 14.4.3 BATTERY MANAGEMENT SYSTEM (FOR EVS)

- 14.4.4 REMOTE DIAGNOSTICS

- 14.4.5 INFOTAINMENT & COMMUNICATION

- 14.4.5.1 Smartphone connectivity

- 14.4.5.2 Music/Media streaming and voice assistants

- 14.4.5.3 Ride telemetry & performance analytics

- 14.4.5.4 Helmet connectivity

- 14.5 OTHER APPLICATIONS

- 14.5.1 OTA SOFTWARE UPDATES

- 14.5.2 REMOTE FEATURE UNLOCKS/SUBSCRIPTION UPGRADES

- 14.5.3 CHARGING STATION LOCATOR

- 14.5.4 REMOTE LOCK/UNLOCK (FOR SHARED BIKES)

- 14.6 KEY PRIMARY INSIGHTS

15 CONNECTED MOTORCYCLE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Vast two-wheeler base and strong manufacturing system to drive market

- 15.2.3 INDIA

- 15.2.3.1 Rising demand for connected features to boost market

- 15.2.4 JAPAN

- 15.2.4.1 Rising population of people preferring two-wheelers to drive market

- 15.2.5 PHILIPPINES

- 15.2.5.1 Growing urban mobility challenges to boost market

- 15.2.6 INDONESIA

- 15.2.6.1 Increased adoption of connected motorcycles to boost market

- 15.2.7 VIETNAM

- 15.2.7.1 Drive for innovation among local manufacturers to boost market

- 15.2.8 THAILAND

- 15.2.8.1 Vast consumer base for two-wheelers to spur demand

- 15.2.9 REST OF ASIA PACIFIC

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 FRANCE

- 15.3.2.1 Intense regulatory pressure and urban mobility needs to boost demand

- 15.3.3 GERMANY

- 15.3.3.1 Strong presence of tier-1 players to drive demand

- 15.3.4 ITALY

- 15.3.4.1 Presence of major OEMs to boost demand for advanced connected motorcycles

- 15.3.5 SPAIN

- 15.3.5.1 People's heavy reliance on motorcycles and scooters to boost market

- 15.3.6 UK

- 15.3.6.1 People's focus on premium products to boost market

- 15.3.7 REST OF EUROPE

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Presence of major manufacturers to boost demand

- 15.4.3 CANADA

- 15.4.3.1 Strong push by government for road safety and electrification policies to boost market

- 15.4.4 MEXICO

- 15.4.4.1 Urban congestion and rising fuel prices to boost market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS OF KEY PLAYERS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 BRAND COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (OEMS), 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PARTICIPANTS

- 16.7.4 PERVASIVE PLAYERS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS (OEMS), 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Hardware footprint

- 16.7.5.3 Region footprint

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS (TECHNOLOGY PROVIDERS), 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS (TECHNOLOGY PROVIDERS) 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Hardware footprint

- 16.8.5.3 Region footprint

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS (OEMS)

- 17.1.1 YAMAHA MOTOR CO., LTD.

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to Win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 KAWASAKI MOTORS CORP.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 SUZUKI MOTOR CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 HARLEY-DAVIDSON

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 BMW AG

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.1 YAMAHA MOTOR CO., LTD.

- 17.2 KEY PLAYERS: HARDWARE PROVIDERS

- 17.2.1 BOSCH LIMITED

- 17.2.1.1 Business overview

- 17.2.1.2 Products offered

- 17.2.1.3 Recent developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths/Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses & competitive threats

- 17.2.2 CONTINENTAL AG

- 17.2.2.1 Business overview

- 17.2.2.2 Products offered

- 17.2.2.3 Recent developments

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths/Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses & competitive threats

- 17.2.3 AUTOTALKS

- 17.2.3.1 Business overview

- 17.2.3.2 Products offered

- 17.2.3.3 Recent developments

- 17.2.3.4 MnM view

- 17.2.3.4.1 Key strengths/Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses & competitive threats

- 17.2.4 PANASONIC CORPORATION

- 17.2.4.1 Business overview

- 17.2.4.2 Products offered

- 17.2.4.3 Recent developments

- 17.2.4.4 MnM view

- 17.2.4.4.1 Key strengths/Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses & competitive threats

