PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833431

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833431

North America Self-monitoring Blood Glucose Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

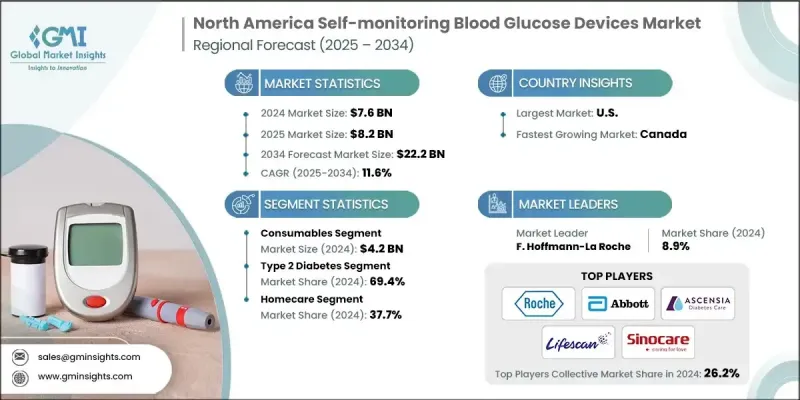

North America Self-monitoring Blood Glucose Devices Market was valued at USD 7.6 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 22.2 billion by 2034.

This upward trend is driven by a rising number of individuals being diagnosed with diabetes, increasing investments in healthcare infrastructure, and continuous technological progress in blood glucose monitoring solutions. As diabetes becomes more prevalent across the region, there is a growing demand for efficient and accessible ways to track glucose levels. Self-monitoring blood glucose devices allow patients to measure their blood sugar in real time, which supports effective management of their condition and reduces the likelihood of complications. These tools are especially useful for adjusting daily lifestyle habits, medication routines, and diet decisions, offering autonomy and immediate feedback to users. The growth is also supported by a healthcare ecosystem increasingly focused on prevention and proactive disease management, along with greater availability of digital tools that enhance device connectivity, usability, and data interpretation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $22.2 Billion |

| CAGR | 11.6% |

Improvements in device precision, ease of use, and digital connectivity have completely transformed how patients engage with diabetes care. Features such as seamless Bluetooth syncing, compact form factors, and integration with smartphone health platforms are making these devices more user-friendly and widely accessible. These advancements are increasing adherence and improving patient outcomes. Real-time data sharing also supports better communication between patients and providers, allowing for timely interventions and personalized care adjustments.

The self-monitoring blood glucose meters segment generated USD 3.3 billion in 2024 and is forecasted to reach USD 10.1 billion by 2034. These meters remain at the core of diabetes management due to their reliability, affordability, and ability to deliver instant results without requiring a clinical setting. Their simple operation allows users to track glucose levels from any location, supporting better self-management of diabetes and contributing to more consistent glycemic control.

The type 2 diabetes segment held a 69.4% share and is expected to reach USD 15.6 billion by 2034. This chronic condition is primarily associated with the body's reduced sensitivity to insulin or an inability to produce sufficient insulin. While traditionally more common in adults over the age of 45, the condition is increasingly being diagnosed in younger individuals, driven by lifestyle changes and rising obesity rates. Frequent glucose monitoring is critical for type 2 diabetes patients, especially those using medications that could lead to hypoglycemia.

U.S. Self-monitoring Blood Glucose Devices Market was valued at USD 7 billion in 2024. This steady progression is closely linked to increasing investments in healthcare technologies and efforts to make these devices more affordable and widely accessible. As a result, more individuals are incorporating SMBG tools into their daily routines, which is accelerating adoption across the nation.

Several leading companies in the North America Self-monitoring Blood Glucose Devices Market are Sanofi, All Medicus, Sinocare, Ypsomed Holding, Nova Biomedical, Bionime Corporation, LifeScan, Omnis Health, DarioHealth, F. Hoffmann-La Roche, Ascensia Diabetes Care Holdings, B. Braun Melsungen, AgaMatrix, Abbott Laboratories, Arkray, and Teva Pharmaceutical. These players are significantly shaping the competitive landscape through continuous innovation and strategic expansion. Key players in the Self-Monitoring Blood Glucose Devices Market are leveraging a mix of product innovation, digital integration, and strategic partnerships to reinforce their positions. Many companies are introducing compact, connected glucose meters with Bluetooth and app support, aiming to enhance patient engagement and real-time tracking. Some firms focus on integrating SMBG devices with broader chronic care platforms, enabling seamless data sharing with healthcare providers. Expansion into underserved markets and direct-to-consumer models is also gaining traction to boost adoption.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Application

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of diabetes across the North America

- 3.2.1.2 Rising technological advancements in self-monitoring blood glucose devices

- 3.2.1.3 Increased healthcare spending and accessibility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced devices and accessories

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of mobile health and digital platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Self-monitoring blood glucose meters

- 5.3 Consumables

- 5.3.1 Testing strips

- 5.3.2 Lancets

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1 diabetes

- 6.3 Type 2 diabetes

- 6.4 Gestational diabetes

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Diagnostic centers

- 7.5 Homecare

- 7.6 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AgaMatrix

- 9.3 All Medicus

- 9.4 Arkray

- 9.5 Ascensia Diabetes Care Holdings

- 9.6 B. Braun Melsungen

- 9.7 Bionime Corporation

- 9.8 DarioHealth

- 9.9 F. Hoffmann-La Roche

- 9.10 LifeScan

- 9.11 Nova Biomedical

- 9.12 Omnis Health

- 9.13 Sanofi

- 9.14 Sinocare

- 9.15 Ypsomed Holding