PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833437

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833437

Water Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

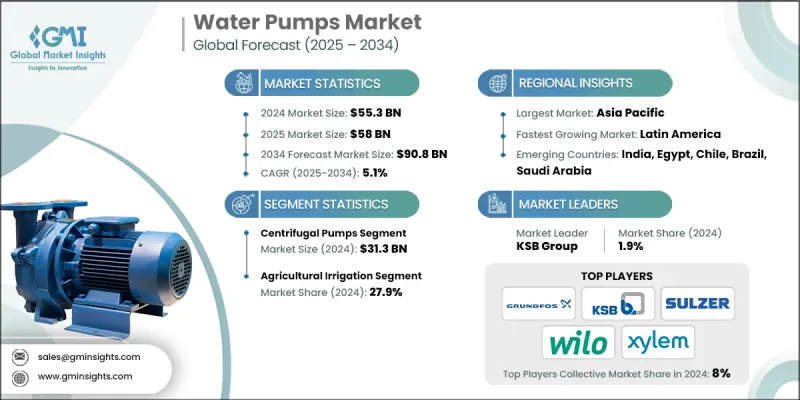

The Global Water Pumps Market was valued at USD 55.3 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 90.8 billion by 2034.

Urbanization and population growth are putting significant pressure on existing water infrastructure, leading to a growing need for reliable and scalable water supply and wastewater management systems. As more people migrate to urban areas and cities expand, the demand for clean, safe, and continuous water access is rising sharply. At the same time, larger populations generate more wastewater, requiring efficient treatment and disposal systems to meet environmental and health standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.3 Billion |

| Forecast Value | $90.8 Billion |

| CAGR | 5.1% |

Rising Adoption of Centrifugal Pumps

The centrifugal pumps segment held a significant share in 2024 owing to its versatile design, ease of operation, and wide-ranging applicability across sectors. Known for their ability to handle high flow rates and low-viscosity fluids, centrifugal pumps are extensively used in municipal water supply systems, industrial processes, and building services. Their relatively low maintenance costs and compatibility with automated systems further boost adoption.

Increasing Demand in Agriculture Irrigation

The agriculture irrigation segment witnessed a substantial share in 2024, supported by the increasing need for efficient water distribution systems in farming. With global water resources under pressure and food demand on the rise, farmers are turning to electric, solar, and diesel-powered pumps to ensure consistent irrigation across varying terrains and crop types. Water pumps help minimize manual labor while maximizing yield, making them indispensable in modern agricultural practices. In many developing regions, government subsidies and rural electrification programs are helping to accelerate pump adoption.

Asia Pacific to Emerge as a Propelling Region

Asia Pacific water pumps market held a notable share in 2024, fueled by rapid urban development, industrial expansion, and growing agricultural needs across countries like China, India, and Southeast Asia. Infrastructure modernization, investments in smart cities, and government-led water management initiatives are creating strong demand for a variety of water pump types, from centrifugal to submersible systems. Additionally, the rise of manufacturing hubs in the region is driving industrial demand for reliable fluid handling solutions.

Major Players in the market are JEE Pumps Limited, Xylem, The Weir Group PLC, SPP Pumps, Dover Corporation, Flowserve, Pentair Corporation, Grundfos, Baker Hughes Corporation, ITT Gould Pumps, Sulzer Ltd, Crompton, WILO SE, KSB Group, and Ebara Corporation.

To reinforce their position, leading water pump manufacturers are adopting a mix of innovation, localization, and strategic expansion. Many are investing in R&D to design pumps that deliver higher efficiency with lower energy consumption, targeting sectors with strict sustainability requirements. Companies are also tailoring products for specific applications such as solar pumps for rural farms or corrosion-resistant pumps for industrial chemicals to meet unique market needs. Expanding manufacturing facilities closer to demand centers, particularly in Asia and Latin America, helps reduce costs and improve delivery timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Pump Type

- 2.2.2 Material

- 2.2.3 Water Capacity Range

- 2.2.4 Power Source

- 2.2.5 Application

- 2.2.6 Distribution Channel

- 2.2.7 Regional

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region and product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Centrifugal Pumps

- 5.2.1 Single-stage Centrifugal Pumps

- 5.2.2 Multi-stage Centrifugal Pumps

- 5.3 Submersible Pumps

- 5.3.1 Deep Well Submersible Pumps

- 5.3.2 Borehole Submersible Pumps

- 5.3.3 Sewage & Wastewater Submersible Pumps

- 5.4 Vertical Turbine Pumps

- 5.5 Slurry Pumps

- 5.5.1 Rubber-Lined Slurry Pumps

- 5.5.2 Metal-Lined Slurry Pumps

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cast Iron Pumps

- 6.3 Stainless Steel Pumps

- 6.4 Bronze & Brass Pumps

- 6.5 Composite & Plastic Pumps

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Water Capacity Range, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low Capacity Pumps (Up to 100 m³/h)

- 7.3 Medium Capacity Pumps (100-1,000 m³/h)

- 7.4 High Capacity Pumps (1,000-5,000 m³/h)

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Electric-Powered Pumps

- 8.3 Diesel Engine-Driven Pumps

- 8.4 Solar-Powered Pumps

- 8.5 Wind-Powered Pumps

- 8.6 Hydraulic-Powered Pumps

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Agricultural Irrigation

- 9.3 Desalination Plants

- 9.4 Industrial Process

- 9.5 Mining Operations

- 9.6 Municipal Water Supply

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct Sales

- 10.3 Indirect Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Baker Hughes Corporation

- 12.2 Crompton

- 12.3 Dover Corporation

- 12.4 Ebara Corporation

- 12.5 Flowserve

- 12.6 Grundfos

- 12.7 ITT Gould Pumps

- 12.8 JEE Pumps Limited

- 12.9 KSB Group

- 12.10 Pentair Corporation

- 12.11 SPP Pumps

- 12.12 Sulzer Ltd

- 12.13 The Weir Group PLC

- 12.14 WILO SE

- 12.15 Xylem