PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833658

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833658

Metal and Mining Wastewater Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

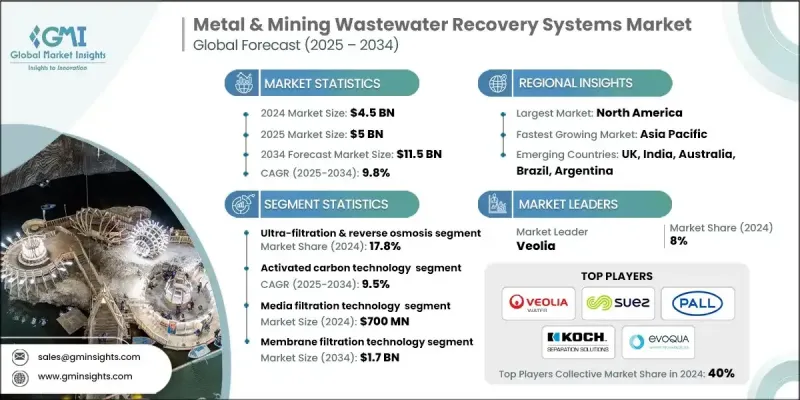

The global metal & mining wastewater recovery systems market was estimated at USD 4.5 billion in 2024 and is expected to grow from USD 5 billion in 2025 to USD 11.5 billion by 2034, at a CAGR of 9.8%, according to the latest report published by Global Market Insights Inc.

Governments worldwide are tightening discharge limits for heavy metals, suspended solids, and toxic chemicals from mining operations. This regulatory pressure is pushing mining companies to adopt advanced wastewater recovery systems to remain compliant and avoid hefty fines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 9.8% |

Rising Adoption in Ultrafiltration & Reverse Osmosis

The ultrafiltration and reverse osmosis (RO) segment held a significant share in 2024, driven by its effectiveness in removing dissolved salts, metals, and microscopic contaminants. These membrane-based technologies are increasingly preferred for achieving high-purity water suitable for reuse in mining operations, particularly in regions with limited freshwater resources.

Increasing Demand for Activated Carbon Technology

The activated carbon technology held a substantial share in 2024, fueled by the removal of organic pollutants, heavy metals, and residual chemicals from mining wastewater streams. Known for its high adsorption capacity and cost-effectiveness, activated carbon is widely used in both standalone systems and as part of multi-stage treatment processes.

Media Filtration Technology to Gain Traction

The media filtration technology segment generated a sustainable share in 2024 owing to its simplicity, scalability, and effectiveness in removing suspended solids and particulates. This segment is particularly popular in the early stages of water treatment, serving as a pre-treatment step before more advanced methods like ultrafiltration or chemical treatment.

North America to Emerge as a Propelling Region

North America metal & mining wastewater recovery systems market is poised to grow at a significant CAGR during 2025-2034, backed by stringent environmental regulations, advanced technological capabilities, and a mature mining sector. The region is home to large-scale operations in copper, gold, lithium, and rare earth mining, all of which generate complex wastewater streams requiring high-performance treatment systems.

Major players operating in the metal & mining wastewater recovery systems industry are KONTEK Ecology Systems Inc., Evoqua Water Technologies LLC, Calgon Carbon Corporation, Mech-Chem Associates, Inc., BioChem Technology, CECO Environmental, Saltworks Technologies, ClearBlu Environmental, Veolia, CLEARAS Water Recovery, DYNATEC SYSTEMS, INC., Aquatech, ChemREADY, Koch Separation Solutions, Puragen Activated Carbons, Clean TeQ Water, KORTE Kornyezettechnika Zrt., ENCON Evaporators, Suez, Pall Corporation, EnviroWater Group.

To strengthen their foothold in the metal & mining wastewater recovery systems market, companies are focusing on innovation, strategic collaborations, and service diversification. Leading players are developing modular and scalable systems that can be customized for specific site conditions, helping reduce installation time and capital expenditure. Others are forming partnerships with mining operators to offer long-term operation and maintenance (O&M) contracts, ensuring steady revenue streams. Digital integration is also gaining traction, with the use of remote monitoring, IoT sensors, and AI for predictive maintenance and performance optimization. Additionally, companies are expanding into emerging markets

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Activated carbon

- 5.3 Ultra-filtration & reverse osmosis

- 5.4 Membrane filtration

- 5.5 Ion exchange resin systems

- 5.6 Media filtration

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Poland

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Malaysia

- 6.4.6 Indonesia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Mexico

- 6.6.3 Argentina

Chapter 7 Company Profiles

- 7.1 Aquatech

- 7.2 BioChem Technology

- 7.3 Calgon Carbon Corporation

- 7.4 CECO Environmental

- 7.5 ChemREADY

- 7.6 CLEARAS Water Recovery

- 7.7 Clean TeQ Water

- 7.8 ClearBlu Environmental

- 7.9 DYNATEC SYSTEMS, INC.

- 7.10 ENCON Evaporators

- 7.11 EnviroWater Group

- 7.12 Evoqua Water Technologies LLC

- 7.13 Koch Separation Solutions

- 7.14 KONTEK Ecology Systems Inc.

- 7.15 KORTE Kornyezettechnika Zrt.

- 7.16 Mech-Chem Associates, Inc.

- 7.17 Pall Corporation

- 7.18 Puragen Activated Carbons

- 7.19 Suez

- 7.20 Saltworks Technologies

- 7.21 Veolia