- 17.2.5 SIEMENS

- 17.2.5.1 Business overview

- 17.2.5.2 Products offered

- 17.2.5.3 Recent developments

- 17.2.5.4 MnM view

- 17.2.5.4.1 Key strengths/Right to win

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses & competitive threats

- 17.2.1 BOSCH LIMITED

- 17.3 KEY PLAYERS: SOFTWARE PROVIDERS

- 17.3.1 STARCOM SYSTEMS LLC

- 17.3.1.1 Business overview

- 17.3.1.2 Products offered

- 17.3.1.3 MnM view

- 17.3.1.3.1 Key strengths/Right to win

- 17.3.1.3.2 Strategic choices

- 17.3.1.3.3 Weaknesses & competitive threats

- 17.3.2 COMODULE OU

- 17.3.2.1 Business overview

- 17.3.2.2 Products offered

- 17.3.2.3 Recent developments

- 17.3.2.4 MnM view

- 17.3.2.4.1 Key strengths/Right to win

- 17.3.2.4.2 Strategic choices

- 17.3.2.4.3 Weaknesses & competitive threats

- 17.3.3 KPIT TECHNOLOGIES LTD

- 17.3.3.1 Business overview

- 17.3.3.2 Products offered

- 17.3.3.3 Recent developments

- 17.3.3.4 MnM view

- 17.3.3.4.1 Key strengths/Right to win

- 17.3.3.4.2 Strategic choices

- 17.3.3.4.3 Weaknesses & competitive threats

- 17.3.4 ITURAN GLOBAL

- 17.3.4.1 Business overview

- 17.3.4.2 Products offered

- 17.3.4.3 MnM view

- 17.3.4.3.1 Key strengths/Right to win

- 17.3.4.3.2 Strategic choices made

- 17.3.4.3.3 Weaknesses & competitive threats

- 17.3.5 E-NOVIA S.P.A

- 17.3.5.1 Business overview

- 17.3.5.2 Products offered

- 17.3.5.3 Recent developments

- 17.3.5.4 MnM view

- 17.3.5.4.1 Key strengths/Right to win

- 17.3.5.4.2 Strategic choices

- 17.3.5.4.3 Weaknesses & competitive threats

- 17.3.1 STARCOM SYSTEMS LLC

- 17.4 KEY PLAYERS: SERVICE PLATFORM PROVIDERS

- 17.4.1 IBM

- 17.4.1.1 Business overview

- 17.4.1.2 Products offered

- 17.4.1.3 Recent developments

- 17.4.1.4 MnM view

- 17.4.1.4.1 Key strengths/Right to win

- 17.4.1.4.2 Strategic choices

- 17.4.1.4.3 Weaknesses & competitive threats

- 17.4.2 AMAZON

- 17.4.2.1 Business overview

- 17.4.2.2 Products offered

- 17.4.2.3 Recent developments

- 17.4.2.4 MnM view

- 17.4.2.4.1 Key strengths/Right to win

- 17.4.2.4.2 Strategic choices

- 17.4.2.4.3 Weaknesses & competitive threats

- 17.4.3 GOOGLE LLC

- 17.4.3.1 Business overview

- 17.4.3.2 Products offered

- 17.4.3.3 Recent developments

- 17.4.3.4 MnM view

- 17.4.3.4.1 Key strengths/Right to win

- 17.4.3.4.2 Strategic choices

- 17.4.3.4.3 Weaknesses & competitive threats

- 17.4.4 APPLE INC.

