PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833647

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833647

Hearing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

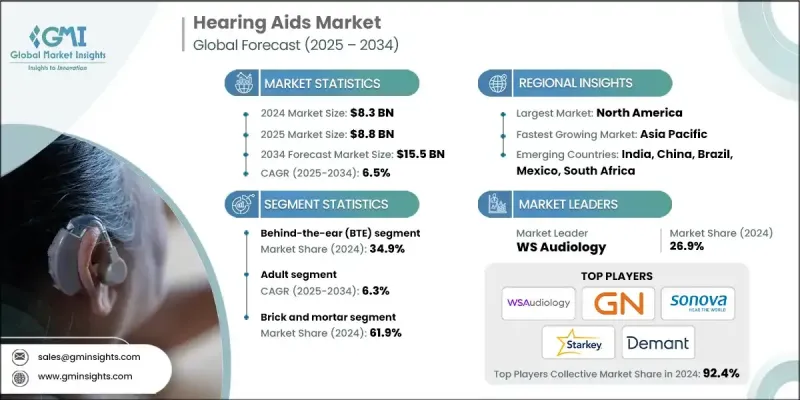

The Global Hearing Aids Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 15.5 billion by 2034.

The aging population is one of the most influential drivers of the hearing aids market, particularly in developed regions such as North America, Europe, and parts of Asia. As life expectancy continues to rise, so does the proportion of individuals aged 65 and older, an age group that is most susceptible to presbycusis, or age-related hearing loss.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 6.5% |

Rising Demand for Behind-the-Ear (BTE) Devices

The Behind-the-Ear (BTE) segment generated notable revenues in 2024 owing to its versatility, durability, and ability to accommodate a wide range of hearing loss levels. BTE devices are especially preferred for older adults and children because of their ease of use, longer battery life, and ability to integrate with assistive listening technologies. The growing preference for multifunctional devices that balance performance with comfort is helping BTE models maintain their competitive edge.

Increasing Adoption Among Adults

The adult segment held a sizeable share in 2024, driven by the rising prevalence of age-related hearing loss. As millions of adults enter their senior years, hearing impairment is becoming increasingly common, fueling demand for both prescription and over-the-counter solutions. Companies are tailoring their marketing strategies to appeal to tech-savvy older consumers who value features like rechargeable batteries, smartphone integration, and discreet aesthetics.

Brick-and-Mortar to Gain Traction

The brick-and-mortar will grow at a decent CAGR during 2025-2034, backed by the clinical nature of the product. In-person hearing assessments, professional fittings, and post-purchase support continue to make physical clinics and audiology centers the preferred point of sale, especially for first-time users. Personalized care and the ability to test products on-site remain key advantages that keep this channel relevant and resilient.

North America to Emerge as a Lucrative Region

North America hearing aids market garnered significant valuation in 2024, bolstered by its aging population, strong healthcare infrastructure, and widespread awareness. United States leads to the adoption of premium and over-the-counter hearing aids. Regulatory support, such as the FDA's approval of OTC devices, is driving accessibility and expanding consumer choice.

Major players in the hearing aids market are Clariti Hearing, SOUNDWAVE HEARING, GN Store Nord, EARGO, Sonova, RION, Starkey, Audio Service, SeboTek Hearing Systems, Demant, Zounds Hearing, Ear Technology, WS Audiology, Audina Hearing Instruments, and Nano Hearing Aids

To strengthen their presence and gain share, hearing aid manufacturers are deploying a combination of product innovation, multi-channel distribution, and direct-to-consumer outreach. Many are investing in AI-powered sound processing, app-based controls, and rechargeable technology to meet the expectations of modern users. Strategic partnerships with retail pharmacies, optical chains, and consumer electronics outlets are helping brands expand their reach beyond traditional audiology clinics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Patient trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of hearing loss

- 3.2.1.2 Rising geriatric population

- 3.2.1.3 Growing awareness regarding treatment options

- 3.2.1.4 Facilitative government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of hearing aids and lack of reimbursement

- 3.2.2.2 Lack of knowledge regarding hearing loss and hearing aids in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of hearing aids with smartphones and wearable tech

- 3.2.3.2 Rising e-commerce and tele-audiology services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 OTC hearing aids legislation

- 3.7.1 Need for OTC hearing aids

- 3.7.2 Legislation and changes

- 3.7.3 Impact assessment

- 3.8 Consumer pathway

- 3.8.1 Conventional pathway

- 3.8.2 Need for new pathway

- 3.8.3 Hybrid pathway

- 3.9 Consumer insights

- 3.10 Policy landscape

- 3.10.1 U.S. preventive treatments task force (USPSTF)

- 3.10.2 Medicare audiologist access and services act (MAASA)

- 3.11 Investor overview

- 3.12 Risk management analysis

- 3.12.1 Research and development

- 3.12.2 Operations

- 3.12.3 Marketing and sales

- 3.12.4 Quality

- 3.12.5 Intellectual property rights

- 3.12.6 Regulatory

- 3.12.7 Information technology

- 3.12.8 Climate

- 3.12.9 Financial

- 3.13 Pricing analysis

- 3.14 Gap analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

- 3.17 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.4 Completely-in-the-canal/invisible-in-canal (CIC/IIC)

- 5.5 In-the-ear (ITE)

- 5.6 In-the-canal (ITC)

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Audina Hearing Instruments

- 9.2 Audio Service

- 9.3 Clariti Hearing

- 9.4 Demant

- 9.5 Ear Technology

- 9.6 EARGO

- 9.7 GN Store Nord

- 9.8 Nano Hearing Aids

- 9.9 RION

- 9.10 SeboTek Hearing Systems

- 9.11 Sonova

- 9.12 SOUNDWAVE HEARING

- 9.13 Starkey

- 9.14 WS Audiology

- 9.15 Zounds Hearing