PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833637

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833637

Tubeless Insulin Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

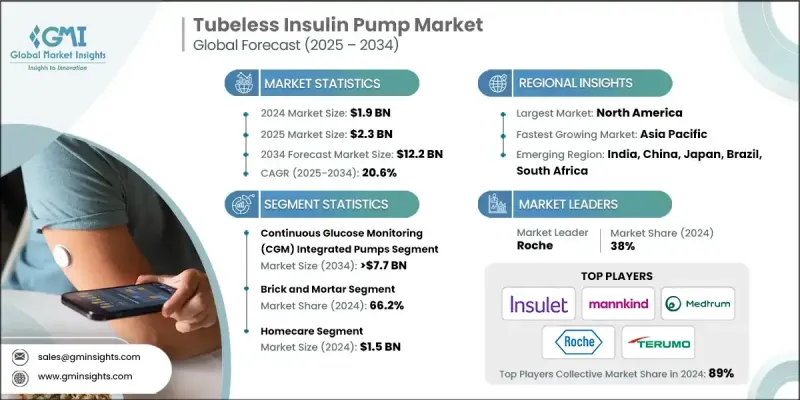

The Global Tubeless Insulin Pump Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 12.2 billion by 2034.

According to the World Health Organization (WHO), diabetes is one of the leading causes of death globally, and the rising number of cases is creating an urgent need for more efficient and manageable treatment options. The traditional methods of insulin administration, such as daily injections, often lead to inconsistent results, reduced patient adherence, and discomfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 20.6% |

Rising Demand for Continuous Glucose Monitoring (CGM) Integral Pumps

The continuous glucose monitoring (CGM) integral pumps segment held a significant share in 2024, driven by diabetes management that offers real-time data on glucose levels. CGM-integral pumps allow for seamless insulin delivery adjustments based on constant glucose monitoring, reducing the risk of hypo- or hyperglycemia. The combination of CGM and insulin delivery in one device ensures better control, precision, and convenience for users, especially for those with type 1 diabetes who require continuous monitoring.

Bricks and Mortar to Gain Traction

The bricks and mortar segment generated significant revenues in 2024, driven by hospitals, clinics, and pharmacies, where tubeless insulin pumps are often sold, prescribed, and serviced. The focus is on the distribution and initial training of patients in proper pump usage. Companies in this segment are working to establish strong relationships with healthcare providers, offering comprehensive training and support services to ensure patients understand how to use their pumps effectively.

Rising Adoption in Homecare

The homecare segment held a sizeable share in 2024, as patients seek more convenient, at-home diabetes management solutions. Tubeless insulin pumps in this sector offer flexibility, discretion, and ease of use, allowing patients to manage their insulin delivery at home. As healthcare systems move toward patient-centric care, companies are focusing on offering support services such as remote monitoring, telemedicine consultations, and patient education to ensure successful outcomes and better health management.

Regional Insights

North America to Gain Traction

North America tubeless insulin pump market held a notable share in 2024, driven by the increasing prevalence of diabetes and the rising adoption of advanced diabetes management tools. A key driver in this market is the increasing preference for more convenient, less invasive insulin delivery systems, particularly among type 1 diabetes patients. With the availability of insurance coverage and growing awareness of the benefits of continuous insulin delivery, patients in North America are opting for tubeless insulin pumps that offer enhanced portability and functionality.

Major players in the tubeless insulin pump market are Medtrum, MicroTech, Roche, TERUMO, Insulet, MannKind Corporation, and Pharmasens.

To strengthen their presence and market foothold in the tubeless insulin pump market, companies are focusing on several key strategies. First, they are heavily investing in research and development to integrate cutting-edge technologies such as continuous glucose monitoring (CGM), artificial intelligence (AI), and remote monitoring into their pumps, which provide enhanced control and ease of use for patients. Additionally, companies are forming strategic partnerships with healthcare providers and insurers to improve device accessibility and coverage for patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Distribution channel trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Technological advancements in tubeless insulin pumps

- 3.2.1.3 Increasing diabetes care expenditure

- 3.2.1.4 Injuries caused by conventional & invasive insulin pumps

- 3.2.1.5 Adoption of facilitative initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High long-term costs associated with the tubeless insulin pumps

- 3.2.2.2 Stringent government regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Shift toward wearable & user-friendly devices

- 3.2.3.2 Growing adoption in homecare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Incidence & prevalence of diabetes, by region, 2021-2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 RoW

- 3.9 New product development landscape

- 3.10 Start-up scenario

- 3.11 Pricing analysis, 2024

- 3.12 Investment landscape

- 3.13 Consumer behaviour analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 RoW

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous glucose monitoring (CGM) integrated pumps

- 5.3 Standard tubeless pumps

Chapter 6 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Brick and mortar

- 6.3 E-commerce

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Homecare

- 7.3 Hospitals & clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 RoW

Chapter 9 Company Profiles

- 9.1 Insulet

- 9.2 MannKind Corporation

- 9.3 Medtrum

- 9.4 MicroTech

- 9.5 Pharmasens

- 9.6 Roche

- 9.7 TERUMO