- 17.4.4.1 Business overview

- 17.4.4.2 Products offered

- 17.4.4.3 Recent developments

- 17.4.4.4 MnM view

- 17.4.4.4.1 Key strengths/Right to win

- 17.4.4.4.2 Strategic choices

- 17.4.4.4.3 Weaknesses & competitive threats

- 17.4.5 DXC TECHNOLOGY COMPANY

- 17.4.5.1 Business overview

- 17.4.5.2 Products offered

- 17.4.5.3 Recent developments

- 17.4.5.4 MnM view

- 17.4.5.4.1 Key strengths/Right to win

- 17.4.5.4.2 Strategic choices

- 17.4.5.4.3 Weaknesses & competitive threats

- 17.4.1 IBM

- 17.5 KEY PLAYERS: NETWORK PROVIDERS

- 17.5.1 VODAFONE GROUP

- 17.5.1.1 Business overview

- 17.5.1.2 Products offered

- 17.5.1.3 Recent developments

- 17.5.1.4 MnM view

- 17.5.1.4.1 Key strengths/Right to win

- 17.5.1.4.2 Strategic choices

- 17.5.1.4.3 Weaknesses & competitive threats

- 17.5.2 VERIZON

- 17.5.2.1 Business overview

- 17.5.2.2 Products offered

- 17.5.2.3 Recent developments

- 17.5.2.4 MnM view

- 17.5.2.4.1 Key strengths/Right to win

- 17.5.2.4.2 Strategic choices

- 17.5.2.4.3 Weaknesses & competitive threats

- 17.5.3 TELEFONICA S.A.

- 17.5.3.1 Business overview

- 17.5.3.2 Products offered

- 17.5.3.3 Recent developments

- 17.5.3.4 MnM view

- 17.5.3.4.1 Key strengths/Right to win

- 17.5.3.4.2 Strategic choices

- 17.5.3.4.3 Weaknesses & competitive threats

- 17.5.4 AERIS

- 17.5.4.1 Business overview

- 17.5.4.2 Products offered

- 17.5.4.3 Recent developments

- 17.5.4.4 MnM view

- 17.5.4.4.1 Key strengths/Right to win

- 17.5.4.4.2 Strategic choices

- 17.5.4.4.3 Weaknesses & competitive threats

- 17.5.5 CHINA TELECOM GLOBAL LIMITED

- 17.5.5.1 Business overview

- 17.5.5.2 Products offered

- 17.5.5.3 Recent developments

- 17.5.5.4 MnM view

- 17.5.5.4.1 Key strengths/Right to win

- 17.5.5.4.2 Strategic choices

- 17.5.5.4.3 Weaknesses & competitive threats

- 17.5.1 VODAFONE GROUP

- 17.6 OTHER KEY PLAYERS

- 17.6.1 HERO MOTOCORP LTD

- 17.6.2 HONDA MOTOR CO., LTD.

- 17.6.3 TRIUMPH MOTORCYCLES

- 17.6.4 TVS MOTORS COMPANY

- 17.6.5 KEEWAY

- 17.6.6 ROYAL ENFIELD

- 17.6.7 KTM AG

- 17.6.8 DUCATI MOTOR HOLDING S.P.A

- 17.6.9 IAV

- 17.6.10 FACOMSA

- 17.6.11 HARMAN INTERNATIONAL

- 17.6.12 TOMTOM INTERNATIONAL BV

- 17.6.13 NVIDIA CORPORATION

- 17.6.14 AIRTEL INDIA

- 17.6.15 QUALCOMM TECHNOLOGIES, INC.

- 17.6.16 NXP SEMICONDUCTORS

- 17.7 KEY STARTUPS AND NEW ENTRANTS

- 17.7.1 ZERO MOTORCYCLES, INC.

- 17.7.2 TORK MOTORS

- 17.7.3 TE CONNECTIVITY

- 17.7.4 EMBIEN TECHNOLOGIES INDIA PVT LTD.

- 17.7.5 CALIMOTO GMBH

- 17.7.6 NAVINFO

- 17.7.7 INDIAN MOTORCYCLE INTERNATIONAL, LLC

- 17.7.8 THE FLOOW LIMITED

- 17.7.9 TELTONIKA

- 17.7.10 PARKOFON INC. DBA SHEEVA.AI

- 17.7.11 SIBROS TECHNOLOGIES INC.

- 17.7.12 TWILIO INC.

- 17.7.13 COSMO CONNECTED

- 17.7.14 CONCIRRUS LTD

- 17.7.15 RIDE VISION

- 17.7.16 AMODO

- 17.7.17 BLUARMOR

- 17.7.18 COBI.BIKE

- 17.7.19 SENA TECHNOLOGIES INC.

- 17.7.20 YADEA TECHNOLOGY GROUP CO., LTD.

- 17.7.21 BAJAJ AUTO LTD.

- 17.7.22 NIU INTERNATIONAL

- 17.7.23 PIAGGIO & C. SPA

- 17.7.24 KYMCO

- 17.7.25 ATHER ENERGY

- 17.7.26 OLA ELECTRIC MOBILITY LTD

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA PACIFIC TO BE KEY FOCUS REGION IN SHORT TERM

- 18.2 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN LONG TERM

- 18.3 CONNECTED FEATURES IN BUDGET-FRIENDLY MOTORCYCLES CAN BE KEY FOCUS FOR MANUFACTURERS

- 18.4 TECHNOLOGICAL ADVANCEMENTS TO HELP SPEED UP CONNECTED MOTORCYCLE MARKET GROWTH

- 18.5 PARTNERSHIPS AMONG CONNECTED MOTORCYCLE ECOSYSTEM PLAYERS FOR SEAMLESS SOLUTION OFFERING

- 18.6 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CURRENCY EXCHANGE RATES, 2021-2024

- TABLE 2 REGULATIONS, BY COUNTRY/REGION

- TABLE 3 STANDARDS FOR CONNECTED VEHICLES IN US

- TABLE 4 COLLABORATION BETWEEN SUPPLIERS AND OEMS FOR CAN & ETHERNET-BASED ARCHITECTURES

- TABLE 5 EFFECTS OF CYBERATTACKS ON VEHICLES AND POSSIBLE OUTCOME

- TABLE 6 CONNECTED MOTORCYCLE MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 7 CONNECTED MOTORCYCLE MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONNECTED MOTORCYCLES, BY PROPULSION TYPE

- TABLE 9 KEY BUYING CRITERIA FOR CONNECTED MOTORCYCLES, BY PROPULSION TYPE

- TABLE 10 EUROPE: MOTORCYCLE SALES, BY COUNTRY/REGION, 2025 (THOUSAND UNITS)

- TABLE 11 EUROPE: SCOOTER SALES, BY COUNTRY/REGION, 2025 (THOUSAND UNITS)

- TABLE 12 ASIA PACIFIC: MOTORCYCLE SALES, BY COUNTRY/REGION, 2025 (THOUSAND UNITS)

- TABLE 13 ASIA PACIFIC: SCOOTER SALES, BY COUNTRY/REGION, 2025 (THOUSAND UNITS)

- TABLE 14 NORTH AMERICA: MOTORCYCLE SALES, BY COUNTRY, 2025 (THOUSAND UNITS)

- TABLE 15 NORTH AMERICA: SCOOTER SALES, BY COUNTRY, 2025 (THOUSAND UNITS)

- TABLE 16 PATENT REGISTRATIONS, 2021-2023

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 21 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 22 CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 23 CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 24 CONNECTED SCOOTER/MOPED MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 25 CONNECTED SCOOTER/MOPED MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 26 CONNECTED MOTORCYCLE MARKET, BY HARDWARE,

021-2024 (THOUSAND UNITS)

- TABLE 27 CONNECTED MOTORCYCLE MARKET, BY HARDWARE, 2025-2032 (THOUSAND UNITS)

- TABLE 28 EMBEDDED: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 29 EMBEDDED: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 30 INTEGRATED: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 31 INTEGRATED: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 32 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 33 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 34 POPULAR CONNECTED ICE AND ELECTRIC MOTORCYCLES, BY COMPANY

- TABLE 35 < 125 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 36 < 125 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 37 125-300 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 38 125-300 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 39 > 300 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 40 > 300 CC: CONNECTED ICE MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 41 < 3 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 42 < 3 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 43 3-7 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 44 3-7 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 45 > 7 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 46 > 7 KW: CONNECTED ELECTRIC MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 47 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 48 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 49 3G/4G: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 50 3G/4G: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 51 5G: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 52 5G: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 53 OTHERS: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 54 CONNECTED MOTORCYCLE MARKET, BY END USER, 2021-2024 (THOUSAND UNITS)

- TABLE 55 CONNECTED MOTORCYCLE MARKET, BY END USER, 2025-2032 (THOUSAND UNITS)

