PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906964

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906964

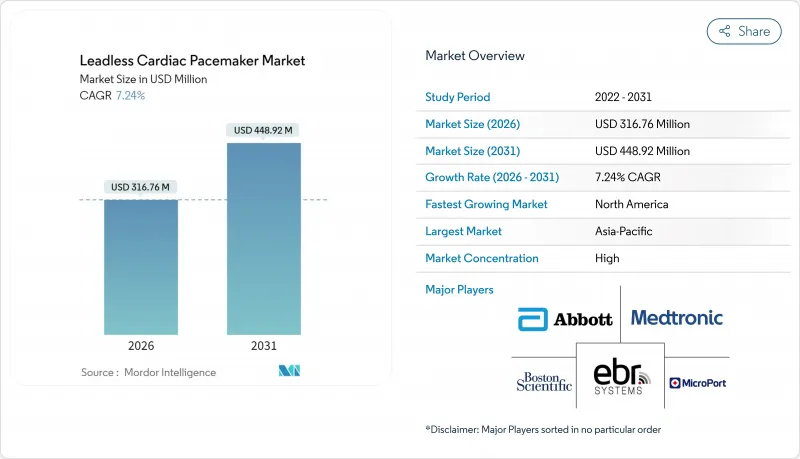

Leadless Cardiac Pacemaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The leadless pacemaker market is expected to grow from USD 295.37 million in 2025 to USD 316.76 million in 2026 and is forecast to reach USD 448.92 million by 2031 at 7.24% CAGR over 2026-2031.

Demand momentum rests on the rapid shift from single-chamber ventricular pacing toward dual-chamber and forthcoming conduction-system solutions that promise physiologic synchrony without transvenous leads. North American reimbursement clarity, expanding MRI-conditional labeling, and aging demographics continue to anchor volume growth. Competitive intensity is high because Abbott and Medtronic defend entrenched positions through differentiated technology and deep clinical trial pipelines, yet Boston Scientific's modular platform illustrates how new architectures can disrupt the established order. Market opportunities widen in Asia-Pacific where streamlined approvals and hospital investments offset persistent pricing barriers.

Global Leadless Cardiac Pacemaker Market Trends and Insights

Rising Prevalence of Bradyarrhythmias & CVD

Increasing cardiovascular disease burden results in some 600,000 new pacing candidates annually across developed economies, and age-related conduction deficits intensify device demand in older cohorts. Leadless pacing reduces pneumothorax and pocket infection risks, enabling 96.9% implant success and only 4.5% complications in frail patients treated at U.K. tertiary centers. Clinical applicability also extends to conduction disturbances post-TAVR, broadening the eligible base.

Superior Safety Profile Versus Transvenous Leads

Registry evidence shows Micra recipients experienced 63% fewer major complications than comparable transvenous cohorts at five years. The abolition of leads and pockets effectively removes the principal nidus for device infection, an advantage magnified in dialysis and immunocompromised populations. Cardiac perforation risk remains salient at roughly 1.5% of cases, yet real-world data confirm overall safety parity with conventional systems once operator proficiency matures.

Elevated Device Price in Cost-Sensitive Regions

List prices surpass USD 15,000 against transvenous systems below USD 5,000, constraining uptake where reimbursement lags GDP growth. Economic analyses place cost-effectiveness thresholds at AUD 47,379 per QALY in Australia, an acceptable range for mature markets but a hurdle for emerging payers. Specialized training and imaging overhead further inflate total procedural cost in low-resource settings.

Other drivers and restraints analyzed in the detailed report include:

- Rapidly Aging Global Population

- MRI-Conditional Approvals Widening Eligible Cohort

- Limited Extraction Protocols & Battery Life Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

2025 data show the leadless pacemaker market size for single-chamber systems at 96.88% share, yet dual-chamber devices exhibit an 7.82% CAGR outlook through 2031 as Abbott's AVEIR DR secures 98.1% atrioventricular synchrony in trials. Single-chamber models remain clinically indispensable for permanent atrial fibrillation and end-of-life scenarios where procedural simplicity overrides physiologic pacing benefits.

Continued miniaturization and implant-to-implant communication propel dual-chamber platforms toward standard of care, elevating revenue mix toward premium-priced configurations. Manufacturers also explore conduction-system pacing capsules that deliver native bundle activation without transvenous leads, a step anticipated to compress heart-failure admissions linked with RV septal pacing. Patent landscaping indicates more than 25 active filings covering wireless energy transfer and retrieval tooling, underscoring sustained R&D investment.

The Leadless Pacemaker Market Report is Segmented by Product Type (Single-Chamber Ventricular Leadless Pacemaker, Dual-Chamber Leadless Pacemaker), Indication (Bradyarrhythmia, Atrioventricular Block, Atrial Fibrillation, Others), End User (Hospitals, Cardiac Centres, Ambulatory Surgical Centres), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 41.88% share in 2025 on the strength of Medicare Coverage with Evidence Development that reimburses while capturing outcomes data. Hospital networks integrate leadless pacemakers into value-based bundles that reward reduced infection readmissions.

Europe sustains robust volume through CE-marked evidence programs and pan-regional registries that refine practice guidelines, although MDR compliance adds incremental certification cost. Asia-Pacific posts the fastest 8.74% CAGR as India cleared AVEIR VR in 2024 and major Chinese centers ramp local clinical trials to support National Reimbursement Drug List petitions. Rising middle-class coverage and infrastructure builds accelerate procedure counts despite lingering affordability challenges.

Latin America and Middle East & Africa remain opportunity pockets where private insurance penetration and public tender cycles dictate slower diffusion trajectories.

- Abbott Laboratories

- BIOTRONIK

- Boston Scientific

- EBR Systems, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic

- MicroPort

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of bradyarrhythmias & CVD

- 4.2.2 Superior safety profile versus trans-venous leads

- 4.2.3 Rapidly ageing global population

- 4.2.4 MRI-conditional approvals widening eligible cohort

- 4.2.5 Catheter-based miniaturisation enabling non-OR implants

- 4.2.6 Emerging reimbursement models for day-case procedures

- 4.3 Market Restraints

- 4.3.1 Elevated device price in cost-sensitive regions

- 4.3.2 Limited extraction protocols & battery life uncertainty

- 4.3.3 Competitive threat from battery-less bio-resorbable tech

- 4.3.4 Electrophysiologist training gap in developing markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Supplier Power

- 4.7.3 Buyer Power

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of New Entrants

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value, USD million)

- 5.1.1 Single-Chamber Ventricular Leadless Pacemaker

- 5.1.2 Dual-Chamber Leadless Pacemaker

- 5.2 By Indication (Value, USD million)

- 5.2.1 Bradyarrhythmia

- 5.2.2 Atrioventricular Block

- 5.2.3 Atrial Fibrillation

- 5.2.4 Others

- 5.3 By End User (Value, USD million)

- 5.3.1 Hospitals

- 5.3.2 Cardiac Centres

- 5.3.3 Ambulatory Surgical Centres

- 5.4 By Geography (Value, USD million)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 BIOTRONIK SE & Co. KG

- 6.3.3 Boston Scientific Corporation

- 6.3.4 EBR Systems, Inc.

- 6.3.5 Lepu Medical Technology (Beijing) Co., Ltd.

- 6.3.6 Medtronic plc

- 6.3.7 MicroPort Scientific Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment