PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833439

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833439

InGaAs Avalanche Photodiode (InGaAs APD) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

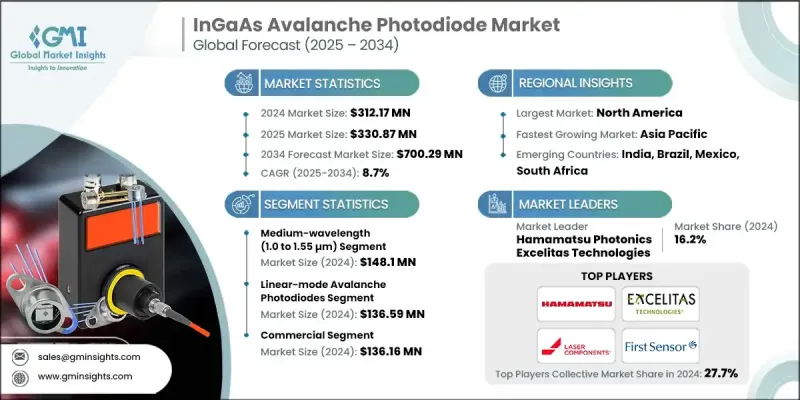

The Global InGaAs Avalanche Photodiode Market was valued at USD 312.17 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 700.29 million by 2034.

This growth is supported by the surging demand for fiber-optic communication networks, driven by the increasing dependence on high-speed internet, cloud platforms, and data-heavy applications. InGaAs avalanche photodiodes (APDs) are critical to ensuring rapid and accurate optical signal detection in high-performance telecommunication environments, including long-distance transmission, metropolitan networks, and advanced data center infrastructure. Their high responsiveness, fast signal processing capabilities, and low-noise characteristics make them essential in today's bandwidth-driven world. As telecom providers ramp up their infrastructure to support next-gen connectivity and as digital transformation continues across sectors, the role of InGaAs APDs becomes increasingly vital. Furthermore, as LiDAR-based applications become more widespread across industries such as automation, mapping, and robotics, the demand for photo detectors that can operate efficiently in near-infrared wavelengths continues to climb. These trends are creating strong momentum for innovation and product expansion within the InGaAs APD market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.17 Million |

| Forecast Value | $700.29 Million |

| CAGR | 8.7% |

The medium-wavelength segment (1.0 to 1.55 µm) generated USD 148.1 million in 2024 and is forecasted to grow at a 10% CAGR. This segment benefits from its increasing utility in industrial and environmental applications, including fiber optics, spectroscopy, and precision sensing technologies. The emphasis remains on optimizing photodiodes for wavelength-specific responsiveness, thermal stability, and reduced electronic interference. Manufacturers are continually enhancing their performance parameters to better serve evolving requirements from telecommunications and scientific industries, where accuracy and reliability are paramount.

In 2024, the single-photon avalanche diodes (SPADs) segment accounted for USD 114.49 million. These diodes can detect individual photons with exceptional precision, making them ideal for fast-paced, light-restricted environments. Increasing demand in quantum applications, low-light imaging systems, and time-resolved analytics continues to accelerate innovation in SPAD technology. Manufacturers are heavily investing in compact, CMOS-compatible SPAD arrays with ultra-low jitter to allow easy integration into smaller photonic systems. Their integration into navigation, 3D imaging, and scientific research fields is expected to diversify use cases and expand commercial interest.

U.S. InGaAs Avalanche Photodiode (InGaAs APD) Market generated USD 74.6 million in 2024. Growth in the U.S. stems from the rising implementation of photonic technologies in both commercial and defense sectors. The widespread use of advanced optical sensing and communication tools across aerospace, telecom, and scientific research is creating long-term demand for InGaAs APDs. As optical fiber networks grow and LiDAR use expands in infrastructure and security systems, the need for high-accuracy photodetectors continues to drive regional market performance.