- TABLE 56 COMPANIES PROVIDING RIDE-HAILING SERVICES ON MOTORCYCLES

- TABLE 57 PRIVATE: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 58 PRIVATE: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 59 COMMERCIAL: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 60 COMMERCIAL: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 61 CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 63 SAFETY & SECURITY: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 SAFETY & SECURITY: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 NAVIGATION: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 NAVIGATION: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 VEHICLE HEALTH & DIAGNOSTICS: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 VEHICLE HEALTH & DIAGNOSTICS: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 INFOTAINMENT & COMMUNICATION: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 INFOTAINMENT & COMMUNICATION: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 CONNECTED MOTORCYCLE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 74 CONNECTED MOTORCYCLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 75 CONNECTIVITY PLANS OFFERED BY LEADING OEMS IN ASIA PACIFIC

- TABLE 76 ASIA PACIFIC: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 78 CHINA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 79 CHINA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 80 INDIA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 81 INDIA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 82 JAPAN: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 83 JAPAN: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 84 PHILIPPINES: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 85 PHILIPPINES: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 86 INDONESIA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 87 INDONESIA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 88 VIETNAM: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 89 VIETNAM: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 90 THAILAND: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 91 THAILAND: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 92 REST OF ASIA PACIFIC: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 93 REST OF ASIA PACIFIC: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 94 EUROPE: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2021-2024 (USD MILLIONS)

- TABLE 95 EUROPE: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2025-2032 (USD MILLIONS)

- TABLE 96 FRANCE: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 97 FRANCE: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 98 GERMANY: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 99 GERMANY: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 100 ITALY: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 101 ITALY: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 102 SPAIN: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 103 SPAIN: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 104 UK: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 105 UK: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 106 REST OF EUROPE: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 107 REST OF EUROPE: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 108 NORTH AMERICA: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 110 US: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 111 US: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 112 CANADA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 113 CANADA: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 114 MEXICO: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 115 MEXICO: CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 116 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 117 CONNECTED MOTORCYCLE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 118 CONNECTED MOTORCYCLE MARKET: HARDWARE FOOTPRINT

- TABLE 119 CONNECTED MOTORCYCLE MARKET: REGION FOOTPRINT

- TABLE 120 HARDWARE FOOTPRINT

- TABLE 121 REGION FOOTPRINT

- TABLE 122 CONNECTED MOTORCYCLE MARKET: PRODUCT LAUNCHES, JANUARY 2024-JULY 2025

- TABLE 123 CONNECTED MOTORCYCLE MARKET: DEALS, JANUARY 2024-JULY 2025

- TABLE 124 CONNECTED MOTORCYCLE MARKET: OTHER DEVELOPMENTS, JANUARY 2024-JULY 2025

- TABLE 125 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 126 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 127 YAMAHA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 128 YAMAHA MOTOR CO., LTD.: DEALS

- TABLE 129 YAMAHA MOTOR COMPANY: EXPANSION

- TABLE 130 YAMAHA MOTOR COMPANY: OTHER DEVELOPMENTS

- TABLE 131 KAWASAKI MOTORS CORP.: COMPANY OVERVIEW

- TABLE 132 KAWASAKI MOTORS CORP.: PRODUCTS OFFERED

- TABLE 133 KAWASAKI MOTORS CORP.: PRODUCT LAUNCHES

- TABLE 134 KAWASAKI MOTORS CORP.: DEALS

- TABLE 135 KAWASAKI MOTORS CORP.: OTHER DEVELOPMENTS

- TABLE 136 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 137 SUZUKI MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 138 SUZUKI MOTOR CORPORATION: PRODUCT LAUNCHES

- TABLE 139 SUZUKI MOTOR CORPORATION: DEALS

- TABLE 140 SUZUKI MOTOR CORPORATION: EXPANSION

- TABLE 141 HARLEY-DAVIDSON: COMPANY OVERVIEW

- TABLE 142 HARLEY-DAVIDSON: PRODUCTS OFFERED

- TABLE 143 HARLEY-DAVIDSON: PRODUCT LAUNCHES

- TABLE 144 HARLEY-DAVIDSON: DEALS

- TABLE 145 HARLEY-DAVIDSON: EXPANSION

- TABLE 146 BMW AG: COMPANY OVERVIEW

- TABLE 147 BMW AG: PRODUCTS OFFERED

- TABLE 148 BMW AG: PRODUCT LAUNCHES

- TABLE 149 BMW AG: DEALS

- TABLE 150 BOSCH LIMITED: COMPANY OVERVIEW

- TABLE 151 BOSCH LIMITED: PRODUCTS OFFERED

- TABLE 152 BOSCH LIMITED: DEALS

- TABLE 153 BOSCH LIMITED: EXPANSION

- TABLE 154 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 155 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 156 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 157 CONTINENTAL AG: DEALS

- TABLE 158 AUTOTALKS: COMPANY OVERVIEW

- TABLE 159 AUTOTALKS: PRODUCTS OFFERED

- TABLE 160 AUTOTALKS: PRODUCT LAUNCHES

- TABLE 161 AUTOTALKS: DEALS

- TABLE 162 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 163 PANASONIC CORPORATION: PRODUCTS OFFERED

- TABLE 164 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 165 PANASONIC CORPORATION: DEALS

