PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833442

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833442

HVAC Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

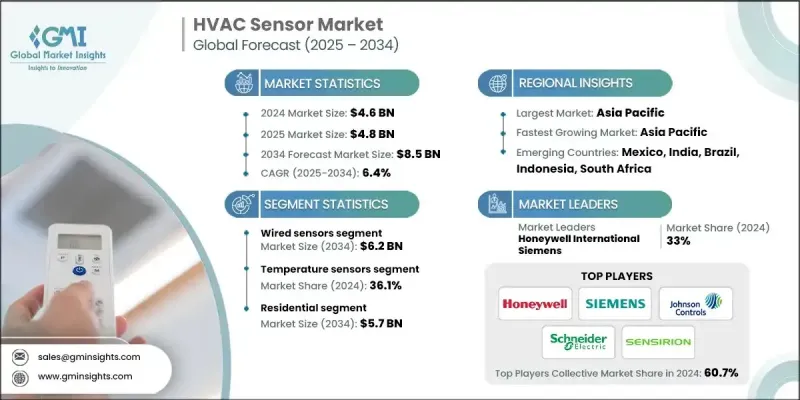

The Global HVAC Sensor Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 8.5 billion by 2034.

Increasing emphasis on indoor air quality, coupled with growing HVAC system installations in residential environments, continues to fuel demand for advanced sensor technologies. A growing number of property owners and facility operators are turning to multi-functional sensor units to monitor temperature, humidity, carbon dioxide levels, particulate matter, and volatile organic compounds in real time. This shift is being driven by heightened consumer awareness around health, comfort, and air quality, as well as regulatory frameworks focused on environmental safety. As HVAC systems become more advanced and interconnected, the demand for precision sensors that ensure air quality and energy efficiency is rising across commercial, industrial, and residential sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 6.4% |

The wired sensors segment is predicted to generate USD 6.2 billion by 2034, maintaining its dominance in large-scale industrial and commercial spaces due to its reliability, consistent performance, and data integrity. While wireless alternatives are gaining traction, wired configurations continue to be favored in mission-critical environments where seamless communication and minimal latency are key. Manufacturers are now focusing on enhancing installation convenience and integrating wired sensors more effectively into centralized control infrastructures without compromising their core performance advantages.

The temperature sensors segment held a 36.1% share in 2024. Their integration into smart HVAC systems is becoming more sophisticated, often packaged within multi-functional devices that also detect humidity, CO2, and air pollutants. These advanced temperature sensors play a crucial role in intelligent climate regulation, adapting airflow and temperature in real-time to improve comfort and reduce energy usage. As connected buildings evolve, compact, high-accuracy sensors that align with IoT protocols are gaining favor among manufacturers and end-users alike.

North America HVAC Sensor Market held 27% share in 2024 and is projected to grow at a CAGR of 6.6% through 2034. The region's strong momentum is driven by rising demand for energy-efficient HVAC installations and the proliferation of smart building ecosystems. The use of multi-parameter sensors in North America is steadily transforming air management strategies across residential and commercial properties, enabling automated, data-driven HVAC systems that improve compliance and occupant well-being.

Key players operating in the HVAC Sensor Market include Siemens, Johnson Controls, Honeywell International, Sensirion, and Schneider Electric. Leading companies in the HVAC sensor industry are advancing their market position by developing compact, multi-functional sensor solutions that align with the growing need for real-time monitoring and smart HVAC integration. These firms are investing heavily in R&D to create energy-efficient, IoT-compatible sensors that combine temperature, humidity, and air quality detection in a single module. Partnerships with smart building system providers and increased focus on interoperability and data analytics help enhance system-wide performance and simplify deployment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Connectivity type trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising need for customized HVAC solutions in healthcare and pharmaceuticals

- 3.2.1.2 Growing adoption of smart homes and building automation

- 3.2.1.3 Rising focus on indoor air quality (IAQ) monitoring

- 3.2.1.4 Rising HVAC system installations in residential sector

- 3.2.1.5 Surge in data center construction driving cooling demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and installation costs

- 3.2.2.2 Complexity in integration with existing HVAC systems

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for smart and connected buildings

- 3.2.3.2 Energy efficiency regulations and standards

- 3.2.3.3 Retrofit and upgradation of legacy HVAC systems

- 3.2.3.4 Integration with building management systems (BMS)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Temperature sensors

- 5.3 Humidity sensors

- 5.4 Pressure sensors

- 5.5 Smoke & gas sensors

- 5.6 Motion sensors

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Connectivity Type, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Wired sensors

- 6.3 Wireless sensors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 Honeywell International

- 9.1.2 Siemens

- 9.1.3 Johnson Controls

- 9.1.4 TE Connectivity

- 9.1.5 Schneider Electric

- 9.2 Regional Key Players

- 9.2.1 North America

- 9.2.1.1 Emerson Electric

- 9.2.1.2 Trane

- 9.2.1.3 Amphenol

- 9.2.2 Europe

- 9.2.2.1 Belimo Holding

- 9.2.2.2 STMicroelectronics

- 9.2.2.3 Infineon Technologies

- 9.2.3 APAC

- 9.2.3.1 Omron

- 9.2.3.2 Chino

- 9.2.3.3 Acal Bfi

- 9.2.1 North America

- 9.3 Niche Players / Disruptors

- 9.3.1 Sensirion

- 9.3.2 Sensata Technologies

- 9.3.3 Microchip Technology

- 9.3.4 Greystone Energy Systems

- 9.3.5 Texas Instruments