Prominent industry participants in the InGaAs Avalanche Photodiode (InGaAs APD) Market include Hamamatsu Photonics, Albis Optoelectronics AG (Enablence), Excelitas Technologies, OSI Optoelectronics, Laser Components DG, Inc., First Sensor, Dexerials Corporation, and Thorlabs Inc. These companies play a critical role in shaping the technological evolution and commercial success of the industry. Key players in the InGaAs avalanche photodiode market are implementing multifaceted strategies to enhance their competitive edge. A primary focus is on technological innovation, with companies channeling investments into R&D to improve spectral sensitivity, reduce noise levels, and enhance performance across varying environmental conditions. Many are also diversifying product portfolios, introducing compact and application-specific photodiodes for verticals such as quantum computing, LiDAR, and advanced telecom systems. Strategic partnerships with component manufacturers and system integrators help streamline product adoption. Additionally, firms are leveraging semiconductor fabrication advancements like CMOS integration to enable mass production and miniaturization. To further boost market presence, global players continue to expand their distribution networks and tailor solutions for regional and application-specific demands across high-growth sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Type trends

- 2.2.3 Wavelength range trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in fiber-optic communication

- 3.2.1.2 Growth of LiDAR applications

- 3.2.1.3 Expansion of medical imaging technologies

- 3.2.1.4 Emergence of quantum communication & photonics

- 3.2.1.5 Military & aerospace advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing and material costs

- 3.2.2.2 Limited dynamic range and saturation at high optical powers

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Single-photon Avalanche Diodes (SPADs)

- 5.3 Multi-photon Avalanche Diodes (MPADs)

- 5.4 Linear-mode Avalanche Photodiodes

Chapter 6 Market Estimates and Forecast, By Wavelength Range, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Short-wavelength (up to 1.0 µm)

- 6.3 Medium-wavelength (1.0 to 1.55 µm)

- 6.4 Long-wavelength (1.55 µm and above)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.2.1 3D imaging

- 7.2.2 Gesture recognition

- 7.2.3 Depth sensing

- 7.2.4 Automotive LiDAR

- 7.2.5 Others

- 7.3 IT & Telecommunication

- 7.3.1 High-speed optical interconnects

- 7.3.2 Optical transceivers

- 7.3.3 Long-haul optical fiber communication

- 7.3.4 Metro and access networks

- 7.3.5 Passive optical networks (PONs)

- 7.3.6 Others

- 7.4 Aerospace & Defense

- 7.4.1 Communication links

- 7.4.2 Optical communication

- 7.4.3 Military LiDAR and rangefinding

- 7.4.4 Remote sensing

- 7.4.5 Others

- 7.5 Industrial

- 7.5.1 Machine vision

- 7.5.2 Industrial automation

- 7.5.3 Monitoring

- 7.5.4 Metrology & inspection

- 7.5.5 Others

- 7.6 Healthcare

- 7.6.1 Optical Coherence Tomography (OCT)

- 7.6.2 Positron Emission Tomography (PET)

- 7.6.3 Biomedical sensing

- 7.6.4 Near-infrared spectroscopy

- 7.6.5 Others

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players:

- 9.1.1 Hamamatsu Photonics

- 9.1.2 Excelitas Technologies

- 9.1.3 OSI Optoelectronics

- 9.1.4 Thorlabs Inc.

- 9.2 Regional Players:

- 9.2.1 Albis Optoelectronics (Enablence)

- 9.2.2 Dexerials Corporation

- 9.2.3 First Sensor

- 9.2.4 GPD Optoelectronics Corp.

- 9.2.5 Laser Components GmbH

- 9.2.6 LONTEN

- 9.2.7 Voxtel Inc.

- 9.3 Emerging Players:

- 9.3.1 Advanced Photonix, Inc.

- 9.3.2 GoFoton

- 9.3.3 New England Photoconductor (NEP)

- 9.3.4 NuPhotonics LLC