PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750447

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1750447

Direct Digital Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

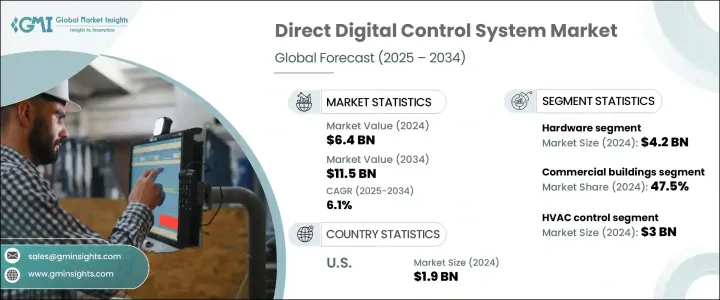

The Global Direct Digital Control System Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 11.5 billion by 2034, driven by the increasing demand for smart infrastructure, fueled by rapid urbanization and industrialization. These systems help manage HVAC, lighting, and energy operations within buildings, enhancing efficiency, comfort, and sustainability. As urban expansion continues, particularly in developing regions such as India, Africa, and Latin America, the demand for intelligent, automated building management systems is surging. DDC systems help in energy optimization, automation, and reducing manual labor, making them indispensable for large-scale infrastructure projects.

These systems allow for seamless control of heating, ventilation, air conditioning (HVAC), lighting, and other critical building functions, improving overall efficiency and sustainability. Their ability to optimize energy consumption while ensuring comfort is a key factor behind their widespread adoption in the commercial, residential, and industrial sectors. However, the market faces challenges, such as the disruptions caused by tariff policies, which have hindered the import of critical electronic components, sensors, and controllers from major manufacturing regions like China, the EU, and Canada. These geopolitical factors can delay project timelines and increase costs for DDC system manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 6.1% |

The DDC system market is primarily segmented into hardware, software, and services, with hardware being the dominant segment. In 2024, the hardware segment was valued at USD 4.2 billion. The core components, including controllers, sensors, and actuators, are essential for the effective functioning of DDC systems. As the demand for smart infrastructure grows globally, especially in emerging markets, there is an increasing need for advanced hardware solutions that enable real-time monitoring, precise automation, and efficient energy management. This hardware facilitates high-level control across various building functions, ensuring energy efficiency and occupant comfort.

Commercial buildings, with their high energy usage and complex infrastructure, represented a 47.5% share in 2024. DDC systems are extensively used in office buildings, shopping malls, airports, and hotels, where there is a strong need for efficient energy management and occupant comfort. The complex nature of these buildings makes DDC systems an ideal choice for automating operations, thereby reducing operational costs and enhancing overall building performance. The increasing awareness of sustainability and energy efficiency also makes DDC systems an attractive solution for managing energy resources in commercial facilities.

U.S. Direct Digital Control System Market was valued at USD 1.9 billion in 2024, driven by the widespread adoption of these systems across commercial, institutional, and industrial buildings. Strict energy efficiency regulations and the growing trend of retrofitting older buildings with advanced automation solutions have significantly contributed to the market's expansion in the U.S. Additionally, the presence of major players in the DDC industry further supports the growth and innovation in the market, ensuring a steady supply of high-quality and efficient systems for various sectors.

Key players in the Global Direct Digital Control System Industry include Schneider Electric, Azbil Corporation, Honeywell International Inc., and Johnson Controls Inc. To strengthen their presence in the DDC system market, companies are heavily investing in research and development to enhance the performance and cost-effectiveness of their products. By focusing on improving energy efficiency and scalability, they aim to cater to the growing demand for smart building solutions. Many players are also expanding their service offerings to include comprehensive installation, maintenance, and system integration services, ensuring clients can maximize the value of DDC systems. Strategic partnerships with commercial and industrial players help companies expand their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increased adoption of smart building technologies

- 3.3.1.2 Rapid urbanization and industrialization

- 3.3.1.3 Rising demand for energy efficiency

- 3.3.1.4 Aging infrastructure and retrofitting demand

- 3.3.1.5 Technological advancements in automation and control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High initial installation costs

- 3.3.2.2 Complexity of integration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Controllers

- 5.2.2 Sensors

- 5.2.3 Actuators

- 5.2.4 Input/output modules

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Control algorithms

- 5.3.2 Interface & visualization tools

- 5.3.3 Data analytics software

- 5.3.4 Others

- 5.4 Services

- 5.4.1 Installation & integration

- 5.4.2 Maintenance & support

- 5.4.3 consulting & training

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 HVAC control

- 6.3 Lighting control

- 6.4 Industrial automation

- 6.5 Energy management systems (EMS)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Residential buildings

- 7.3 Commercial buildings

- 7.3.1 office spaces

- 7.3.2 retail stores

- 7.3.3 hospitality

- 7.4 Industrial facilities

- 7.4.1 manufacturing plants

- 7.4.2 warehouses

- 7.5 Institutional buildings

- 7.5.1 hospitals

- 7.5.2 schools

- 7.5.3 government buildings

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allison Mechanical, Inc.

- 9.2 Arvin Air Systems

- 9.3 Azbil Corporation

- 9.4 Computrols, Inc.

- 9.5 DEOS AG

- 9.6 Honeywell International Inc.

- 9.7 Innotech

- 9.8 Johnson Controls Inc.

- 9.9 KMC Controls

- 9.10 Lennox International Inc.

- 9.11 Mason & Barry

- 9.12 Matrix HG, Inc.

- 9.13 Mitsubishi Electric Corporation

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Winona Heating & Ventilating

- 9.17 WODFA Company