PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833616

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833616

Pacemakers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

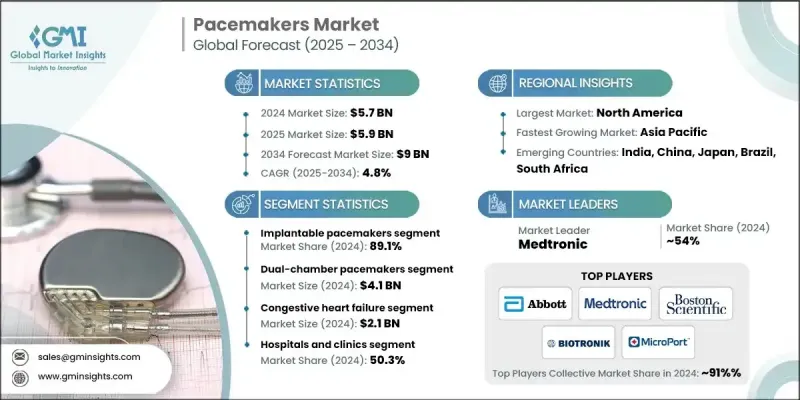

The Global Pacemakers Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 9 billion by 2034.

This robust growth is driven by the rising incidence of cardiovascular diseases, supportive reimbursement policies, and the increasing preference for minimally invasive procedures. Pacemakers play a vital role in managing heart rhythm disorders by delivering electrical impulses that regulate the heartbeat when the heart's natural conduction system falters. Industry leaders such as Medtronic, Abbott, and Boston Scientific are at the forefront, pushing innovation with advanced designs, extended battery life, and remote monitoring capabilities. MRI-compatible pacemakers have become increasingly popular, enabling patients to safely undergo magnetic resonance imaging after implantation-a crucial development for diagnosing other health conditions. Moreover, the introduction of Bluetooth-enabled and AI-powered pacemakers is transforming cardiac care by allowing real-time remote monitoring, reducing emergency hospital visits by up to 30%, and letting clinicians customize device settings based on patient activity and heart rhythm patterns. The battery technology improvements have significantly extended pacemaker longevity, with many modern devices lasting up to 20 years, minimizing the need for frequent replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9 Billion |

| CAGR | 4.8% |

The implantable pacemakers segment held 89.1% share in 2024, favored for their proven effectiveness in treating chronic heart rhythm conditions such as bradycardia and arrhythmias. These devices offer continuous pacing, enhanced patient outcomes, and are widely adopted due to minimally invasive implantation techniques. Their programmability allows healthcare providers to tailor settings to individual patient needs, ensuring optimal cardiac care, especially for aging populations and those with recurrent rhythm issues.

The dual-chamber pacemakers segment generated USD 4.1 billion and is expected to grow at a CAGR of 5.2% during 2025-2034, attributed to the increasing number of patients suffering from atrioventricular block who benefit from dual-chamber devices. These pacemakers have two leads positioned in the right atrium and right ventricle, which work together to replicate the natural timing of atrial and ventricular contractions. This synchronization improves blood flow and cardiac output, leading to better oxygen delivery to the body's tissues and organs.

North America Pacemakers Market held 50.9% share in 2024, driven by the presence of key market players, rising demand for cardiovascular devices, and a growing prevalence of heart conditions. Increased hospital admissions due to cardiovascular issues further boost the demand for pacemakers and related monitoring devices. The region also benefits from strong R&D activities focused on enhancing pacemaker technologies, fueling continued market expansion. The entry of new companies into the market is expected to accelerate growth throughout the forecast period.

Prominent companies in the Global Pacemakers Industry include Boston Scientific, BIOTRONIK, Lepu Medical, MEDICO, Medtronic, Abbott, MicroPort, Oscor, Osypka Medical, Pacetronix, and Vitatron. To strengthen their market position, leading companies in the pacemakers sector focus heavily on innovation, developing devices with longer battery lives, improved compatibility with imaging technologies, and enhanced remote monitoring capabilities. Many firms are investing in AI and Bluetooth technologies to offer real-time data transmission and personalized patient care. Expanding geographic presence, especially into emerging markets, is another key strategy, supported by partnerships with healthcare providers and government programs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Favorable reimbursement policies

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising adoption of minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of pacemaker devices and implantation

- 3.2.2.2 Stringent regulatory approvals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for MRI-compatible pacemakers

- 3.2.3.2 Integration of remote monitoring and telecardiology solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Brand analysis

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Number of pacemaker units, by region, 2021-2024

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Latin America

- 3.12.5 MEA

- 3.13 Pricing analysis, 2024

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implantable pacemakers

- 5.3 External pacemakers

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Single-chamber pacemakers

- 6.2.1 Single-chamber ventricular

- 6.2.2 Single-chamber atrial

- 6.3 Dual-chamber pacemakers

- 6.4 Biventricular/CRT pacemakers

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Congestive heart failure

- 7.3 Bradycardia

- 7.4 Arrhythmias

- 7.5 Tachycardia

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Cardiac care centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 BIOTRONIK

- 10.3 Boston Scientific

- 10.4 Lepu Medical

- 10.5 MEDICO

- 10.6 Medtronic

- 10.7 MicroPort

- 10.8 Oscor

- 10.9 Osypka Medical

- 10.10 Pacetronix

- 10.11 Vitatron