- TABLE 166 PANASONIC CORPORATION: EXPANSION

- TABLE 167 SIEMENS: COMPANY OVERVIEW

- TABLE 168 SIEMENS: PRODUCTS OFFERED

- TABLE 169 SIEMENS: DEALS

- TABLE 170 STARCOM SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 171 STARCOM SYSTEMS LLC: PRODUCTS OFFERED

- TABLE 172 COMODULE OU: COMPANY OVERVIEW

- TABLE 173 COMODULE OU: PRODUCTS OFFERED

- TABLE 174 COMODULE OU: PRODUCT LAUNCHES

- TABLE 175 COMODULE OU: DEALS

- TABLE 176 KPIT TECHNOLOGIES LTD: COMPANY OVERVIEW

- TABLE 177 KPIT TECHNOLOGIES LTD: PRODUCTS OFFERED

- TABLE 178 KPIT TECHNOLOGIES LTD: PRODUCT LAUNCHES

- TABLE 179 KPIT TECHNOLOGIES LTD: DEALS

- TABLE 180 KPIT TECHNOLOGIES LTD: EXPANSION

- TABLE 181 ITURAN GLOBAL: COMPANY OVERVIEW

- TABLE 182 ITURAN GLOBAL: PRODUCTS OFFERED

- TABLE 183 ITURAN GLOBAL: DEALS

- TABLE 184 E-NOVIA S.P.A: COMPANY OVERVIEW

- TABLE 185 E-NOVIA S.P.A: PRODUCTS OFFERED

- TABLE 186 E-NOVIA S.P.A: DEALS

- TABLE 187 IBM: COMPANY OVERVIEW

- TABLE 188 IBM: PRODUCTS OFFERED

- TABLE 189 IBM: DEALS

- TABLE 190 AMAZON: COMPANY OVERVIEW

- TABLE 191 AMAZON: PRODUCTS OFFERED

- TABLE 192 AMAZON: DEALS

- TABLE 193 GOOGLE LLC: COMPANY OVERVIEW

- TABLE 194 GOOGLE LLC: PRODUCTS OFFERED

- TABLE 195 GOOGLE LLC: DEALS

- TABLE 196 APPLE INC.: COMPANY OVERVIEW

- TABLE 197 APPLE INC.: PRODUCTS OFFERED

- TABLE 198 APPLE INC.: DEALS

- TABLE 199 DXC TECHNOLOGY COMPANY: COMPANY OVERVIEW

- TABLE 200 DXC TECHNOLOGY COMPANY: PRODUCTS OFFERED

- TABLE 201 DXC TECHNOLOGY: DEALS

- TABLE 202 VODAFONE GROUP: COMPANY OVERVIEW

- TABLE 203 VODAFONE GROUP: PRODUCTS OFFERED

- TABLE 204 VODAFONE: PRODUCT LAUNCHES

- TABLE 205 VODAFONE: DEALS

- TABLE 206 VERIZON: COMPANY OVERVIEW

- TABLE 207 VERIZON: PRODUCTS OFFERED

- TABLE 208 VERIZON: DEALS

- TABLE 209 TELEFONICA S.A.: COMPANY OVERVIEW

- TABLE 210 TELEFONICA S.A.: PRODUCTS OFFERED

- TABLE 211 TELEFONICA S.A.: PRODUCT LAUNCHES

- TABLE 212 TELEFONICA S.A: DEALS

- TABLE 213 AERIS: COMPANY OVERVIEW

- TABLE 214 AERIS: PRODUCTS OFFERED

- TABLE 215 AERIS: DEALS

- TABLE 216 CHINA TELECOM GLOBAL LIMITED: COMPANY OVERVIEW

- TABLE 217 CHINA TELECOM GLOBAL LIMITED: PRODUCTS OFFERED

- TABLE 218 CHINA TELECOM GLOBAL LIMITED: DEALS

- TABLE 219 HERO MOTOCORP LTD: COMPANY OVERVIEW

- TABLE 220 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 221 TRIUMPH MOTORCYCLES: COMPANY OVERVIEW

- TABLE 222 TVS MOTORS COMPANY: COMPANY OVERVIEW

- TABLE 223 KEEWAY: COMPANY OVERVIEW

- TABLE 224 ROYAL ENFIELD: COMPANY OVERVIEW

- TABLE 225 KTM AG: COMPANY OVERVIEW

- TABLE 226 DUCATI MOTOR HOLDING S.P.A.: COMPANY OVERVIEW

- TABLE 227 IAV: COMPANY OVERVIEW

- TABLE 228 FACOMSA: COMPANY OVERVIEW

- TABLE 229 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 230 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 231 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 232 AIRTEL INDIA: COMPANY OVERVIEW

- TABLE 233 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 234 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 235 ZERO MOTORCYCLES, INC.: COMPANY OVERVIEW

- TABLE 236 TORK MOTORS: COMPANY OVERVIEW

- TABLE 237 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 238 EMBIEN TECHNOLOGIES INDIA PVT LTD.: COMPANY OVERVIEW

- TABLE 239 CALIMOTO GMBH: COMPANY OVERVIEW

- TABLE 240 NAVINFO: COMPANY OVERVIEW

- TABLE 241 INDIAN MOTORCYCLE INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 242 THE FLOOW LIMITED: COMPANY OVERVIEW

- TABLE 243 TELTONIKA: COMPANY OVERVIEW

- TABLE 244 PARKOFON INC. DBA SHEEVA.AI: COMPANY OVERVIEW

- TABLE 245 SIBROS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 246 TWILIO INC.: COMPANY OVERVIEW

- TABLE 247 COSMO CONNECTED: COMPANY OVERVIEW

- TABLE 248 CONCIRRUS LTD: COMPANY OVERVIEW

- TABLE 249 RIDE VISION: COMPANY OVERVIEW

- TABLE 250 AMODO: COMPANY OVERVIEW

- TABLE 251 BLUARMOR: COMPANY OVERVIEW

- TABLE 252 COBI.BIKE: COMPANY OVERVIEW

- TABLE 253 SENA TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 254 YADEA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 255 BAJAJ AUTO LTD.: COMPANY OVERVIEW

- TABLE 256 NIU INTERNATIONAL: COMPANY OVERVIEW

- TABLE 257 PIAGGIO & C. SPA: COMPANY OVERVIEW

- TABLE 258 KYMCO: COMPANY OVERVIEW

- TABLE 259 ATHER ENERGY: COMPANY OVERVIEW

- TABLE 260 OLA ELECTRIC MOBILITY LTD: BUSINESS OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 MARKET SIZE ESTIMATION: HYPOTHESIS BUILDING

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 CONNECTED MOTORCYCLE MARKET OVERVIEW

- FIGURE 8 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE BY 2032

- FIGURE 9 SCOOTER/MOPED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 INTEGRATED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 RISING DEMAND FOR CONNECTED TWO-WHEELERS TO DRIVE MARKET GROWTH

- FIGURE 12 SCOOTER/MOPED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 EMBEDDED SEGMENT TO LEAD MARKET IN 2025

- FIGURE 14 ICE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 3G/4G SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 PRIVATE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 SAFETY & SECURITY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 19 CONNECTED MOTORCYCLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 MOTORCYCLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 5G CONNECTIVITY FOR CONNECTED VEHICLES

- FIGURE 22 CONNECTIVITY ISSUES ACROSS DEVELOPING COUNTRIES

- FIGURE 23 'SMART CITY' PLANS FOR CONNECTED DEVICES

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 CONNECTED MOTORCYCLE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 CONNECTED MOTORCYCLE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 INVESTMENT SCENARIO, 2021-2025

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONNECTED MOTORCYCLES, BY PROPULSION TYPE

- FIGURE 29 KEY BUYING CRITERIA FOR CONNECTED MOTORCYCLES, BY PROPULSION TYPE

- FIGURE 30 ICE AND ELECTRIC VEHICLE SALES, 2025 VS. 2032 (UNITS)

- FIGURE 31 CONNECTED TECHNOLOGY PENETRATION, 2021-2032

- FIGURE 32 PATENT GRANTED, 2014-2025

- FIGURE 33 CONNECTED MOTORCYCLE MARKET, BY TWO-WHEELER TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 34 CONNECTED MOTORCYCLE MARKET, BY HARDWARE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 35 CONNECTED MOTORCYCLE MARKET, BY PROPULSION TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 36 CONNECTED MOTORCYCLE MARKET, BY NETWORK TYPE, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 37 CONNECTED MOTORCYCLE MARKET, BY END USER, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 38 CONNECTED MOTORCYCLE MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 CONNECTED MOTORCYCLE MARKET, BY REGION, 2025 VS. 2032 (THOUSAND UNITS)

- FIGURE 40 ASIA PACIFIC: CONNECTED MOTORCYCLE MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 44 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 45 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 46 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 47 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 49 NORTH AMERICA: CONNECTED MOTORCYCLE MARKET SNAPSHOT

- FIGURE 50 AMERICAS: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 51 AMERICAS: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 52 AMERICAS: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 53 AMERICAS: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 54 MARKET SHARE ANALYSIS OF KEY PLAYERS (OEMS), 2024

- FIGURE 55 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 56 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 57 FINANCIAL METRICS, 2025 (USD BILLION)

- FIGURE 58 BRAND COMPARISON

- FIGURE 59 CONNECTED MOTORCYCLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 60 COMPANY FOOTPRINT

- FIGURE 61 CONNECTED MOTORCYCLE MARKET: COMPANY EVALUATION MATRIX (TECHNOLOGY PROVIDERS), 2024

- FIGURE 62 COMPANY FOOTPRINT

- FIGURE 63 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 KAWASAKI MOTORS CORP.: COMPANY SNAPSHOT

- FIGURE 65 SUZUKI MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 HARLEY-DAVIDSON: COMPANY SNAPSHOT

- FIGURE 67 BMW AG: COMPANY SNAPSHOT

- FIGURE 68 BMW AG: LOCATIONS WORLDWIDE

- FIGURE 69 BOSCH LIMITED: COMPANY SNAPSHOT

- FIGURE 70 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 71 PANASONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 SIEMENS: COMPANY SNAPSHOT

- FIGURE 73 STARCOM SYSTEMS LLC: COMPANY SNAPSHOT

- FIGURE 74 HELIOS E-VEHICLE SUITE FOR CONNECTED VEHICLES

- FIGURE 75 KPIT TECHNOLOGIES LTD: COMPANY SNAPSHOT

- FIGURE 76 ITURAN GLOBAL: COMPANY SNAPSHOT

- FIGURE 77 IBM: COMPANY SNAPSHOT

- FIGURE 78 AMAZON: COMPANY SNAPSHOT

- FIGURE 79 GOOGLE LLC: COMPANY SNAPSHOT

- FIGURE 80 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 81 DXC TECHNOLOGY COMPANY: COMPANY SNAPSHOT

- FIGURE 82 VODAFONE GROUP: COMPANY SNAPSHOT

- FIGURE 83 VERIZON: COMPANY SNAPSHOT

- FIGURE 84 TELEFONICA S.A.: COMPANY SNAPSHOT

- FIGURE 85 CHINA TELECOM GLOBAL LIMITED: COMPANY SNAPSHOT